Bitcoin has been hinting at lower levels during today’s trading session. This benchmark crypto was rejected for $48,000, and it has failed to return to its former highs.

Similar Reading| Galaxy Digital’s Jason Urban What Will Drive Ethereum To Flip Bitcoin

Bitcoin currently trades at $43,100, with a loss rate of 1% and 5.5% for the 24 hours and 7 day respectively.

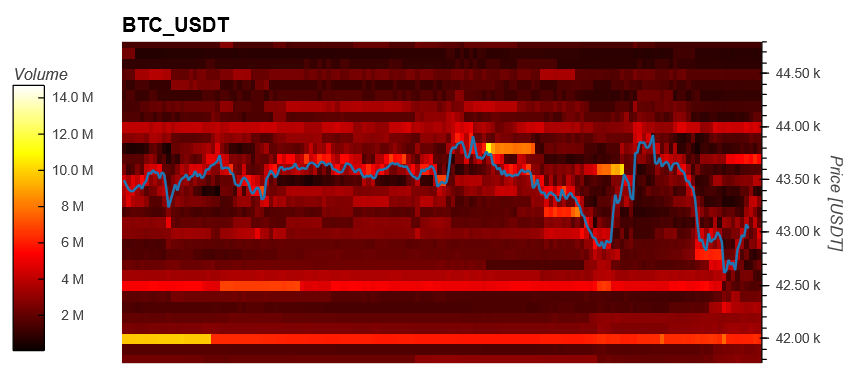

Data from Material Indicators records little support for BTC’s price as it moves in a tight range between $42,500 and $43,500. Future downside price action could be absorbed by losing bid orders for the benchmark crypto.

Below is a chart showing that BTC held around $10 million worth of bids orders. This was pulled during the downtrend in crypto. These liquidity appears to have been divided between $42,000 and $41,500. This could be the last defense against another attack by the bears.

The chart also shows how an entity places strategic asks orders when BTC’s price attempted to reclaim its previous levels. This happened as investors with asks orders of around $100,000 push BTC’s price back down to the low $40,000.

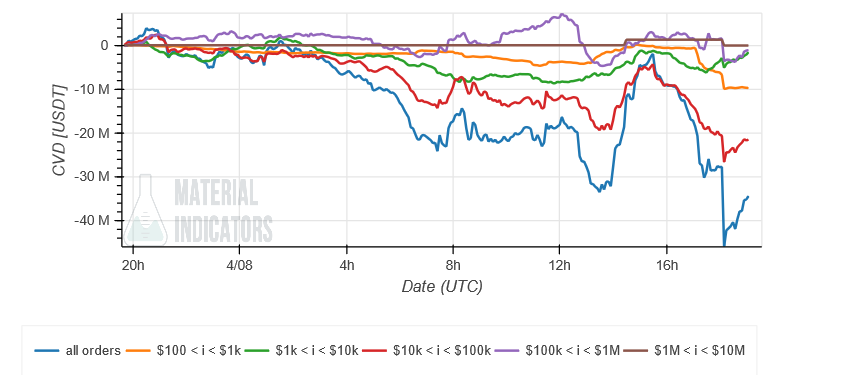

Retail investors, as well as investors who have asks orders in excess of $10,000 are the biggest buyers of current price action (yellow and cyan below). Only investors with bid orders of around $1,000 (green in the chart) seem to have been showing interest in buying into BTC’s price.

The above suggest a potential large entity trying to push BTC’s price down to accumulate BTC at optimal levels. This theory seems supported by evidence that liquidity was first distributed at $42,000 then spread between the levels of $40,000 and $32,000.

BTC Whales use this technique to capture retail investors and to obtain liquidity in order to maintain their positions. The bait seems to be attractive to small investors.

Bitcoin Whales Play Mind Games

Ali Martinez from Analyst showed that crypto Binance has seen an increase in long-term positions. Long traders have a 70% ratio and short traders only 29%.

Read More| More Correction Soon? Bitcoin Whale Ratio remains Elevated

The analyst commented the following on the potential implications for BTC’s price:

The liquidation of Bitcoin is in their plans! Binance Futures has net-long 70.69% on $BTC. This could result in a lengthy squeeze. To collect liquidity, BTC may drop to between $42,000 and $41,000