Dash (DASH), formerly known under the names Xcoin/Darkcoin, was initially launched by Litecoin as a fork. This is a fork from Bitcoin’s protocol. As one of the first altcoins in the market, the token distinguishes itself with innovative techniques used to address Bitcoin’s laws with transaction times and privacy

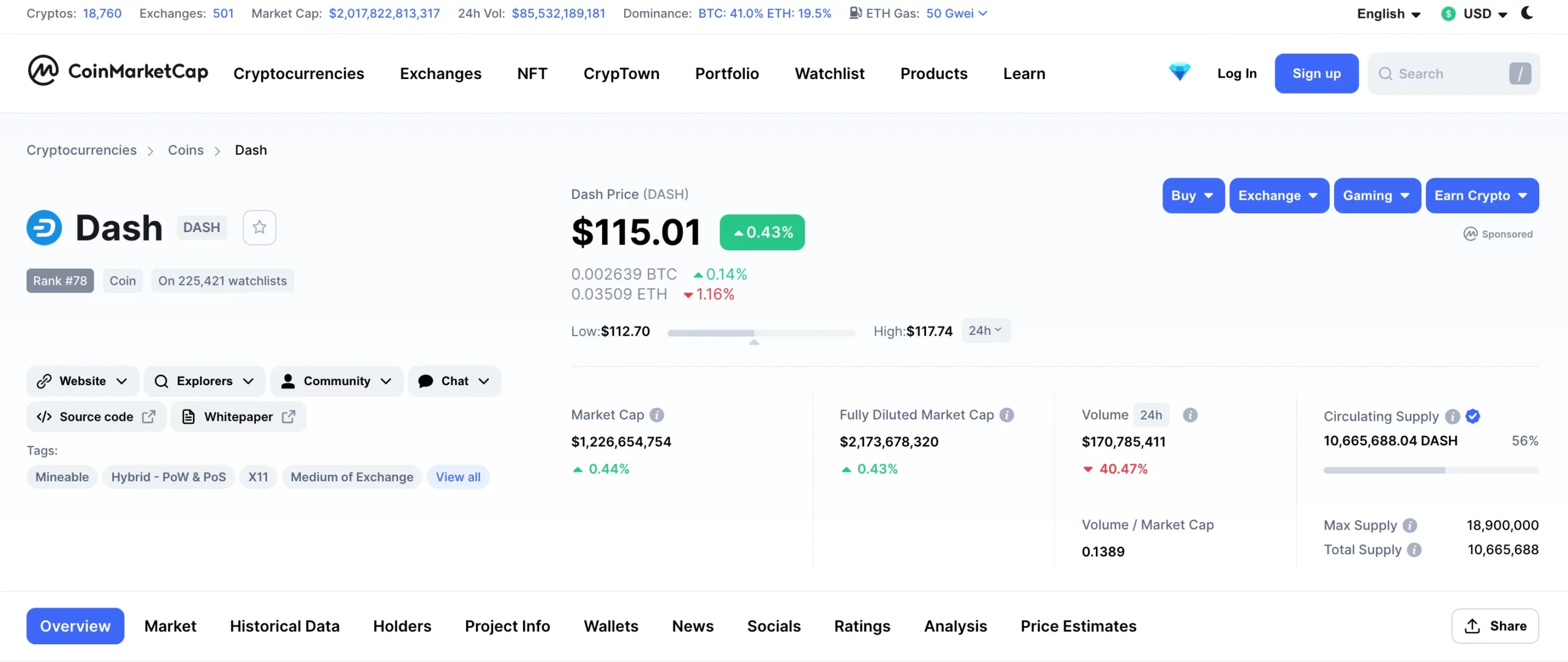

It has been integrated with over 1700 stores and services including well-known e-commerce platforms like WooCommerce and Shopify. The platform is also among the 100 most valuable cryptocurrencies according to market capitalization, at #78 in April 2022. If you’ve been wondering how to buy DASH, you’ve come to the right place!

Read on to learn everything you need to know about DASH, its key features, how it works, why it’s unique, and how to buy DASH tokens to diversify your crypto investment portfolio.

Was Dash Really All About?

Dash, an open-source blockchain and cryptocurrency that allows for fast, affordable payments worldwide without the use of the traditional financial system, is called. The goal of Dash is to make transactions anonymous and fast easy for users.

Evan Duffield created Dash and it was launched January 2014. It is a fork Litecoin (LTC), a fork from the Bitcoin protocol. It used to be called XCoin at first, but it later became Darkcoin because of its privacy features. It was rebranded as Dash in 2015 to stand for Digital Cash.

Dash is the first altcoin to modify and copy the Bitcoin code. According to the project’s white paper, Dash aims to improve upon Bitcoin (BTC) by ensuring more robust privacy and faster transactions. It was intended to offer more functionality and increase market share.

Dash built an efficient digital payment system. It has grown to be one of the most widely used networks in crypto market. The goal is to make Dash an everyday digital currency that can be used via PayPal, credit card or cash.

The Difference between Bitcoin and Dash

Dash has been designed to perform better than Bitcoin.

These two platforms employ different mining algorithms. They are used to calculate the work required for mining cryptocurrency. Dash operates with X11, a newer mining algorithm and a modification of the Proof-of-Stake (PoS) algorithm that demands less processing power in contrast to Bitcoin’s Proof-of-Work (PoW) algorithm. CoinJoin is used to allow private transactions on the blockchain.

Since it went live, Dash has expanded to include features such as a two-tier network with incentivized nodes like “MasterNodes” and decentralized project governance; InstantSend, which allows for instantly settled payments; PrivateSend, which delivers additional optional privacy for transactions; and ChainLocks, which makes the Dash blockchain instantly immutable.

Dash’s InstantSend feature enables transactions to be processed in seconds by allowing users to transfer DASH without waiting for transactions to be confirmed on the DASH blockchain. Every transaction has become instantSend since Dash 0.14 was launched. BTC transactions, on the other hand take a lot longer.

Transaction fees for Dash can also be lower, usually $0.01 to $0.02. BTC transaction charges, on the other hand, can be as low at $0.01 to $0.02.

MasterNodes

MasterNodes run Dash’s project and act as servers. They are backed up by Dash collateral. The MasterNodes are designed to securely deliver advanced services such as simplifying the verification and validation of transactions through governance using Dash’s proposal system. MasterNodes require 1,000 DASH to start. They provide a layer 2 service and can enable functions like InstantSend or PrivateSend.

InstantSend

InstantSend makes it easy to send DASH tokens to others without waiting for the transactions to be verified on Dash’s blockchain. Masternodes will lock your funds until you record it in the next block. Users then have the option to send crypto to Masternodes.

PrivateSend

PrivateSend allows users to make transactions using a mix service where Masternodes receive DASH tokens. Masternodes mix the tokens of users with their own. The trail becomes obscured making it hard to track DASH transactions.

Experimental Features

Dash has added experimental features which allow anybody who holds a specific amount of DASH tokens access to blockchain operations.

Dash uses a modified Proof-of-Stake mechanism (PoS), which is used by miners to create blocks and solve cryptographic puzzles. Miners can, therefore, preserve the blockchain’s transaction history and prevent double-spending. While Dash is based on Bitcoin’s code, it’s different from Bitcoin as the block time is only 2.5 minutes on Dash compared to 10 minutes for Bitcoin. Bitcoin miners who mine 100% of their BTC receive only 45% of DASH tokens, but Dash miners are able to get 45%.

The Dash MasterNodes can facilitate instantaneous private transactions and reject incorrectly created blocks from miners. They also store a full copy of the Blockchain ledger. 45% of the block rewards go to MasterNodes, and 10% – go to funding future proposals. After miners complete a validation they are able to vote on the allocation of 10%.

Everyone can submit a suggestion for a feature or change to the network. But the MasterNodes make the final decision. A new feature is implemented if the “yes” votes exceed the “no” votes by more than 10%.

Dash is Unique

The MasterNodes system, which includes a special server with a complete copy of the Dash blockchain, is Dash’s unique feature. MasterNodes enable Dash features such as InstantSend that allows transactions to be confirmed in under two seconds. CoinJoin runs multiple transactions making them more difficult to trace. In exchange for operating MasterNodes, users receive part of Dash mining’s block rewards.

Most merchants don’t accept many types of cryptocurrencies; however, Dash has had quite a lot of success in this area.

DashDirect was launched on 27 July 2021 by Dash. It allows retail purchase using DASH tokens at more than 125 sites and 155,000 retailers. You may also get discounts depending on where you shop.

Dash’s other noteworthy aspect is its user-friendly design. Dash’s website provides clear information about how Dash works, as well as where to buy DASH tokens.

DASH Token

DASH is the native cryptocurrency of the Dash platform.

DASH can be used as an inflationary asset and has a supply of 18.9 millions tokens. Every year the Dash mining reward rate drops by 7%. It is expected that the last DASH block will be mined in 2254.

DASH’s price history follows the same pattern as BTC because of the fundamental correlation. But, Dash is not the same as Bitcoin.

DASH’s price doubled within a week, reaching an all-time high of almost $60 in March 2017. The all-time low of DASH was recorded to be $0.2139 in February 2014, shortly after the coin’s launch. By December 2017, the token had reached $1,642.22, its highest point.

Why DASH is a good investment for investors

DASH has been a favorite cryptocurrency among many for its ability to perform private, fast, and secure transactions.

It is worth considering adding the token to your portfolio only if you believe that the market will favour protocols that allow for online payments to be efficient and easy.

The DASH token’s limited supply and deflationary nature may also attract new investors who believe DASH is a beneficial store of value.

Things to consider when buying a DASH

You must understand the risks associated with cryptocurrency investments. Cryptocurrencies can be complex and volatile. If you’re considering DASH as a potential addition to your portfolio, you must first consider the following factors:

- Availability: DASH is listed on a range of global crypto exchanges making it easily accessible for traders and increasing the coin’s credibility.

- DASH supply: DASH supply is limited. It will reach its maximum supply before 2300. Prices may then rise after that.

- DASH faces strong competition from a variety of popular cryptocurrencies such as Bitcoin Cash (BCH), Litecoin Cash (LTC), Ripple(XRP), Ripple [XRP] and privacy coins like PIVX/PIVX and Monero/XMR. DASH’s popularity and adoption relative to these competing coins will affect and determine its market value.

- Emission Rate: DASH’s variable block reward is decreasing at a rate of 7.1% each year. According to the Dash whitepaper, Dash will continue to emit coins for approximately 192 years. A full year of mining produces less than one DASH. After 2209, only 14 DASH more will be produced. It will also take 231 years for the last DASH to become available. The process will begin in 2246, ending in 2477, when it completely ceases.

- Decentralized Governance: Dash uses a decentralized governance system and voting system. Any member can submit a request for new features or changes to the Dash network. MasterNodes then vote on these proposals.

DASH:

These are the steps to buy DASH coins

Step 1: Choose a Cryptocurrency Exchange

You must compare the popular cryptocurrency exchanges’ features before choosing the one that suits your investment needs best. Consider the following factors: trading fees, supported deposit methods and ease of use.

You can find this information by clicking the exchange name, such as KuCoin Cryptocurrency Exchange and eToro USA LLC Cryptocurrency Trading. You can find the review page by clicking on its name in the table.

You can buy DASH using fiat currencies like euros, pounds, dollars, etc., on an exchange service like Binance, Binance Futures, HitBTC, HuobiGlobal, OKEx, Yobit, ZBCom, etc.

Step 2: Open an account

After you’ve decided on a reliable crypto exchange, the next step is to open a trading account to buy or sell DASH. There are different requirements depending on which trading platform you choose. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required by most exchanges.

Uploading your bank statements, credit card statements, and utility bills may be required to show proof of address. If you intend to withdraw fiat currency from the bank account in order to buy cryptocurrency, then it is possible that you will need to verify your identity using a smartphone or webcam.

Some exchanges let users trade DASH online without requiring KYC. However, they won’t allow you to transfer local currency from your bank account; therefore, if you plan to purchase DASH with US dollars, you will need to pass the KYC requirements.

You may wish to activate the two-factor authentication ( 2FA) after you have verified your ID. This will add another layer of security for your account.

Step #3: Deposit the funds

The next step after setting up an account is to deposit funds in order to buy DASH or other cryptocurrency. Your bank account, your debit/credit card or crypto coins can all be used to purchase DASH and other cryptocurrencies. The location of the trade platform and your preference will dictate which payment method you use.

- Bank AccountYou can make a wire or bank transfer to a local account for free. However, before depositing funds you should double-check your information with the DASH Exchange you select.

- A Credit Card or Debit cardTo top up your account, you can easily link a credit card. After linking your card, you are able to instantly make a purchase and set up recurring purchases with the card. You should be aware, however, that buying crypto with your card may result in an extra fee.

- CryptocurrencyDASH can be traded for BTC and other cryptos like a stablecoin. You will have to search DASH on spot markets to see the available cryptocurrencies.

Step 4: Purchase a DASHWallet

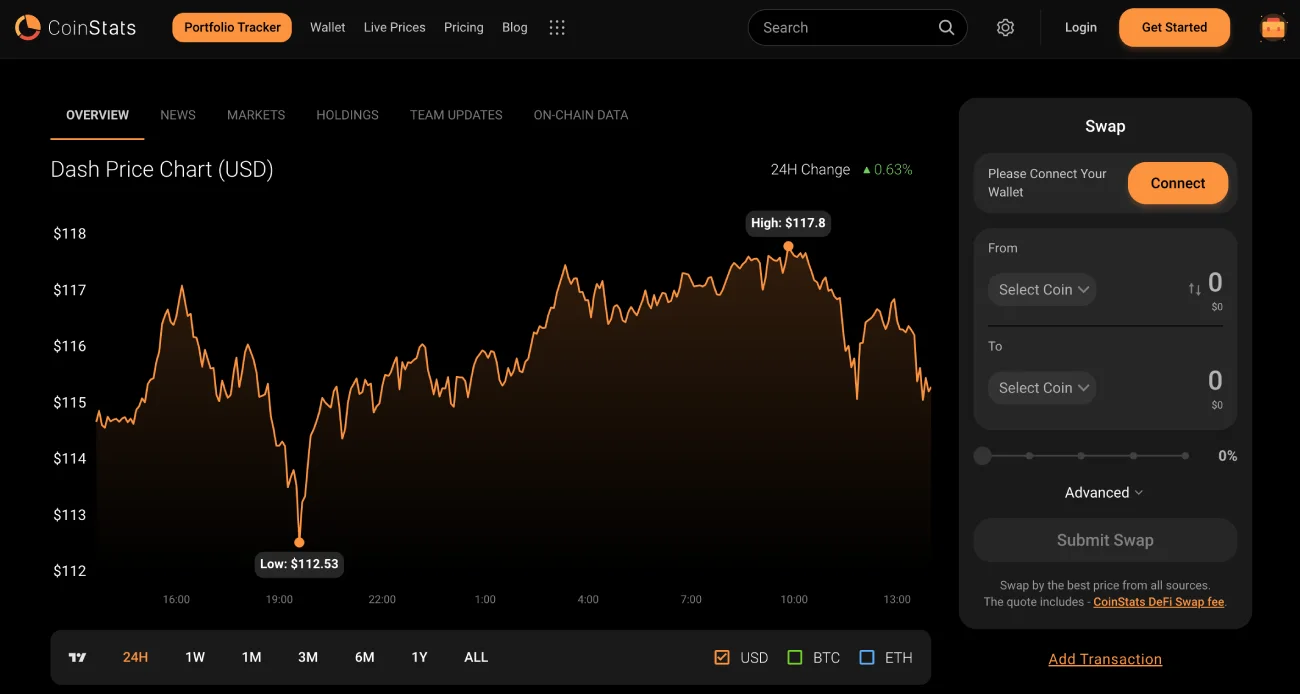

If you already have a DASH wallet, you can buy DASH directly from CoinStats by checking the coin’s current price and performance and directly swapping your existing coins for DASH tokens.

It is possible to either store the DASH coins you have just purchased on the exchange, or to move them to a personal wallet that can support DASH. To ensure ownership of their crypto assets, many users use their personal wallets.

Hardware wallets, or cold storage, are physical devices that can be used to store digital assets. They work in the same way as an HDD and SSD. As they can be stored offline, hardware wallets tend to be the safest way for digital assets to be kept. This greatly reduces the possibility of theft.

If you intend to use your DASH tokens often, you can choose from a digital or software wallet. No matter which wallet you pick, it is important to protect your keys and not share them with others.

The official Dash website has a comprehensive list of all crypto wallets supporting Dash.

Step #5: Buy Dash

Once you have completed the steps above, it is possible to start purchasing DASH. The easiest way is to use the ‘instant buy’ option to purchase DASH for a set price (if the cryptocurrency exchange you have chosen offers this feature). Select Dash from the list of assets or search for Dash by typing “Dash” into the search bar. Tap the Dash icon in the search results to bring up the buy screen. Enter the desired amount.

You can also open a trade in the spot market to set your own price—the most common way to buy cryptocurrency. Although the instant buy option is simple, it may cost more than the spot market.

Before completing your purchase, you should also check the performance of your existing portfolio using a crypto portfolio tracker and monitor the DASH current price to decide if it’s the right time to buy.

By placing a sale order, you can cash out your DASH on the same exchange.

The DASH Token’s Investability

According to walletinvestor.com, DASH is predicted to be an excellent long-term (1-year) investment based on the token’s price and performance as of April 2022. Based on the site’s technical forecasts, you can expect the DASH price to increase to $323.966 by 2027. Your $100 investment could reach $265.75 by 2027.

However, this article is not intended to be used as direct investment advice.

Closing Thoughts

Many users have started trading DASH coins, as a result of Dash’s increasing popularity. DASH has a strong track record and is a good long-term option.

Even after you have purchased your DASH coins, you must continue to monitor the protocol’s performance and adjust your trading plan accordingly to keep your crypto investments safe. You should also use hardware or software wallets that are secure to protect your tokens.

Platforms such as CoinStats allow you to easily purchase DASH with fiat currency, credit card or debit card or via bank transfer or any other cryptocurrency coins. To learn more about DeFi, you can visit our CoinStats Blog. The CoinStats portfolio tracker will help you keep track of your crypto investments. Your DASH coins can be safely stored in the CoinStats Wallet.

Investment advice DisclaimerThis website contains information that is intended to be informative. It does not recommend you to purchase, sell or hold any financial products or instruments. Information on this website is not based on any financial institution. It may be different from information you get from service providers.

Market risks, such as the possibility of losing principal, are all part and parcel of investing. Because cryptocurrency can fluctuate and is sensitive to secondary activities, it’s important to do independent research and seek advice. You should never invest more money that you can afford. Trading stocks and CFDs can be risky. CFD trading can cause losses of between 74 and 9% in retail investor accounts. It is important to consider all aspects of your financial situation before you make any investments. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.