The Bitcoin outflows today have seen a jump of over 30k BTC. This has caused a fall in the reserve on all exchanges.

A Deep Negative Spike in Bitcoin Netflow as 30k BTC Exchanges Exits

In a CryptoQuant blog post, an analyst noted that today’s netflow of BTC showed a substantial negative spike.

The “outflow” is a measure of the total amount of Bitcoin exiting wallets of all exchanges. Similarly, the number of coins being deposited to exchanges is the “inflow.”

Netflow refers to the difference in the inflow and outflow. This indicator indicates the amount of coins that are entering or leaving exchanges.

This indicator will be negative if it is positive. It means that there are more outflows than inflows at the moment and more Bitcoins leaving the exchanges. If this trend continues for a long time, it can signal accumulation and be positive for the cryptocurrency’s price.

USDC Inflow Spikes Up, Will It Act As Dry Powder For New Bitcoin Rally?| USDC Inflow Spikes Up, Will It Act As Dry Powder For New Bitcoin Rally?

A positive netflow, on the other hand shows that coins are being added to exchange wallets. Investors typically deposit coins to exchanges for sale purposes. This can make the trend bearish.

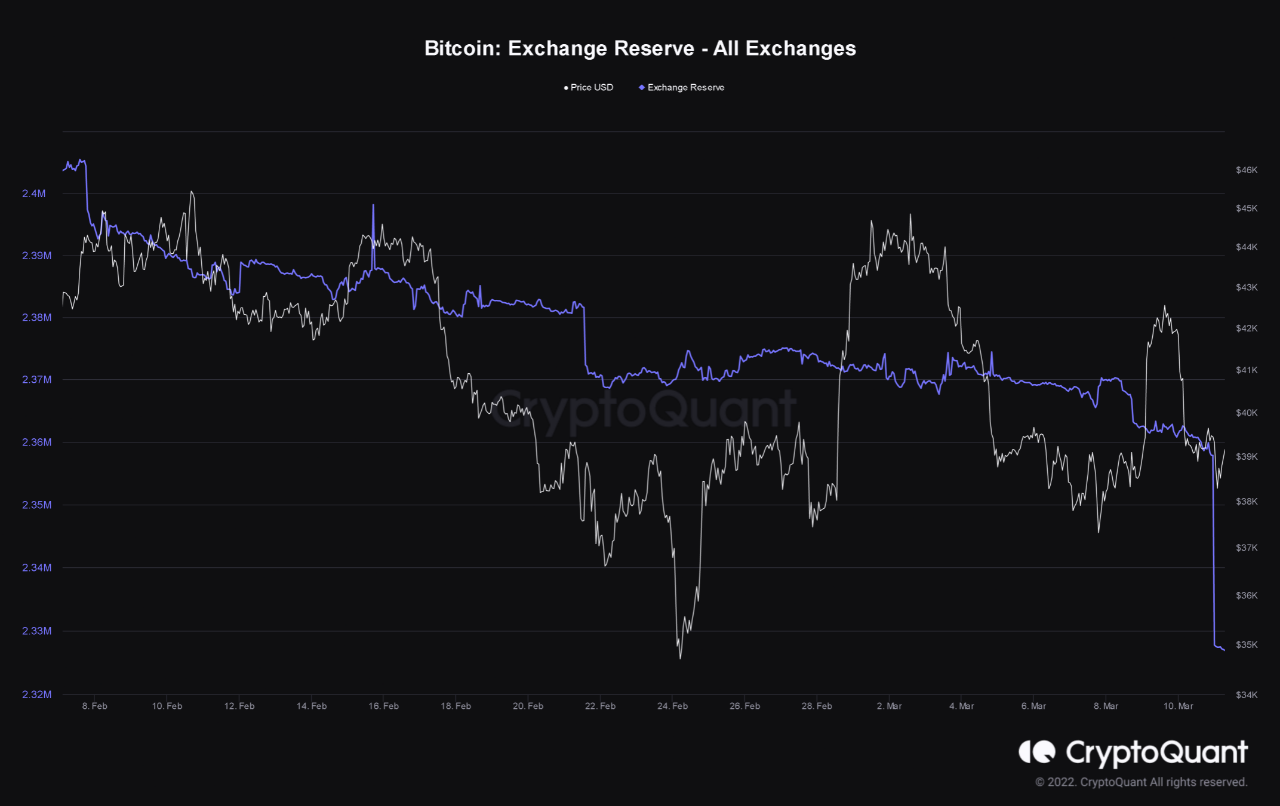

Here’s a chart showing the Bitcoin netflow trend over the last few weeks.

It appears that the indicator has experienced a significant downward trend recently. Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the Bitcoin netflow experienced a significant negative spike today. This resulted in an outflow exceeding 30k BTC (or more than $1.2 billion).

Due to the large number of coins that have left exchanges, the exchange reserve (which measures total BTC available on exchanges) has fallen.

CryptoQuant: The value of the indicator appears to have fallen today| Source: CryptoQuant

It is possible that this outflow was caused by one or more whale entities who withdraw their Bitcoin to store in cold wallets. This can have an impact on the price of crypto because it significantly reduces its supply (that’s the reserve).

Similar Reading: Bitbull CEO predicts Bitcoin will reach $100k in nine months| Bitcoin On Course To Hit $100K Nine Months From Now, Bitbull CEO Predicts

However, as the quant notes, it’s yet unclear at the moment what this negative netflow may signify. It’s possible it could be just an internal transfer within the exchange wallets. And if so, it shouldn’t have any positive effect on the price.

BTC Prices

At the time of writing, Bitcoin’s price floats around $40k, down 3% in the last seven days. In the past month, crypto lost 6%.

Below is a chart showing the change in coin price over the past five days.

Source: BTCUSD tradingview| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts