About 22% of South Africa’s adult population, or 7.6 million people, are cryptocurrency investors, findings by a study done by Kucoin cryptocurrency exchange have shown. Study results show that 72% said they are able to find information on specific projects using social media. Media personalities, influencers, and journalists were found to be important opinion leaders in promoting cryptocurrency.

Research shows that media personalities and influencers are key opinion leaders

According to the findings of a new Kucoin study, about 22% of South Africa’s adult population aged between 18 and 60 (or about 7.6 million people) are cryptocurrency investors. The study also found that 65% of crypto investors “consider crypto to be the future of finance.” The report added that a large percentage of the users appear to prefer digital assets as their favored means of savings to earn stable returns.

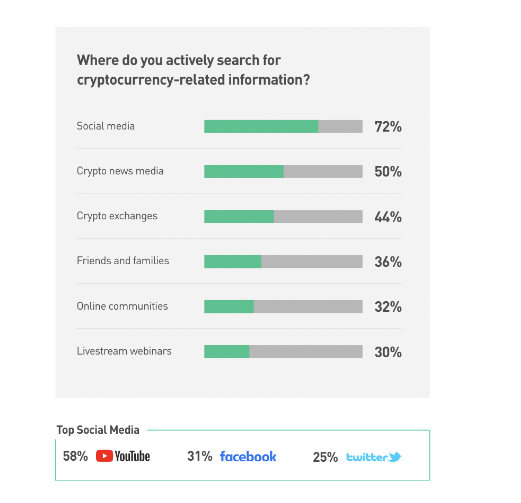

The study results reveal that almost three quarters of South Africans source information about crypto projects they are interested in investing in via social media. Social media was not the only source of information for crypto-related opinions. Media personalities and influencers were also a major part of the space.

Commenting on South Africans’ apparent preference for social media platforms as their first-choice information source, Kucoin CEO Johnny Lyu told Bitcoin.com News:

Statists data shows that South Africans use social networks to connect with their friends. This number is expected to rise to 40 million by 2026, according to Statists. This country has seen a rise in influencers, TikTok blogger and creators who believe that social media is an accessible and simple way of earning income. Khaby Lame, a well-known blogger from Africa, is inspiring many Africans to log on more frequently to social media in order for them find work and earnings as well as dating.

Lyu pointed out that social media is the most efficient way for people to find information. He said this is particularly true now when “users’ time is now fragmented, and obtaining information quickly and effectively has become a mainstream way of life.”

South Africa’s Unequal Wealth Distribution

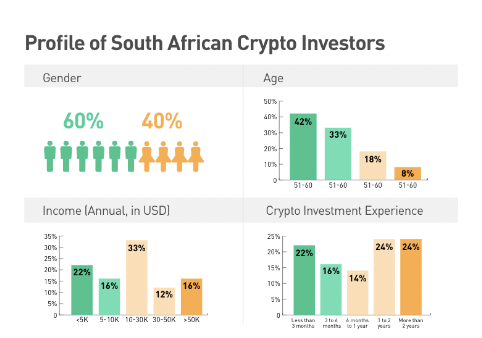

Meanwhile, in demographic terms, the cryptocurrency exchange’s study found that South African crypto investors are predominantly “male and younger generations.” Men are estimated to account for 60% of crypto investors while some 42% of the investors are thought to be aged 18 to 30. The study meanwhile exposes South Africa’s unequal wealth distribution and how low-income earners appear to use crypto as a tool for redressing the situation.

“The unequal distribution of wealth in the country is well illustrated by the findings of the report, as 22% of crypto investors earn less than $5,000 a year, while 16% earn more than $50,000 during the same period,” the study report explained.

While the study’s findings do suggest that interest in cryptocurrency is growing, the constant reports of South African crypto investors losing funds to scammers have nonetheless attracted the attention of regulators who have responded by either cracking down on crypto entities or warning the public against investing in cryptocurrencies.

However, despite the response from regulators, the study still found that South African crypto investors are “maintaining a positive attitude” towards cryptocurrencies as these are proving to be “capable of improving people’s standing financially.” Such adoption of cryptocurrencies is having the right impact on the local crypto market in general and this, in turn, helps to remove fraudulent individuals and players, the report said.

What are your thoughts on this study’s findings? Comment below to let us know your thoughts.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.