According to on-chain data, around 800k ETH left the wallets of Gemini’s crypto exchange Gemini. This is a signal that might be bullish for Ethereum.

Crypto Exchange Gemini Watches Outflows Up To 800k Eth

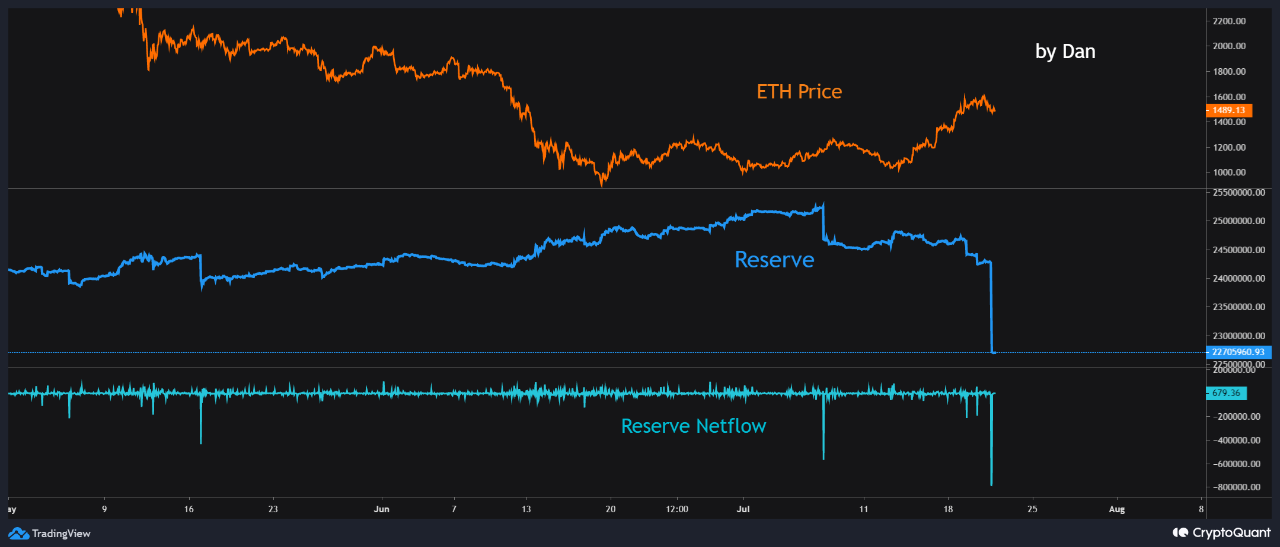

CryptoQuant’s analyst points out that Ethereum exchange reserve fell to new lows, which is something they have not experienced since 2018.

The “all exchanges reserve” is an indicator that measures the total amount of Ethereum currently stored on wallets of all centralized exchanges.

If this metric falls in value, that means there is a decrease in the amount of coins traded on exchanges. This trend can become a signal of investor accumulation and can therefore be bullish on the cryptocurrency’s value.

Related reading: The Average Bitcoin NuPL Holder is Back in Profit, but For How Long?| Bitcoin NUPL Shows Average Holder Back In Profit, But For How Long?

However, an increase of the reserve can mean that people are depositing coins immediately. This trend could have negative consequences for ETH, as investors often transfer their coins to exchanges in order to sell them.

This chart shows you the Ethereum reserves over the last few months.

Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the Ethereum exchange reserves have experienced a decline in value over the past day due to large withdrawals.

The chart also includes data for the “netflow,” which tells us about the amount of ETH entering or exiting exchange wallets (or more simply, it measures the changes in the exchange reserve). This value is determined by subtracting the outflows from the inflows.

Short Positions Over $165 Million Get Liquidated Following The Bitcoin And Ethereum Uptrend| Short Positions Over $165 Million Get Liquidated Following The Bitcoin And Ethereum Uptrend

The indicator showed a significant negative spike in recent months, which is understandable considering the drop in exchange reserves.

These withdrawals were made on crypto exchange Gemini, and the quant notes indicate that they amounted approximately 800k Ethereum.

Gemini has been popularly associated with whales. In the past transfers from and to the exchange were often noticeable in the market.

As such, such a large number of coins exiting from the exchange can mean Ethereum’s near term outlook might be bullish.

ETH Price

At the time of writing, Ethereum’s price floats around $1.6k, up 13% in the last seven days. In the last month, crypto gained 45%.

The chart below shows how the currency’s price has changed over the course of five days.

The crypto market has seen a sideways shift in value over the last days. Source: ETHUSD on tradingView| Source: ETHUSD on TradingView

Bastian Riccardi featured image on Unsplash.com. Charts from TradingView.com and CryptoQuant.com.