Elrond’s blockchain provides a secure, fast and highly-decentralized platform to support the internet economy, enterprise applications and enterprises. Elrond was developed to alleviate congestion caused by traffic on network like Ethereum or Bitcoin and offer solutions for scaling. It uses adaptive state-sharding technology to enable faster transactions and greater throughput. It can handle approximately 15,000 transactions per minute, which makes it one of most efficient blockchain networks on the market.

Continue reading to find out everything about Elrond’s blockchain and its user-friendly interface. Learn how to purchase Elrond (EGLD), and whether Elrond can be a smart investment.

Let’s jump right in!

What is Elrond?

The development team describes the Elrond blockchain network as an “internet-scale blockchain” aimed at creating and developing decentralized applications (DApps), cryptocurrencies, and enterprise use cases. Elrond’s founders, Lucian Todea, Beniamin, and Lucian Mincu, established the network in 2017. Lucian Mincu and Lucian Todea were the founders of Elrond. They also founded MetaChain Capital in 2017 and ICO Market Data. To scale the environment for developers, Elrond uses a robust technology model based on “Adaptive State Sharding” along with a unique “Secure Proof-of-Stake (SPoS)” consensus mechanism. Elrond provides developers access to the most popular programming languages as well as flexible tools, in order to ensure cross-chain interoperability. Its goals are to improve network performance, speed up transactions, decrease network congestion and increase TPS. Elrond is a network reward system that rewards participants who have computational power to support the smart contract system.

How does the Elrond Network work?

Elrond has the ability to scale well and maintain strong security through the integration of three different mechanisms.

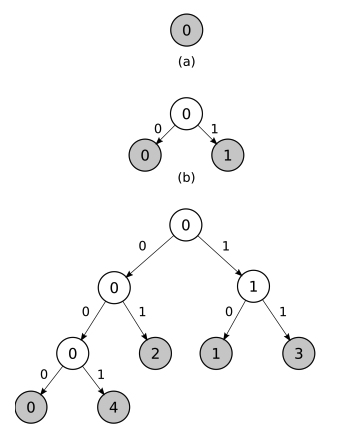

1. Sharding Mechanism

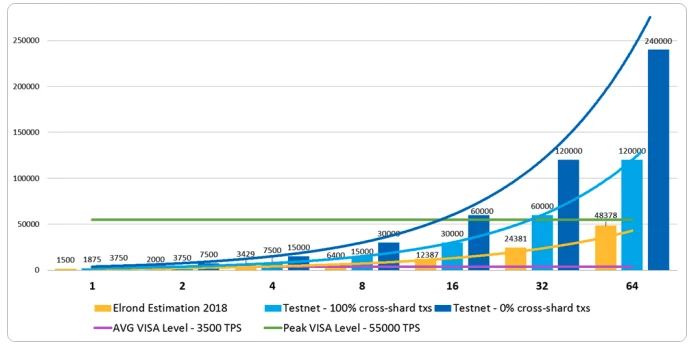

Elrond uses Adaptive State Sharding, a function that splits the network’s infrastructure to support the increasing number of applications and transactions on the ledger. To create an efficient, well-balanced and high-performing system, Elrond combines the three standard sharding methods of network sharding (transaction sharding), state sharding (state sharding), and transaction sharding.

Network Sharding It determines how network nodes will be allocated to and mapped within specific shards in order to maximize communication and message propagation within the shard.

Transaction shardingIt controls how transactions will be assigned to the shards that they will eventually be processed. For instance, a transaction could be assigned to a specific shard based on the sender’s address.

State Sharing: It’s one of the most complex methods to implement where every shard maintains only a portion of the state. Executing a transaction that involves accounts in two different shards will involve updating the state in each shard and the exchange of messages among the two. To increase resistance to malicious attack, nodes within the shards can be programmed to be reset from time-to-time. State sharding increases the transaction throughput due to parallel transaction processing while also lowering the transaction fees to $0.001 per transaction with a six-second latency rate.

2. Elrond’s Proof-of-Stake (PoS) Algorithm

The Elrond network has its own Proof-of-Stake (PoS) consensus algorithm called “Secure Proof of Stake (SPoS).” It uses three specific nodes (nodes can be servers/smartphones/computers) to relay and process data on the network using the Elrond node client software. These are the three nodes:

Validators: Validators act as primary nodes for Elrond. They process transactions through the network and exchange EGLD. These Validators add new blocks on the Elrond Blockchain, stake Elrond EGL tokens, or collateral, to process transactions. They also participate in the consensus system. The protocol rewards validators for their services.

Observers: Passive network members who read, relay and monitor information are called observers. They don’t need to stake EGLD coins to participate in the network and are not compensated for their services on the network. One option for observer is to either keep all of the blockchain history or only two periods.

Fishermen: Fishermen nodes Validator nodes can verify and invalidate block data. They can be awarded when they detect malicious actors within the network. Fishermen can also be served by validators or observers who have not been part of this consensus round.

The Elrond Network’s SPoS mechanism achieves high transaction throughput by choosing instantaneous randomized validators, enabled by blockchain sharding. Each validator is then assigned randomly to a specific shard so that every validator has only to verify the data on its particular blockchain shard.

3. Smart Contracts at Elrond

The Elrond Virtual Machine(VM), also known as Arwen WASM Virtual Machine was created to create smart contracts using the Elrond platform. It can be used to create Web Assembly smart contracts using familiar programming languages, such as Rust or C/C++. The Elrond VM’s smart contract engine is fully compliant with the Ethereum Virtual Machine (EVM). Ethereum smart contract can be seamlessly executed on the Arwen WASM VM. The WASM VM also supports full interoperability among external blockchain systems. This allows the exchange and transfer of data between various blockchain protocols. The Elrond network allows developers to create smart contracts. They can receive 30% as royalty.

In a nutshell, here’s how the Elrond blockchain network works – nodes are split into subsets to process transactions, then, the shards broadcast these transactions to the “Metachain,” Elrond’s central blockchain running on a special shard. The Metachain is responsible for finalizing the transactions and performing actions like notarizing and finalizing the shard block headers, facilitating communication between different shards, maintaining a registry of validators, triggering new epochs, processing challenges forwarded by Fishermen nodes, and rewarding participants on the Elrond blockchain. To prevent collusion among the validators of each shard, one third of validator nodes from each shard is reshuffled every 24 hours.

The Elrond coin: EGold

EGLD is Elrond’s native coin with multiple uses on the blockchain network. EGLD is a cryptocurrency with a finite supply. There will be only 20 million EGLD.

EGLD Can Be Used:

- As part of the platform’s governance mechanism, giving token holders voting rights and letting them vote on network enhancements

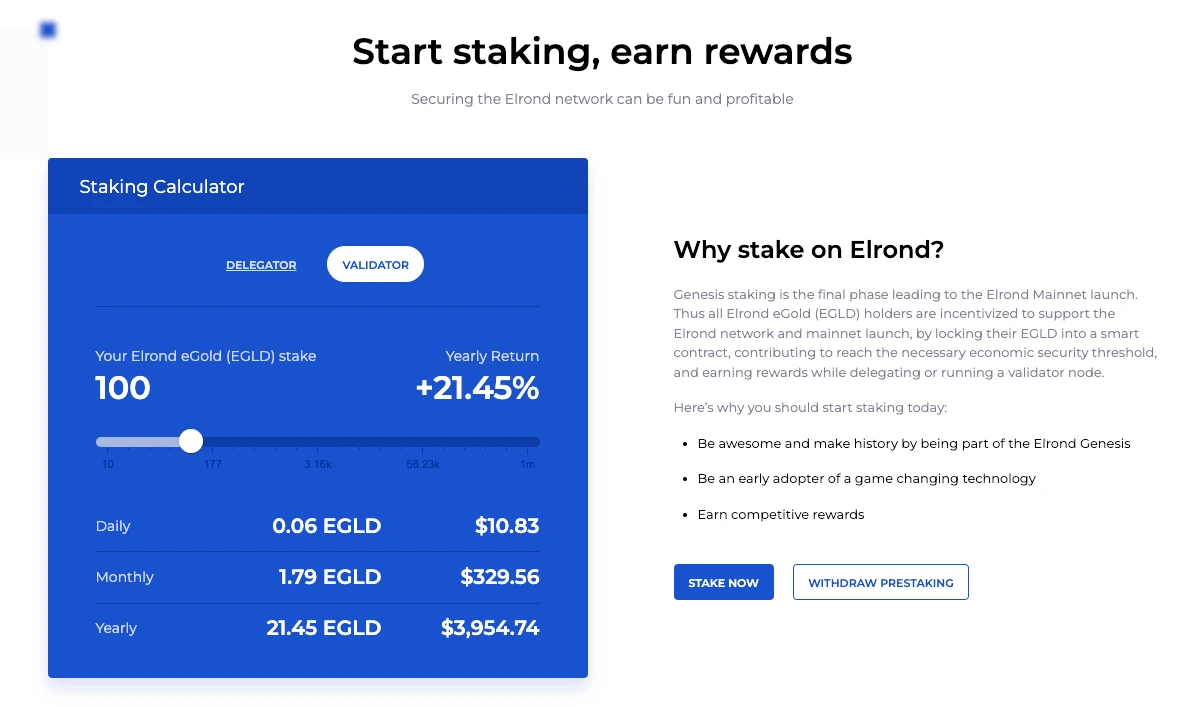

- You can stake and receive validator or active participation rewards

- For transactions and smart contracts, as payment.

Platform developers and users can pay the EGLD token to access the Elrond Network. The EGLD coin was designed for use with Elrond’s proprietary wallet that enables users to send transactions over the Elrond Network.

Elrond Tokenomics

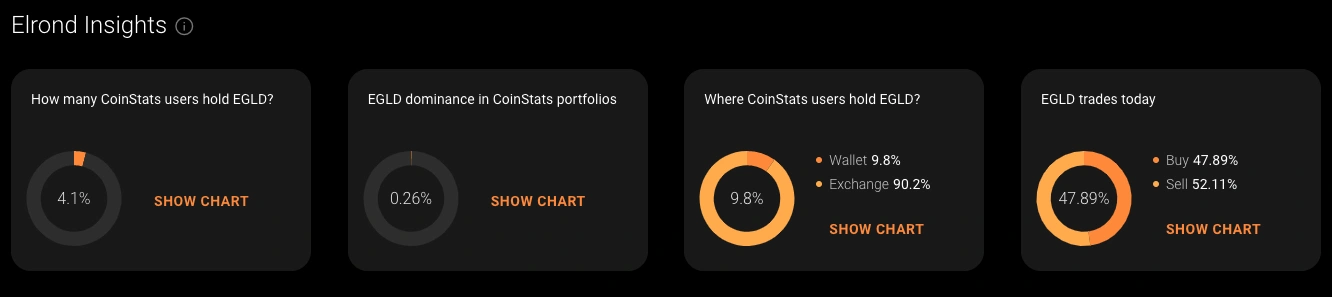

The live Elrond prices, market cap, historical stats and more can all be viewed on CoinStats. It is one of the top crypto platforms. You can purchase, trade and transfer EGLD through exchanges like Binance. KuCoin. CoinEx.

Elrond is a good investment

Elrond’s goal is to establish a new digital economy in which decentralization as well as scalability will be integral features of the blockchain infrastructure. Developers and users can create and use decentralized applications, as well as new crypto assets. They also have the ability to conduct low-cost transactions. It enables secure, scalable and robust transactions, which has sparked interest from traders around the world.

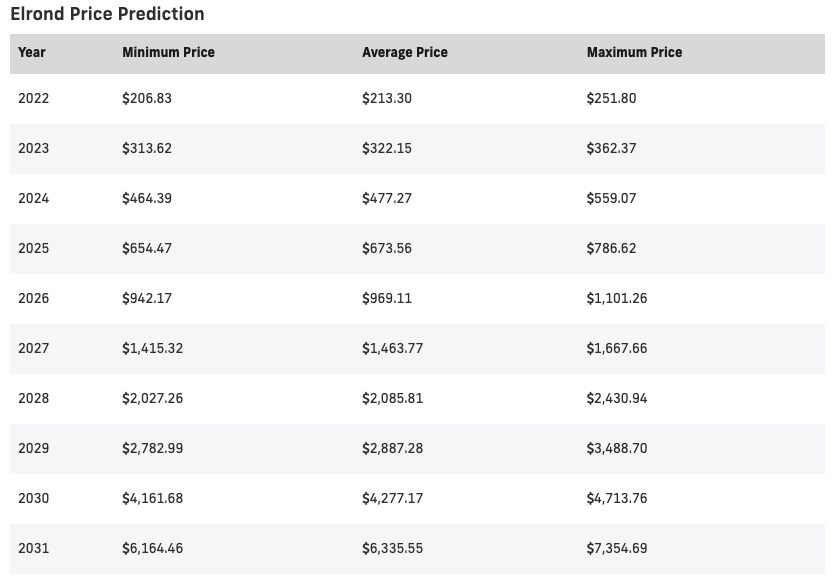

Elrond will reach its maximum price in 2023 at $329.21. In 2027 the EGLD will reach a maximum price of $1515.81.

Elrond (EGLD):

Elrond.EGLD can be purchased from a variety of crypto exchanges such as Binance, Crypto.com and Bitfinex. You also have the option to purchase it through Moonpay or Ramp. You’ll have to compare them to choose the cryptocurrency exchange with the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. Consider whether the exchange offers Elrond purchase with any of your preferred deposit options, including a bank transfer, credit card or debit card.

Below is a step-by–step guide to how to buy Elrond EGLD.

Step 1. Create an exchange account

After you’ve decided on a reliable cryptocurrency exchange that supports EGLD, the next step is to open a trading account for purchasing Elrond. Although the requirements vary depending on which platform you choose, most exchanges follow KYC and ALM protocols. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required for most transactions. This information is required to authenticate if you intend to withdraw fiat currency from a bank account to buy Elrond.

It’s advisable to enable two-factor authentication (2FA) to keep your funds safe once you’ve verified your identity.

Step #2: Fund Your Account

For Elrond purchase and for other cryptocurrencies, funds must be deposited. Elrond can be purchased using any of the following options: a debit or credit card, a bank account, crypto wallet, and a check. You will choose the method of payment that suits your preferences and location.

Step #3: Buy Elrond

The next step is to find the EGLD/USD and EGLD/BTC prices charts on your cryptocurrency exchange, then execute the trade. Be sure to choose an order type before you confirm your Elrond buy.

How to store EGLD

Once you’ve completed your Elrond purchase, the next step is to select a crypto wallet to store your coins securely. While your coins could be saved in your broker exchange wallet, we recommend that you create your private wallet using your unique set of keys. Based on your investment preferences, it is possible to choose between hardware and software wallets. However, the former are more secure. Let’s look into various wallet types below:

1. Elrond Wallet

Your eGold tokens can be safely stored in Elrond Wallet. This wallet has lower transaction fees, and you have full custody of your funds. Maiar, another official eGold wallet that uses the Elrond Blockchain is also available. To access your wallet funds, you can use the app to register your mobile number. To gain access to your wallet again in the event of loss, you can create a passphrase.

2. Hardware wallets

Hardware wallets and cold wallets, such as Ledger Nano X, Ledger Nano X, Trezor, are also options for storing EGLD. A hardware wallet stores your private keys to enable you to send and receive cryptocurrency. Because they provide offline storage and significantly reduce the risk of hacking, hardware wallets are often considered to be the best way to keep your crypto. The pin secures the wallet and erases all information after several failed attempts. This prevents physical theft. You can also sign and verify transactions using hardware wallets, which gives you extra protection from cyberattacks. Since hardware wallets do require some technical knowledge, they’re best for

Experienced traders who have larger amounts of EGLD.

3. Software wallets

Easy-to-use software wallets such as the CoinStats Wallet can be downloaded for free. You can download them as either desktop or smartphone applications and use them to communicate with various Decentralized Finance (DeFi) apps. There are two kinds of software wallets: custodial and non-custodial. Custodial wallets store your private keys and are managed by the service provider. Non-custodial wallets make use of secure elements on a trader’s device to store the private keys. However, software wallets are vulnerable to security leaks because they’re hosted online, so if you want to keep your private keys in software wallets, conduct due diligence before choosing a wallet to avoid security issues. A platform offering 2-factor authentication is recommended as an added layer of security. Because they are easy to use and operate, software wallets work well for beginners with limited funds.

Last Thoughts

Blockchain technology has taken the world by storm. Elrond’s network strives to overcome the limitations encountered in blockchains like Ethereum and Bitcoin through its secure PoS algorithm and Adaptive State Sharding mechanism. Elrond blockchain network’s extensive scalability means that it can handle a significant number of transactions with ease. Let’s sum up the benefits of Elrond below:

- Full Decentralization – No inclusion of any third party and no single point of failure.

- Robust Security – Node shuffling to prevent significant risks from malicious attacks and conduct secure transactions.

- High Scalability – Allowing a high number of transactions to be processed per second with less energy consumption using the SPoS algorithm instead of the PoW (Proof of Work) algorithm that uses high power computational equipment.

- Low Transaction Fees – Providing reasonable trading fees or gas fees per transaction.

- Seamless Cross-chain Interoperability – Elrond’s design permits unlimited communication with external services.

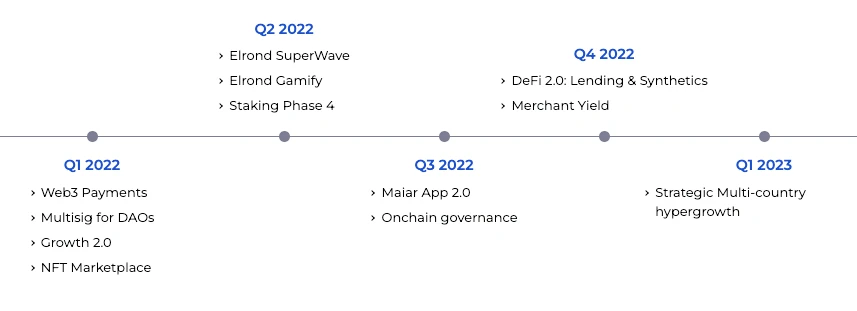

You can view Elrond’s development plan on the chart below:

To learn more about cryptocurrency, the best trackers, the blockchain technology, DeFi and other market factors, visit our CoinStats Blog. We also have the ultimate guide on how and where to purchase digital tokens and coins.

Disclaimer: This website contains information that is intended to be informative. It does not recommend you to purchase, sell or hold any security, financial product or instrument.

The market for cryptocurrency can be volatile. Do your research thoroughly and only lose what you are able to afford. Elrond’s past performance does not guarantee its future. Before you rely on the information, it is important to consider your personal circumstances. You should also carry out your own research, including the legal status and relevant regulatory requirements, and consult the relevant regulators’ websites before making any decision.

CFDs and stocks trading can pose significant risk. CFDs can result in losses between 74 and 9% for retail investors accounts. Before investing in crypto trading, you should take into account your personal circumstances.