Ripple (XRP) is a digital payment system and currency exchange network that can process transactions worldwide. It’s a global payments network, with major banks and financial services as its customers. Ripple was created to be a payment settlement asset and remittance exchange, similar to SWIFT for international money or security transfers.

Ripple is an open-source, peer-to-peer, decentralized platform. It allows money transfers for fiat currencies and cryptocurrencies as well as commodities such gold.

XRP (the native token) is a blockchain-based cryptocurrency that uses the XRP Ledger. It’s an open-source and permissionless decentralized technology that allows transactions to be settled in 3-5 secs. XRP can be sent directly without third parties, making it an intermediate mechanism of exchange between two currencies or networks—a temporary settlement layer denomination.

Learn everything you need about XRP Ripple. Also, how to buy XRP in a few easy steps.

Let’s jump right in!

What’s the XRP? (Ripple).

Ripple is an exchange system for currency and payments. The network was designed to be a substitute for SWIFT. Ripple facilitates the exchange of fiat currencies as well as cryptocurrencies and commodities like gold. To conduct Ripple transactions, the network charges a small amount of XRP.

XRP, the native currency of the XRP Ledger is used for transactions within the network. XRP can be purchased as an investment, or to fund transactions on Ripple.

XRP Founders

Ryan Fugger is a web developer who developed Ripplepay (the predecessor to Ripple) in 2004. Fugger set out to develop a financial network that allowed for online payments and provided security. Jed McCaleb, David Schwartz, and Arthur Britto, three software developers, decided to create a more sustainable system for sending value without Bitcoin’s high energy consumption and scalability issues. They created a distributed ledger in 2012 that addressed these shortcomings. At first, the code was called Ripple. The ledger included a digital asset that would initially be called “ripples” (XRP as the currency code). Ripple stood for the open-source project, the unique consensus ledger (Ripple Consensus Ledger), transaction protocol (Ripple Transaction Protocol or RTXP), the network (Ripple network), and the digital asset (known as “ripples”).

80% of the XRP was gifted to NewCoin, soon renamed OpenCoin, and rebranded as Ripple Labs or “Ripple.”

The XRPL Foundation, an independent nonprofit organization founded in 2020 with the mission of accelerating the adoption and development decentralized XRP Ledger. Coil and Ripple donated over $6.5M for the Foundation’s initial funding. Gatehub also contributed.

Ripple created a new use case today, leveraging the XRP Ledger as well as XRP for liquidity management within its cross-border payments operation. RippleNet’s payment platform allows for instant monetary transactions worldwide via a real time gross settlement (RTGS).

RippleNet’s ledger is maintained by the global XRP Community, with Ripple, the company as an active member.

What does XRP do?

Ripple finances the Interledger Protocol. This software platform facilitates payments between cryptocurrency and bank ledgers. RippleX also allows XRP to leverage RippleX. Developers and entrepreneurs can integrate blockchain technology with their apps using tools and services built upon the XRP Ledger.

Ripple does not use a proof of work system such as Bitcoin, or an Ethereum 2.0 proof-of stake mechanism. To validate and protect transactions, the Ripple network uses the XRP Ledger Consensus. This consensus helps to ensure the integrity and avoid double-spending.

Contrary what some believe, XRP is not dependent on any central entity to enable transactions. The goal of XRP is to make payment systems accessible to everyone. The Unique Node Listing (UNL) is used to make this happen. It’s a distributed network of validators.

The XRP Ledger’s community (or validators), powers all transactions. They must also agree to create a consensus. Unlike other blockchains, however, these validators aren’t compensated so that their performance isn’t affected. Instead, the XRP Ledger is based on the assumption that if a corporation needs to utilize the blockchain, it’s in that company’s best interests to participate in the consensus process and engage honestly.

XRP makes it possible to make instant payments or cross-border settlements within four seconds. ETH confirms transactions in 2 minutes while BTC can take as long as an hour. XRP also handles 1,500 transactions per seconds, as opposed to ETH’s 15 transactions per sec.

RippleNet has three products that are worth mentioning:

xRapid — offers on-demand liquidity and ensures that transactions like swaps and transfers are readily handled using XRPs kept in escrow accounts.

xCurrent — allows financial institutions to make seamless cross-border payments. The same institution can also use xCurrent to communicate with each other and to confirm transactions.

xVia – a simple payment interface that allows institutions to transmit payments, generate invoices, and track deliveries internationally.

Each transaction made on the XRP Ledger must be completed with the XRP currency. After each transaction, XRP will be destroyed.

What is Ripple Protocol Consensus Algorithm? (RPCA).

Ripple confirms transactions using its consensus mechanism, The Ripple Protocol Consensus algorithm (RPCA). Because Ripple does not require Proof-of Work energy-intensive mining, transactions with it are quicker, more efficient, and less expensive than those made using Ethereum or Bitcoin. However, some believe that XRP’s centralized architecture renders the network less secure, censorship-resistant, and permissionless than open-source blockchain networks.

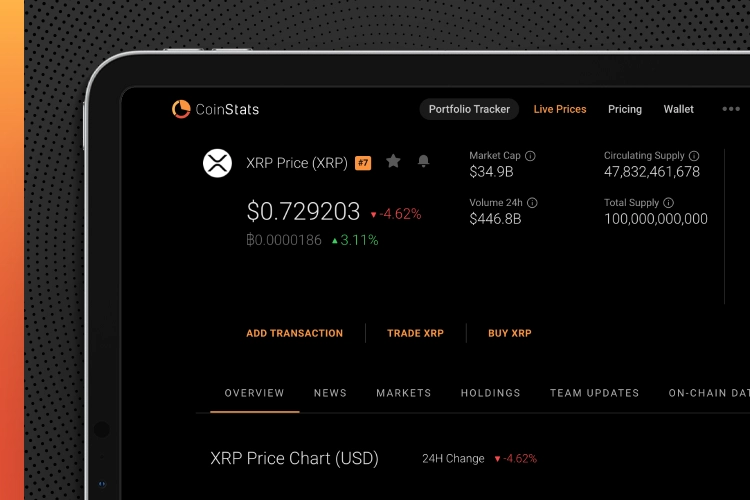

XRP Supply & Tokenomics

The total supply of XRP has a limit of 100 billion. These were all pre-mined prior to launch, and then released slowly into the marketplace by its major investors. XRP’s market value is $33.19billion, with a circulating stock of 47.8 billion as of February 2022.

Stock

Ripple deposited XRP coins in escrow accounts upon its creation. These coins were released at preset intervals to assure that the market supply was consistent. Ripple had 55% supply at launch. Ripple still has 55 billion, but 1 billion new coins are added each month.

All unused XRP that is not used in a given month will be returned to the escrow.

Deflation

XRP, a deflationary currency is subject to a small charge for every transaction. This is in order to prevent spam attacks. Every XRP transaction costs 0.00001XRP, also known as 10 drops or fractions of a penny. Higher costs will be incurred for transactions such as multisignature and escrow transactions. An agreement allows for the possibility of changing the fee and therefore the burn rate. Although Ripple is trying to reduce inflation, the circulating supply will increase as Ripple releases more XRP from its accounts.

Prices for XRP

The XRP price (like that of many other cryptocurrencies) has been highly volatile throughout the coin’s lifetime. Ripple’s price, previously trading for a fraction under a penny over many years, soared to more than $3 in the period between December 2017 & January 2018. The increase in Ripple was in line with Ethereum and Bitcoin’s 2017-2018 highs, which attracted many new investors to cryptocurrencies.

Ripple fell quickly after Bitcoin. In 2018, the price of XRP dropped below $0.50 per token. By the beginning of 2020 the coin was just $0.19. Ripple is still the third most valuable cryptocurrency after Ethereum, Bitcoin, and Ethereum.

After the COVID-19 plague, XRP fell to an all-time low of $0.14 per coins. In August the price was back at $0.30, and it remained relatively stable throughout the year. The currency’s value quadrupled to $0.65 per coin in November 2020. However, the positive momentum was halted by the SEC’s claims that Ripple had failed to register XRP as a security. After falling below $0.22 each token, XRP rebounded in February 2021. After Elon Musk’s April revival of interest in cryptocurrency, Ripple shot up to $1.81 per coin. At the beginning 2022, the XRP cost $0.83

How do I buy XRP?

Take these steps and you will be successful To buy XRP coins:

- A Cryptocurrency Exchange that Allows you to Sell or Buy XRP

- Make an account

- Fund Your Account

- Purchase

- Buy a wallet (Optional).

Let’s look into each step below:

Step 1: Choose the Best Exchange for Ripple

Despite XRP’s widespread popularity, few exchanges support XRP due to its legal struggle with the SEC. Most cryptocurrency exchanges banned trading XRP.

Even though XRP has been involved in a legal battle, Ripple can still be purchased in most countries around the world. You can also buy Ripple on a few trusted cryptocurrency exchanges.

If you are looking for the best exchange to buy XRP, it should offer low fees, high-tier trading features and an integrated XRPWallet. Ripple brokers should be able to accept multiple payment methods.

Now, let’s examine the three best cryptocurrency exchanges that support XRP trading.

1. eToro – Best Place to Buy XRP

eToro is one of the world’s most popular financial service platforms. It is popular for its support of thousands upon thousands of assets in multiple categories. DeFi currencies, such as AAVE, can be bought. You also have the option to purchase major crypto-assets such as Ripple, Ethereum and Bitcoin (XRP).

Users have many benefits from the exchange, such as commission-free trading and a quick account opening process. You can also use an Imitate Trading Tool to mimic the movements of top traders. eToro does not offer a base currency. After one year, there is a $10 inactivity charge.

In terms of cost, few cryptocurrency exchanges compare to eToro. No fees are required to purchase XRP tokens. A 0.5% Forex charge will be charged by the broker when you make your deposit. The process of withdrawing or depositing money is very simple. PayPal, Neteller and debit cards are all accepted as payment options by the portal.

2. Huobi – Secured Crypto Exchange to Buy XRP

Huobi was created in 2013, shortly after Ripple. It has been a household name in crypto since then. Huobi – also known as Huobi Global – hasn’t been hacked or experienced any other security concerns. Huobi advises Bitmart and assists them in strengthening their security.

Huobi offers spot and margin trading, and up to 200x leverage for some assets. This is greater than most other XRP trading platforms. It features a free in-house crypto trading robot using the unique ‘grid trading’ technique. Current backtested annual yield of 44% is 7 days. The ROI performance data are updated every week. Huobi offers high-yield crypto Staking, with as much as 50% Annual Percentage Yield on several assets and crypto Loans, along with a Welcome Bonus.

3. Capital.com – Buy XRP Commission Free

Capital.com, a financial service platform unlike any other, is unique. It focuses on contracts for difference (CFDs) – an agreement to pay the difference between the price of an asset today and the asset’s price at a later period when the contract expires. Capital.com allows access to hundreds upon hundreds of cryptocurrency, as well as crypto-tocrypto transaction support. The fee structure of the service is also appealing – deposits and withdrawals are free. Also, swap deals can be very competitive. However, Capital.com has several drawbacks – the service has hidden costs, such as overnight fees applied to specific instruments and a $250 minimum deposit for bank transfers, which is a little steep.

Step 2: Open an account

After you’ve decided on a reliable exchange, the next step is to open a trading account to buy or sell XRP. The exact requirements vary depending on which platform you choose. To comply with KYC (know your customer) standards and ensure the security of your account, personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required in most transactions. To be authenticated, you must give this information in order to start trading.

Step #3: Fund Your Account

You must verify your account before you can deposit money to buy XRP coins or other cryptocurrencies. To purchase XRP you can use your bank account or credit/debit card. The platform and your preferences will determine the payment method that you choose to purchase XRP coins.

The following are popular payment options

- Crypto deposits

- Wire transfers

- SWIFT transfer

- Transfers to banks

- SEPA deposits

Step 4: Complete a purchase

You can buy XRP using fiat currency (USD, EUR, etc.) You can also use another cryptocurrency. Many cryptocurrency exchanges allow you to instantly deposit funds, allowing you to purchase Ripple XRP tokens immediately after your funds arrive.

From the drop down menu select XRP and enter the amount. Next, look for the XRP pair that corresponds with the currency you intend to use such as XRP/USD. Now, you’re ready to place your order.

You can also buy XRP from CoinStats by clicking the “Buy XRP” button, which will connect you to one of the supported exchanges.

Step #5: Optional, purchase a wallet

You may keep your XRP tokens for use on an exchange of your choosing. You can increase the security and safety of your digital assets by investing in a hardware- or software-based crypto wallet. Your tokens are safe in your crypto wallet, even in the case of hacking.

Best XRP wallet

After purchasing XRP, you must also choose an XRP wallet. You can store your XRP tokens in a Ripple wallet.

SecuX W20

If you’re looking for a simple method to manage your cryptocurrency holdings on the go, consider investing in the SecuX W20. The SecuX W20 wallet is compatible with various cryptocurrencies, including Ripple, Ethereum, Bitcoin, and any ERC-20 token. The wallet’s bright touch screen allows you to view your cryptocurrency holdings and keep track of them without having to connect to a computer or mobile phone.

Ledger Nano X

Ledger’s Nano X cold storage option is very popular. This device offers high levels of security and can be customized to store your money. Nano X supports a large range of currency and app options and can store as many as 100 on a single device.

A Bluetooth connection is also available on the Nano X to allow you instant access to Bitcoin Market from your mobile or desktop computer. For regular investors, it may prove easier to trade and buy coins than to move them into their wallets.

What are the pros and cons of Ripple XRP?

Ripple differs from other cryptocurrencies in key aspects, so it’s essential to consider its advantages and disadvantages before making any investment decisions.

The pros

- Interest/tentative Adoption by Financial Institutions

- Fix supply

- Quick transactions

- Very low fees

Cons

- Validators that are corrupt

- Infrastructure, governance and issuing centrally

- Not supported by different exchanges.

Closing Thoughts

Ripple has drawn a lot of attention. Ripple has collaborated with banks across Japan and South Korea in order to utilize blockchain for efficient, low-cost cross-border transactions.

The Securities and Exchange Commission has been suing XRP. This lawsuit is threatening XRP’s future. They claim that the SEC did not register their crypto XRP security as they had traded $1.3 million in it. Ripple, if validated, has the potential to attract larger institutions in the coming years. It provides an efficient, global, and scalable payment network that lowers transaction fees. Holders of XRP have the potential to make huge profits on their investment.

Our CoinStats blog can be accessed to find out more information about wallets, crypto exchanges, portfolio trackers and tokens. For example, How to Buy Compound or other cryptocurrency.

Disclaimer: None of our information should be taken as legal or financial advice. For instant purchase of XRP, we offer simple and fast methods. Although we do our best to provide accurate information about every cryptocurrency, Ripple cannot be held responsible for its outcome.