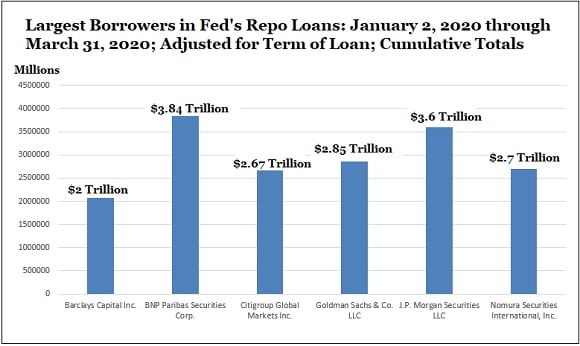

Reports show that the U.S. Federal Reserve provided secret loans of trillions to megabanks in the late 2020 and 2019 years, following the 2008 bank bailouts. Russ Martens of Wall Street on Parade and Pam Martens were investigative journalists who discovered that $3.84 Trillion in secret repo loans had been made by the Fed in March to BNP paribas (Q1 2020). Data further indicates that in the second half of 2019 and early 2020, U.S. central banking leveraged secret repo loan to give $48 trillion to megabanks.

Megabanks and the Fed have been donating tens of trillions of dollars to Megabanks, according to new reports.

While Wall Street eagerly awaits the Federal Reserve’s next benchmark rate hike decision, a number of investigative reports show the U.S. central bank participated in massive bank bailouts that are of biblical proportions. The first report stems from Wall Street on Parade’s Pam and Russ Martens, which accuses the Fed of secretly loaning the French megabank BNP Paribas $3.84 trillion in the first quarter of 2020.

The Martens’ findings highlight many more secret loans that come from a data dump derived from the New York Federal Reserve branch. This data dump contains secret loans that the Fed made to megabanks between September 17, 2019 and July 2, 2020. Wall Street on Parade writers claim that the media hasn’t reported on this data dump.

“Mainstream media has heretofore instituted a news blackout on the names of the banks that received the repo loan bailouts and the Fed’s data releases,” the Martens expose details. “As of 4:00 p.m. today, we see no other news reports on this critical information that the American people need to see,” the authors said on March 31, 2022. This news was not covered by any mainstream media outlet as of today (April 13, 2022), after Bitcoin.com News sought more details.

Pam and Russ Martens’ findings are scathing, and the data dump’s numbers almost seem unfathomable. This is what the report says:

The Fed data released this morning shows that the trading units of six global banks received $17.66 trillion of the $28.06 trillion in term adjusted cumulative loans, or 63 percent of the total for all 25 trading houses (primary dealers) that borrowed through the Fed’s repo loan program in the first quarter of 2020.

Bailouts Given to Banks on the ‘Verge of Failure’ and Institutions Holding Mountains of ‘Risky Derivatives’

Another report published on substack.com written by “Occupy the Fed Movement” also highlights the report from Wall Street on Parade, as it explained how the “NY Fed quietly dumps data on tens of trillions in repo loan bailouts to Wall Street.”

The researcher notes that Wall Street wants to keep the Fed’s “$48 trillion repo bailout secret.” The Occupy the Fed author asks why the Fed did this, and notes the central bank explains it was meant to “support overnight lending liquidity.” The research adds:

However, the data shows a different picture. In the fall of 2019, over 60 percent of the repo loans went to just 6 trading houses: “Nomura Securities International ($3.7 trillion); J.P. Morgan Securities ($2.59 trillion); Goldman Sachs ($1.67 trillion); Barclays Capital ($1.48 trillion); Citigroup Global Markets ($1.43 trillion); and Deutsche Bank Securities ($1.39 trillion).” These firms are all massively exposed to risky derivatives, especially Japan’s Nomura. Moreover, Germany’s Deutsche Bank was literally on the verge of total failure at the time.

Famed Economist Tells Wall Street on Parade Journalists the Fed’s Secret Repos ‘Broke the Law’

In addition to the massive secret repo loans, another report highlights statements from the renowned economist Michael Hudson that says the Fed’s secret loans may have been illegal. Hudson claims there was “no liquidity crisis whatsoever,” and “emergency repo loan operations for a liquidity crisis that has yet to be credibly explained.”

According to the economist, the Dodd-Frank Act was supposed to stop bailouts. However, Janet Yellen (U.S. Treasury Secretary) helped alter that. “Well, what happened, apparently, was that while the Dodd-Frank Act was being rewritten by the Congress, Janet Yellen changed the wording around and she said, ‘Well, how do we define a general liquidity crisis?’ Hudson told the Martens during a phone interview. “Well, it doesn’t mean what you and I mean by a liquidity crisis, meaning the whole economy is illiquid,” Hudson added.

The professor of economics at the University of Missouri–Kansas City continued:

[Dodd-Frank] was supposed to say, ‘OK, we’re not going to let banks have their trading facilities, the gambling facilities, on derivatives and just placing bets on the financial markets – we’re not supposed to help the banks out of these problems at all.’ So I think the reason that the newspapers are going quiet on this is the Fed broke the law. It wants to keep breaking the law.

Fed Members Divide on US Inflation

Meanwhile, as people are awaiting the Federal Reserve’s decision to raise the benchmark bank rate a second time in 2022, a couple of Federal Reserve members are split on whether or not inflation will be a huge problem going forward and whether or not a series of rate hikes are needed.

Federal Reserve governor Lael Mindard and Richmond Fed president Thomas Barkin make up the split. Brainard told the Wall Street Journal that getting inflation down to the 2% mark is the Fed’s “most important task.” Brainard expects inflation to cool down and Barkin agrees with her.

According to Barkin, Barkin intends to target a lower inflation rate around 2.4%.

“The best short-term path for us is to move rapidly to the neutral range and then test whether pandemic-era inflation pressures are easing, and how persistent inflation has become,” Barkin told an audience at a Money Marketeers conference in New York. “If necessary, we can move further,” the Richmond Fed branch president added.

What do you think about the reports that claim the Fed’s participated in secret bailouts that were against the law according to the economist Michael Hudson? Are you concerned that this should concern the American public? Comment below to let us know your thoughts on this topic.

Images CreditShutterstock. Pixabay. Wiki Commons

DisclaimerThe information contained in this article is intended to be informative. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.