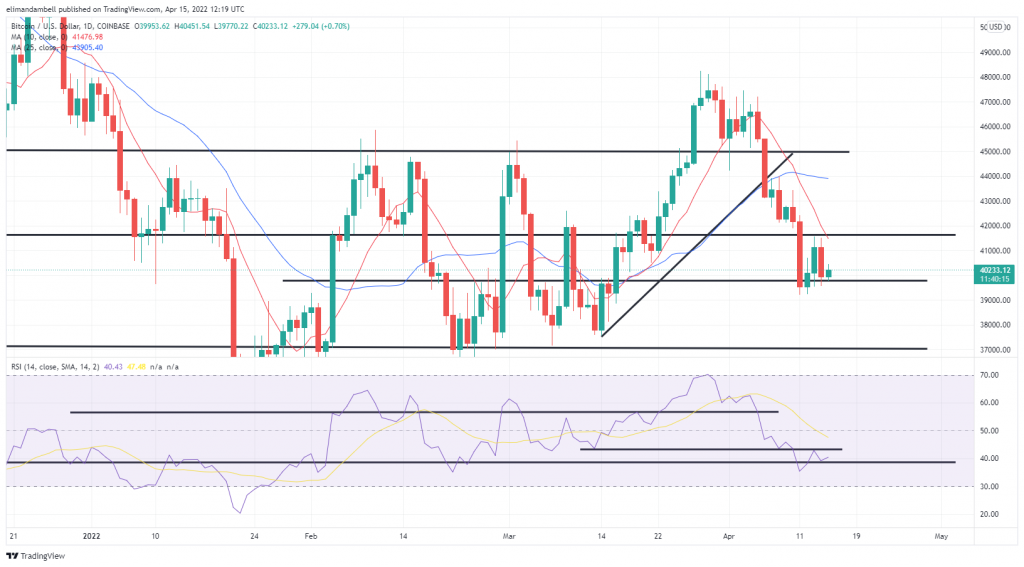

Trading of Ethereum is close to the support level at $3,000, even though some financial markets are closed on Friday for the holidays. Volatility has slightly eased as a result, with BTC also hovering near its floor around $40,000 during today’s session.

Bitcoin

Bitcoin was trading lower during Friday’s session, as volatility in crypto markets somewhat eased as a result of the Easter break.

After a Thursday high of $41,245.49, the BTC/USD has fallen by 2% to $39,695.74 on Thursday.

Today’s drop pushed prices closer to the long-term floor of $39,600, however BTC bounced back, with the move now appearing to be a false breakout.

Bulls are determined to keep prices above $40,000 despite bearish momentum from the 25-day and 10-day moving averages.

After failing to surpass the resistance at 42.65 this week, the 14 day RSI is still in oversold territory.

The chart shows that we could see price consolidation until a breakout at either the ceiling or floor of 38 on the RSI indicator.

Ethereum

Ethereum traded at $3,000, just like bitcoin on Friday. This was after an unsuccessful attempt to break through a crucial resistance level.

Thursday was a failure by ETH/USD at breaking out of the $3,150 ceiling. Prices then fell back to $3,000.

As a result of this, ETH dropped to an intraday low of $2,988.44 earlier in Friday’s session, and is currently down 1.5% on the day.

Bulls helped to reclaim the floor of $3,000, while the 14-day RSI indicator also seems to be finding support.

The 44th level is where the price strength was maintained since yesterday as shown by the sideways trend in the chart.

However, traders could still take advantage of this relatively calm session by swinging momentum to either side of current support levels.

Is there any chance of price volatility in the near future? Comment below to share your views.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.