Inflation continues to rise in the U.S. but the Eurozone’s inflation rate reached 7.5% last month. Energy and food prices have soared throughout the 19 member state economies, and European Central Bank president Christine Lagarde expects energy prices to “stay higher for longer.”

Eurozone inflation continues to climb, ECB predicts that it will raise rates 3 times this year

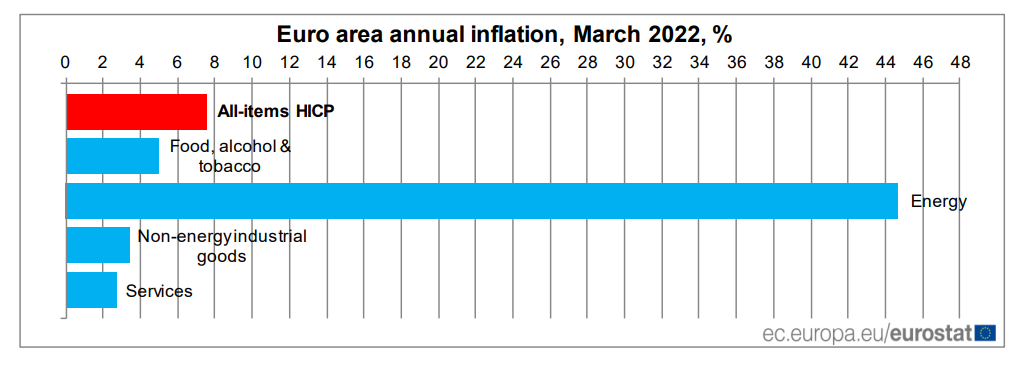

According to March figures, the Euro’s 19 member countries are experiencing rising inflation. The inflation rate was 7.5% in March. Similar to the U.S. Federal Reserve, the European Central Bank’s (ECB) inflation target is 2% and inflation in food prices, services, energy, and durable goods has risen well above the target.

Speaking to an audience in Cyprus on Wednesday, ECB president Christine Lagarde discussed the higher cost of living in Europe and stressed: “three main factors are likely to take inflation higher.” During her speech in Cyprus, Lagarde insisted:

The energy price is expected to rise for the foreseeable future. Some sectors are more likely to experience global manufacturing bottlenecks. [and]Households are growing more pessimistic, and may cut down on their spending.

The ECB must confront inflationary pressures head on, according to reports. Reuters reporter Balazs Koranyi says “markets are now pricing in 60 basis points of rate hikes by the end of the year.” In a note to clients on Friday morning, the senior Europe economist at Capital Economics, Jack Allen-Reynolds, wrote that the firm has “penciled in three 25 basis points rate hikes for this year.”

“With euro-zone inflation rising even further above the ECB’s forecast, and likely to remain very high for the rest of the year, we think it won’t be long before the Bank starts raising interest rates,” the economist said on Friday. According to reports, investors from Germany and Spain are placing their bets on the ECB for rate increases this year.

Margrethe Vestager, Danish Politiker, Strives to Get EU Residents To Avoid Hot Showers

A lot of the responsibility for inflation rising in the 19 countries can also be attributed to the U.S. as European bankers, bureaucrats, and politicians are taking blame for the Ukraine-Russian war. Deutsche Bank’s chief investment officer Christian Nolting explained in a note that elevated inflation may persist. “In the developed economies, already elevated inflation rates may now be driven even higher, given the conflict-induced oil and gas price shock,” Nolting wrote. “Sanctions, as well as businesses’ halting their operations in Russia, are exacerbating supply chain problems.”

Currently, there is very little reporting concerning the EU’s Covid-19 policy spending, the ECB’s long-term negative rates, and the ECB’s massive monetary expansion over the last two years. Before the eurozone’s inflation data was published, Germany’s economic minister Robert Habeck pleaded with Germans to reduce their energy consumption.

“There are currently no supply shortages,” Habeck remarked. “Nevertheless, we must increase precautionary measures in order to be prepared in the event of an escalation on the part of Russia.” Interestingly, the Danish politician and European Commissioner for Competition, Margrethe Vestager, tried to persuadeEU residents are advised to give up long, hot showers. Vestager stated:

Every time you turn off your hot shower water, say — Take that, Putin!

Let us know your thoughts on the eurozone’s rising inflation. Comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.