Bitcoin is trading just north of $39,000, having been rejected once more as the company tried to claim $40,000 in its current area. Market cap first crypto is trading in the low range of between its mid level and approximately $48,000.

Bitcoin Clings To $40K On Easter Sunday As Crypto Seen To Head Lower In The Short Term| Bitcoin Clings To $40K On Easter Sunday As Crypto Seen To Head Lower In The Short Term

Bitcoin is often stuck between low $30,000s to high $60,000s in longer time frames. When it is near, traders fear high levels of greed and turn to extreme fear.

Bitcoin is trading at $39,000. There has been a loss of 3% and 7.7% in Bitcoin over the past 24 hours, and seven days respectively.

Data from analyst Ali Martinez suggest traders are yet to enter the fear territory as BTC’s price still holds its current levels. The majority of traders seem optimistic.

See below that the ratio between long and short is 2.88 on cryptocurrency exchange Binance. That means traders are dominantly longer. As opposed to 25%, 74% of traders traded on the platform in long positions.

Martinez reminded traders to be careful as Bitcoin seldom performs the way that most people expect. Although the initial crypto price seems to have recovered in a short period of time, the bulls still lack conviction.

Analyst added the following on potential support levels for BTC’s price in case of more downside:

Bitcoin is protected by the 78.6% Fibonacci Retracement Level at $38,530. This support level is breached and $BTC could fall as high as $26,820 or $32,853.

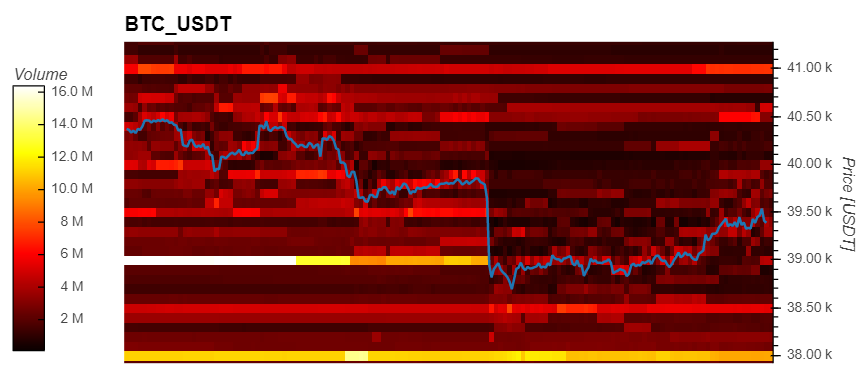

Material Indicators’ (MI) data supports this potential level. Below, you can see that Bitcoin’s price bounced off of a pile of bid orders. (In yellow below price), The price was set at approximately $39,000

After that, the benchmark crypto continued to rise but was not supported at current levels in the event of an increase in selling price until $38,000. The current level of BTC support is $39,000. There are about $10 million in order at these levels.

Bitcoin Fundamentals Suggest Up, But BTC’s Price Stays Down

Bitcoin’s price range has been tightening in the past months. An event known as a capitulation, which is when the price moves out of its range, appears to be in the making.

Martinez provides additional data that shows a marked decrease in BTC available on exchange platforms. This indicator is currently at its lowest level in one year, with an ongoing trend towards the negative.

Although there is a shortage of Bitcoin, it seems that the Bitcoin price has been affected more by macro-economic factors. It is important to note that the U.S. Federal Reserve raised interest rates and that there was a war between Russia, Ukraine.

TA: Bitcoin Remains at Risk, Why 100 SMA Is The Key| TA: Bitcoin Remains at Risk, Why 100 SMA Is The Key

As NewsBTC reported, if the FED turns aggressive on its monetary policy, BTC’s price could retest the bottom of its range or trend lower.