The Bitcoin whale ratio, as seen on-chain, is at a very high level right now. It suggests more negative developments could soon be in store for the cryptocurrency.

The Bitcoin Exchange Whale Ratio has remained at elevated values recently

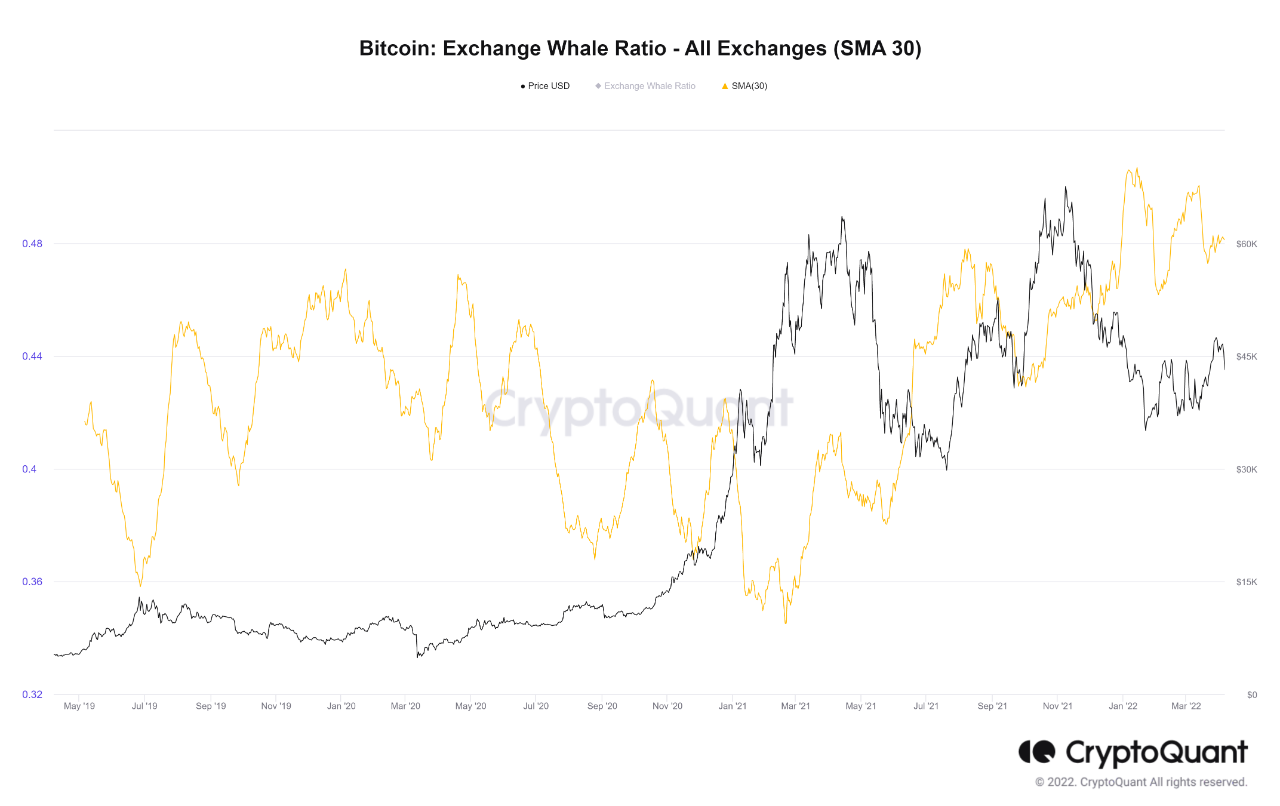

An analyst pointed out in a CryptoQuant posting that the BTC exchange whale rate has been at high levels recently.

The “exchange whale ratio” is defined as the sum of the top 10 Bitcoin transactions to exchanges divided by the total inflows.

The indicator shows us, in simpler terms, how big the transaction of the whale (that is the 10 largest) is relative to the amount of coins that have been moved into the exchanges.

This ratio can spike up if whales are now responsible for large amounts of exchange inflows. This could be an indicator of massive holders selling their shares, which can lead to a bearish trend in Bitcoin’s price.

Quant Explains How Bitcoin Funding Rate Predicted The Latest Top| Quant Explains How Bitcoin Funding Rate Predicted The Latest Top

A low indicator value suggests that whales are a large part of total inflows. Sustained such trend can be bullish for the crypto’s price.

Here’s a chart showing the evolution of the Bitcoin exchange whale rate (SMA30) in recent years.

It appears that the indicator's value has increased in recent years. Source: CryptoQuant| Source: CryptoQuant

The above graph shows that the Bitcoin exchange whale (SMA30) has a very high value at the moment. The indicator’s value had dropped off a bit just before the latest rally that took the coin above $47k, but it wasn’t long until it observed an increase again.

Due to this new wave, the price dropped below the $45k mark once more.

Bitcoin Collapses 7% As FED Gets Hawkish, Why This Could Be A Buy The Dip Opportunity| Bitcoin Collapses 7% As FED Gets Hawkish, Why This Could Be A Buy The Dip Opportunity

This ratio is showing signs of increasing or even staying above its current high levels, suggesting that the price could see further declines.

However, it’s also possible the Bitcoin whales may be done with their dumping for now and the ratio could drop back off to allow the price to recover, but it all remains to be seen.

BTC Prices

At the time of writing, Bitcoin’s price floats around $43.1k, down 5% in the last seven days. In the past month, crypto has seen 13% growth.

The chart below shows how the currency’s price has changed over the course of five days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts