The Indian government has revealed that 11 cryptocurrency exchanges have been under investigation by the country’s tax authority. They have recovered approximately 95.86 crore rupees (or 12.6 million).

Investigations into 11 Crypto Exchanges for Tax Evasion

Lok Sabha, India’s lower house of parliament, asked questions Monday about the taxation of cryptocurrency trading platforms.

Parliament member S. Ramalingam asked the finance minister “whether it is true that some cryptocurrency exchanges were involved in evasion of goods and services tax (GST) and it was also detected that other cryptocurrency exchanges and major investors in digital currencies are under investigation by the government.”

In addition, the parliament member asked the finance minister about “the action taken or proposed to be taken by the government against those cryptocurrency exchanges that were detected in GST evasion.”

Pankaj Chaudhary (Minister of State in the Ministry of Finance) replied to:

Central GST formations have not detected many cases of the evasion or manipulation of GST by cryptocurrency exchanges.

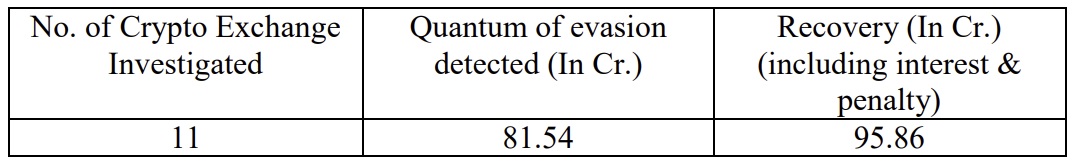

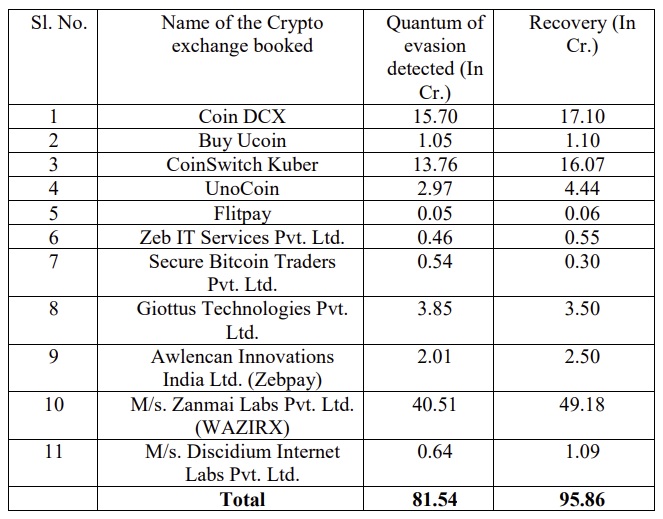

The tax authorities investigated 11 cryptocurrency exchanges and found that there was tax evasion of approximately 81.54 million rupees. Tax authorities have recovered 95.86 Crore rupees including penalty and interest.

A list of 11 exchanges was provided by the minister of state: Coindcx. Buyucoin. Coinswitch Kuber. Unocoin. Flitpay. Zeb IT Services (Zebpay). Secure Bitcoin Traders. Giottus Technologies. Awlencan innovations India. Wazirx. Discidium Internet Labs. Wazirx was followed by Coindcx and Coinswitch Kuber according to the listing.

Lok Sabha member Ramalingam also asked the finance minister “whether the government has any data regarding the number of cryptocurrency exchanges that are presently involved in cryptocurrency exchange business in the country.”

Minister Chaudhary answered:

There is no government data about crypto exchanges.

Indian Finance Minister Nirmala Sitharaman proposed taxing crypto income at 30 percent and imposing an additional 1% tax deducted from the source (TDS), on all crypto transactions. Recenty, a parliamentarian urged the government not to impose the 1% TDS because it would kill crypto assets.

What do you think about the minister of state’s answers? Comment below to let us know your thoughts.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.