Following a year of falling under $200 billion, the crypto-economy is now nearing $2 trillion. The TVL of defi fell 0.51% in the past 24 hours. However, statistics indicate that today’s TVL is around $210.29 Billion with Curve Finance leading by 8.75%.

Defi TVL Rebounds and Ethereum Classic Spikes. Weekly NFT sales increase by 32%

- The value locked in decentralized finance has once again risen above the $200 billion mark as it’s been coasting along at $210.29 billion on March 20, 2022. At the end of January, the TVL in defi dropped to a low of $185.20 billion and since then, it’s jumped 13.54% to today’s value.

- Curve Finance operates on eight blockchains and is the defi protocol that dominates all hundreds of TVLs. It has $18.41 trillion. Makerdao is the second-largest known defi protocol, with $16.2 million in locked total value. Curve and Makerdao follow Lido, Anchor,, and Aave.

- Terra’s Anchor protocol is now the largest lending defi protocol by TVL with $14.08 billion, while the lending protocol Aave holds $12.83 billion.

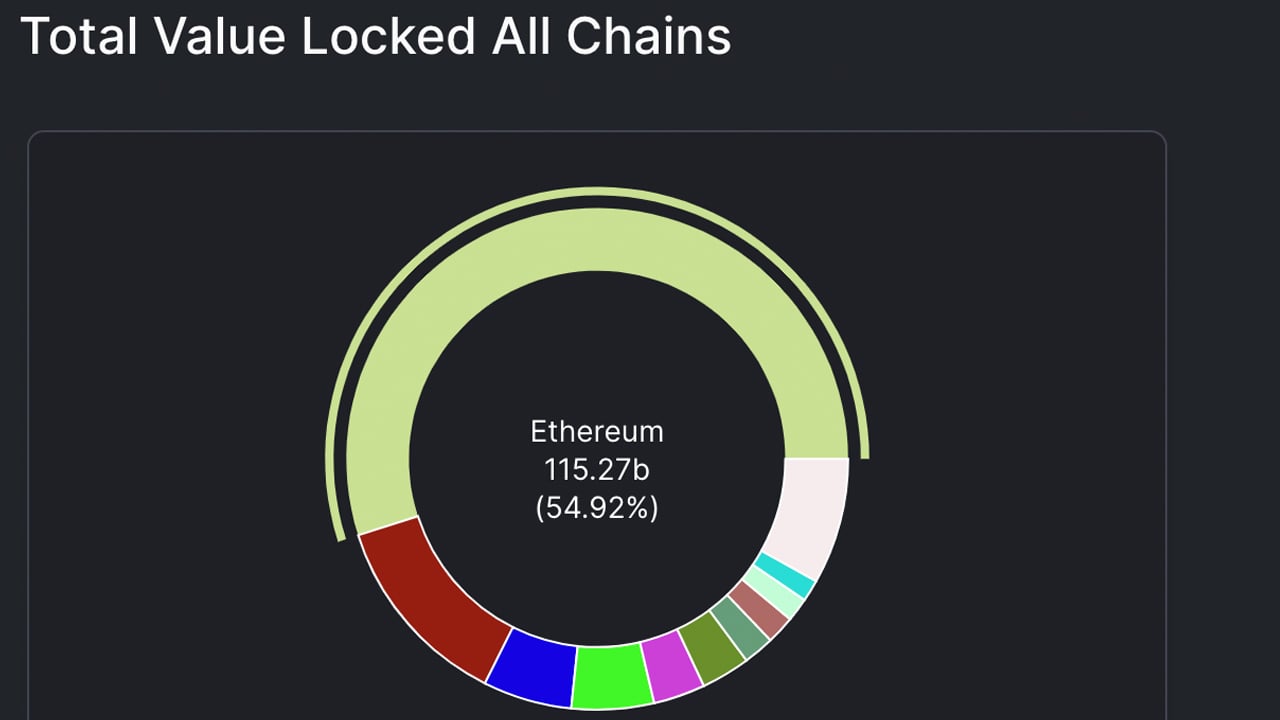

- Ethereum holds the TVL dominant position among all blockchains supporting defi protocol. It has a total of $210.29 Billion with 54.92% (or 115.27 Billion) in locked value. Ethereum currently supports 570 decentralized financial protocols, each with different TVLs.

- Terra, which has $26.66 Billion or 12.7% TVL of defiable assets today is second in size. The following are Terra, Avalanche ($11.13B), Solana (7.01B), Fantom ($6.62B), and Binance Smart Chain ($12.03B).

- According to market valuation, the six largest smart contract platform coin values equated to $642 million in value on March 20. Ethereum, binance Smart Chain, Terra, Solana and Cardano are the top smart contract platform coins according to market capital.

- Moonriver, qtum and boba network are the top five smart contract platform coins gainers over the last 24 hours. Ethereum classic has seen a 21.9% increase in value over the last 24 hour.

- Edenchain, Ethereum Classic, Kylin Network, Gather, and Casper Network were the five top seven-day smart platform coin gainsers. In the past seven days, Edenchain (EDN jumped 39.2%

- BTC (Bitcoin) is the dominant market player in crypto’s $1.9 trillion economy. ETH (Smart Contract Platform Coin ethereum) has a lead of 17.7%.

- Ethereum’s market cap is 43.8% away from rising above BTC’s market cap and at the time of writing, ETH’s 24-hour block reward revenue is larger than BTC’s revenue. Over the past day, ETH miners have accumulated $79,645,721 in rewards, while BTC miners have collected $74,790,000.

- With 49,845 addresses that leverage cross-chain technology in defi.

- The last 7 days saw $529.519.374 (NFT) sales across 15 different blockchains. The $529 million is up 32.10% from last week’s NFT sales volume.

How do you feel about the smart contract platform and defi coin activity this week? Please comment below to let us know your thoughts on this topic.

Credit for the imageShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.