This is our inaugural market insights monthly report Bitcoin.com Exchange. You will find this report, as well as the next, a summation of crypto market performance, along with a macro recap and analysis of market structure.

Performance of crypto markets

BTC crossed $48,000 at the end of March. That was a crucial resistance level not seen since September 2017. Following failure to get through the test, BTC saw a rebound to the $40-42,000 mark. This was a new support that had been acted as a significant increase from the prior support of $36-38,000 in the first quarter. BTC, however, had fallen below $40,000 at the time we wrote this.

The outperformance in the past 30 day was led by Layer-one protocols, NEAR the highest performing large-cap cryptocurrency. The capital raise by Tiger Global of $350M had pushed it up 64% at the time this article was written. SOL and ADA also performed well in large-cap categories, with both rising 37.5% & 31.16% respectively during the last thirty days.

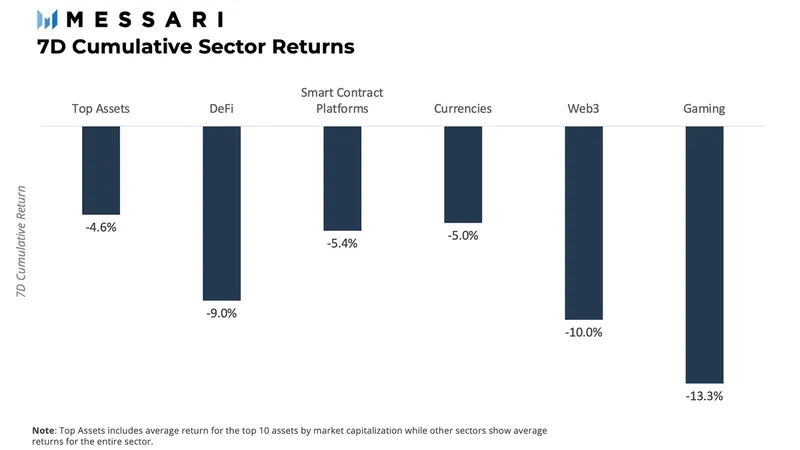

Even though April had a solid 30-day performance the start of April showed weakness with large losses in all sectors. The biggest drawback was in gaming at -13.3%. Web3 followed at -10%, and Defi at -9%.

Macro Recap: Inversion Points To Worry For The Yield Curve and Hawkish Fed

Although there has been some relief from the turmoil in Ukraine that caused headwinds, U.S. Monetary Policy remains the primary driver of financial markets. With the March 2022 release of core U.S. CPI numbers, the month began. Markets were relieved that the 8.5% number was slightly less than what they had expected.

However, the 8.5% increase in core inflation from month to month was the greatest since 1980. Christopher Waller from the Federal Reserve Board of Governors said that interest rates will rise significantly in the months ahead, given current inflation levels and economic strength.

In the meantime, the 2-year Treasury yields as well as the 10-year Treasury yields have inverted for the first-time since 2019. This is often interpreted to indicate a possible recession. The inversion is correlated to seven of the eight previous recessions.

The cost of banks borrowing money over the next two years is represented by the Treasury yields. Ten-year yields indicate the ability to use the funds to purchase long-term assets. Inverted Treasury yield rates, which are tighter or less flexible than the average rate of money in Treasurys, can lead to economic slowdowns.

Market Structure: Price Weakness Contrasts with Historically High Accumulation

BTC gains have been erased in the week following the breakthrough of the multi-month price range. The market has seen some profit-taking and decreased activity since the upside price action. Some market metrics however show an all time high accumulation of BTC, which is a support for the market.

This accumulation has been made public by using Bitcoin as collateral. Notably, Luna Foundation Guard declared it is using BTC as collateral for its algorithmic stablecoin, but we’ve also seen inflows of BTC on Canadian Exchange Traded Funds (ETFs) as well as an increase in Wrapped BTC (WBTC) on Ethereum.

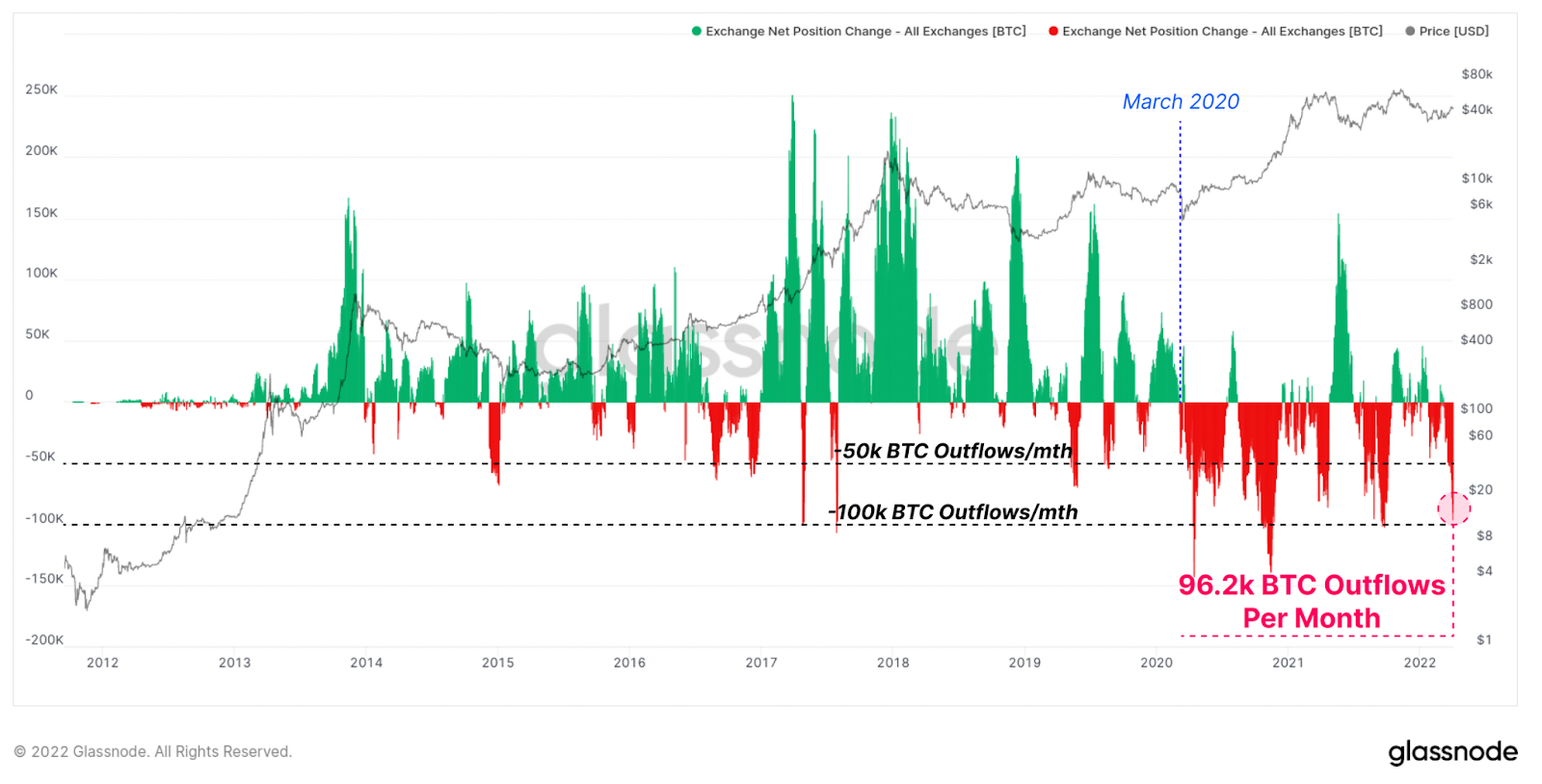

The graph shows that exchanges experienced high volumes of BTC outflows from their Treasury each month, which could be seen as an indicator of BTC holders’ accumulation. This was a similar rate to that seen before the 2017 bull runs and March 2020.

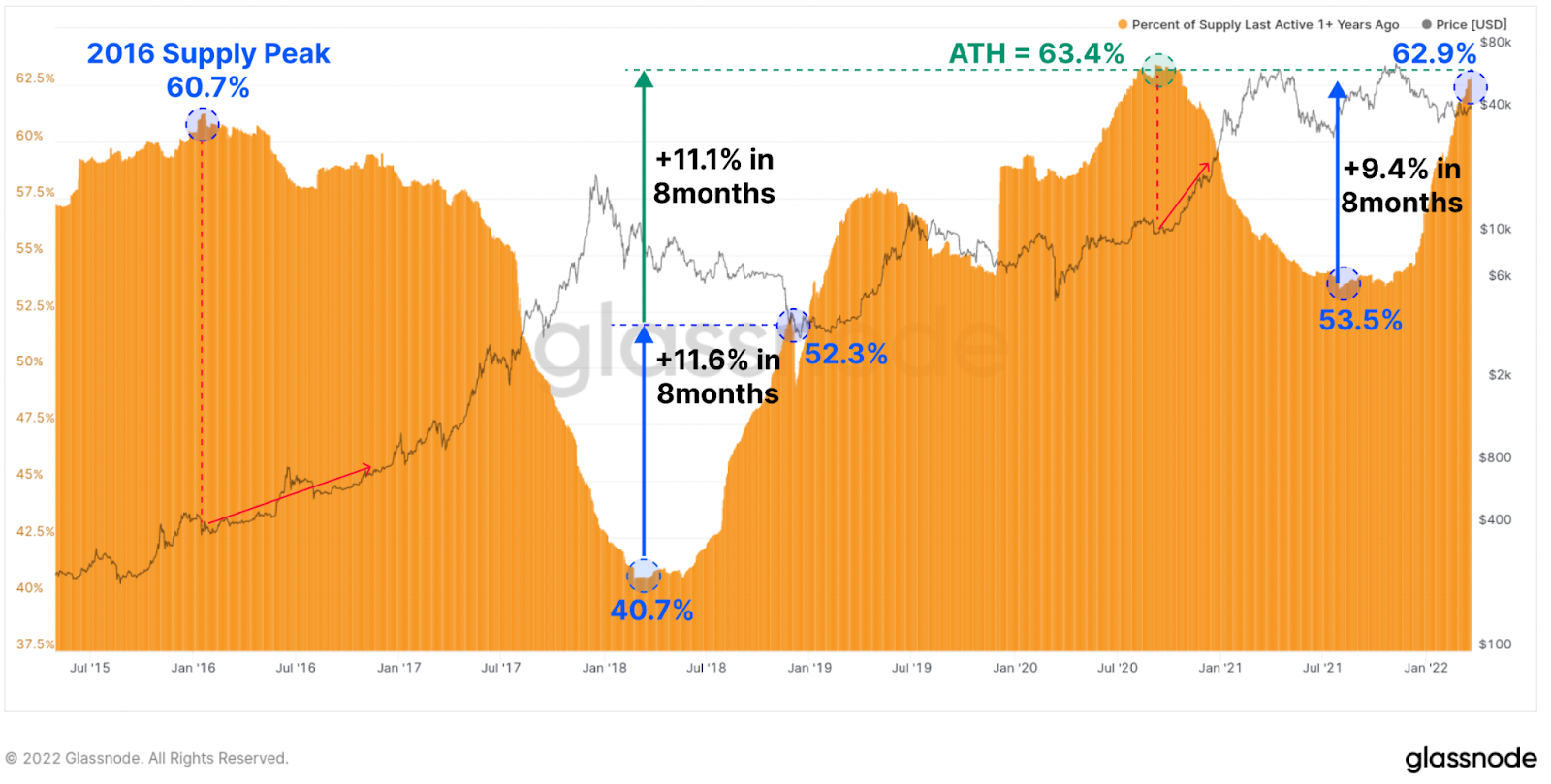

The ageing supply, which is defined as BTC that hasn’t been traded for at least one calendar year, another interesting measure of market accumulation. In the below chart, you can see an increase of ageing supply by 9.4% in just eight months. Similar to the 2018. bear market when ageing supplies increased 11.6%, this chart shows an increase in supply of 9.4% over the last eight months. This is important as it illustrates the willingness market participants to keep holding BTC, despite any drawbacks (53% in 2018 vs 53.5% for 2022).

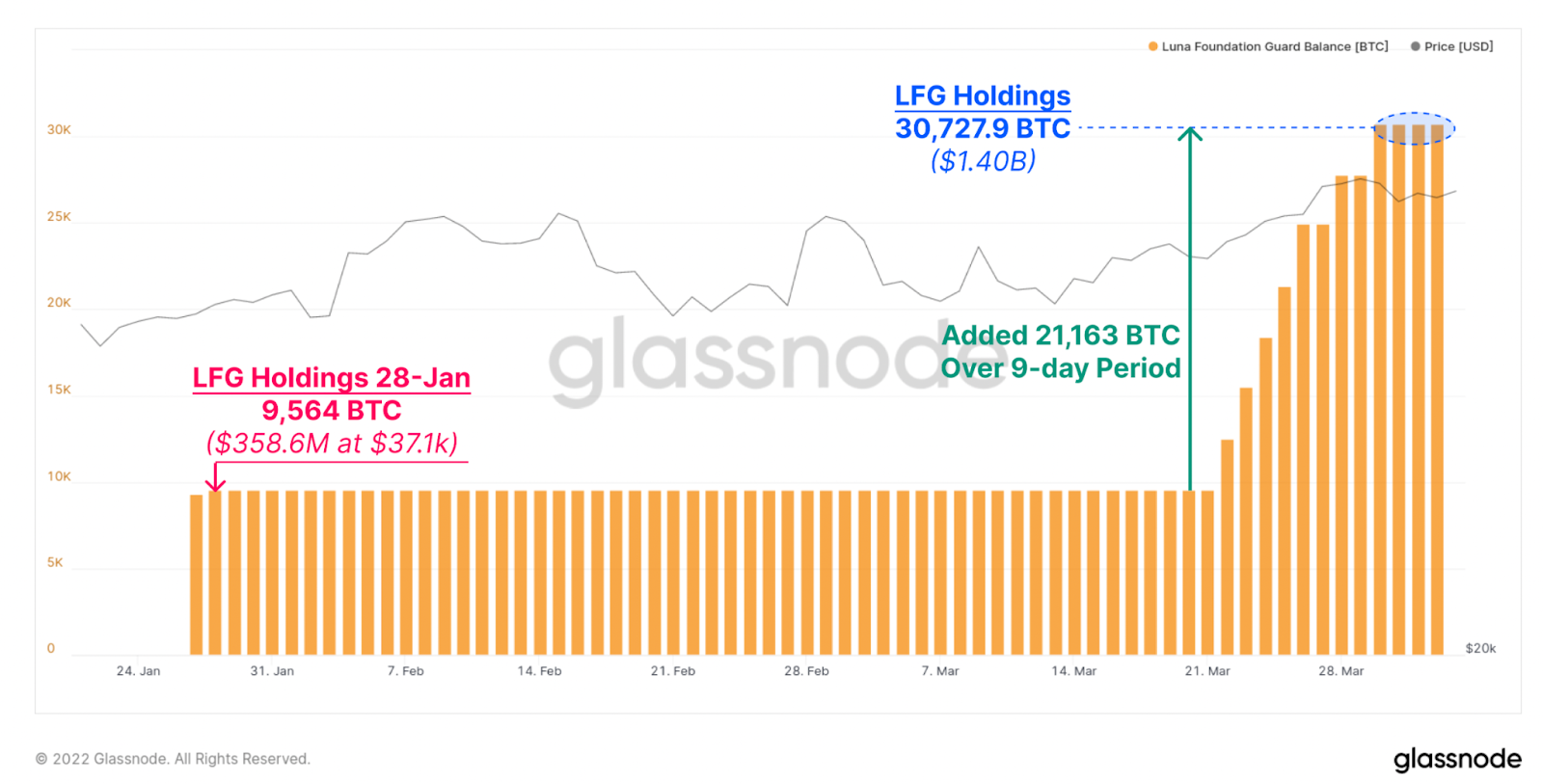

Luna Foundation Guard, (LFG) has been a vocal advocate for obtaining BTC supplies. LFG increased their BTC balance by 3x during a 9 day period and reached 30k BTC in their treasury.

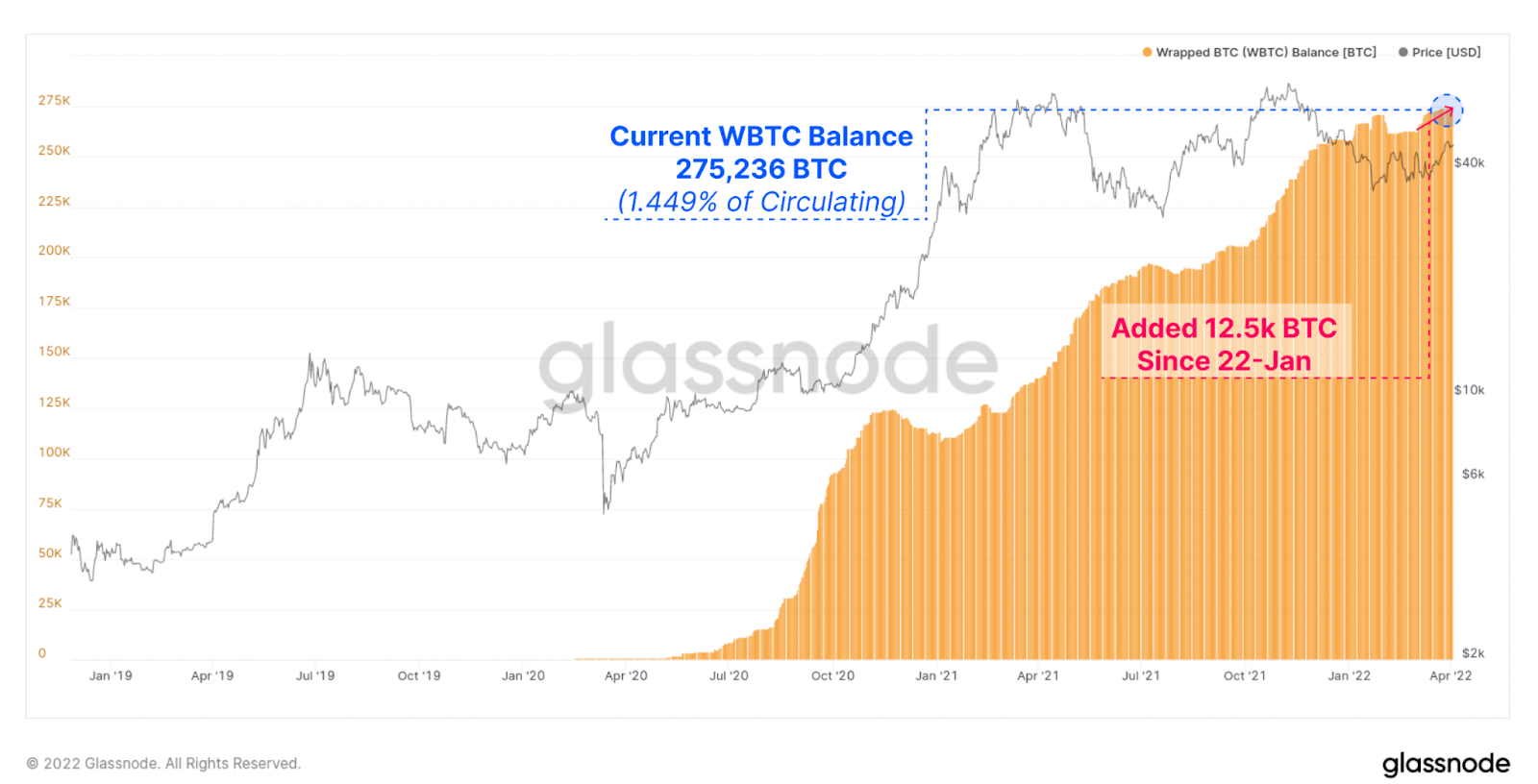

In the meantime, Bitgo’s growth in WBTC is an indication of the demand for BTC within the DeFi markets. There has been some buying pressure on the remaining supply of BTC. We can see below an increase of 12,500 WBTC units in January. These will be used primarily for DeFi.

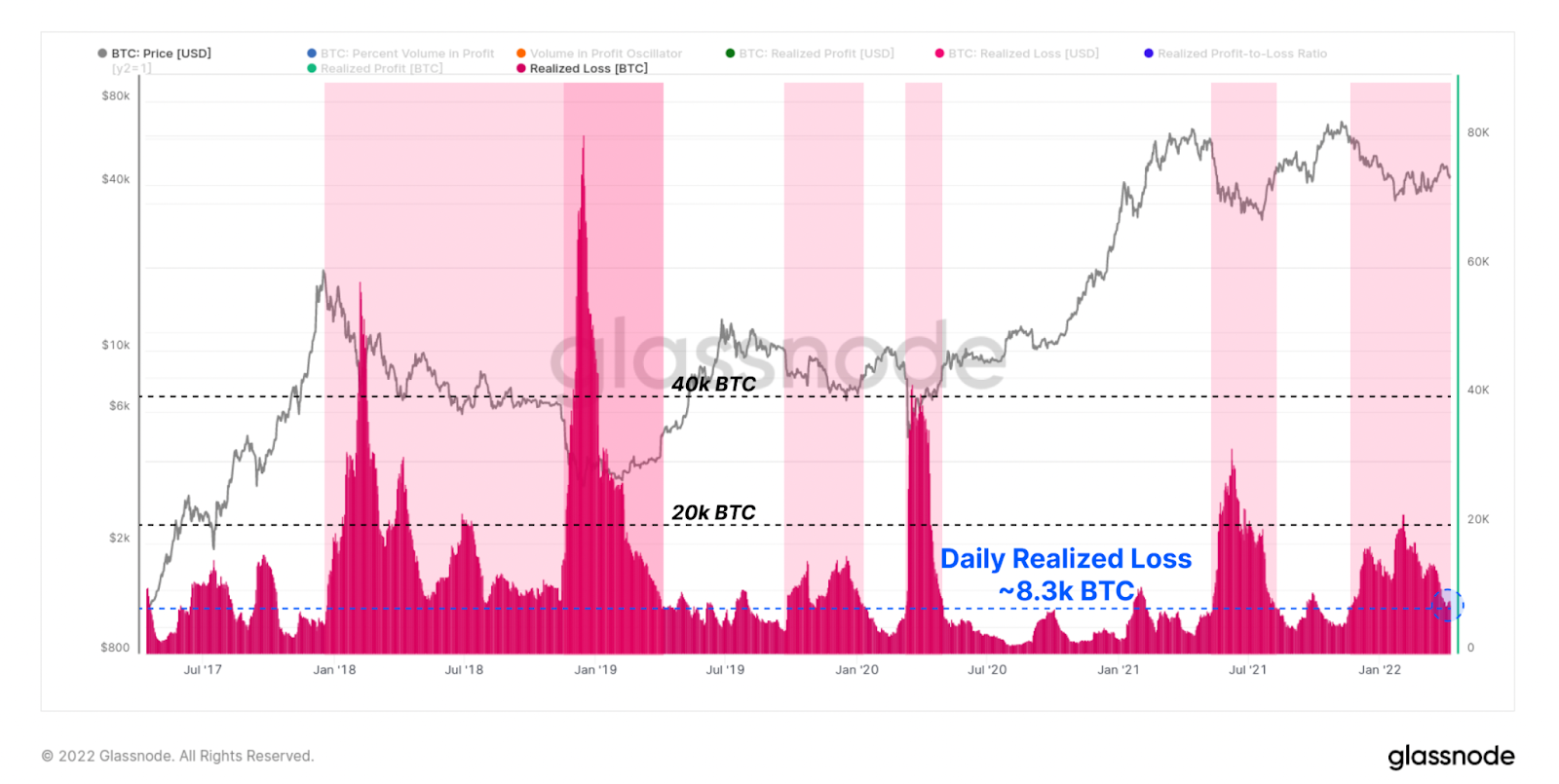

We also consider realized losses. This indicator shows when token holders are more likely to sell the token and make losses than own it with no realisations. We notice an increase in daily realized losses during bear market. The current market absorbs approximately 8.5k daily in BTC transactions.

It can be argued that BTC has continued to accumulate strong amounts despite adverse macroeconomic conditions. Realized losses data show that some market participants are being absorb at current prices. Strong market resilience is evident. Positive price movement could be possible in the immediate future due to an improved macroeconomic environment.

Credit for the imageShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.