On December 12, 90% of bitcoin in existence today is still available. The five largest exchanges currently hold approximately 1.6million bitcoin. Coinbase’s bitcoin holdings, Binance’s Huobi, Kraken and Okex together account for 7.96% in the total 21 million bitcoin supply. The bitcoin held by Coinbase is a whopping 51% of the 1.6 million bitcoin or $41.6 billion using today’s exchange rates.

Five Exchanges Have 1.6 million Bitcoin Worth $81 billion

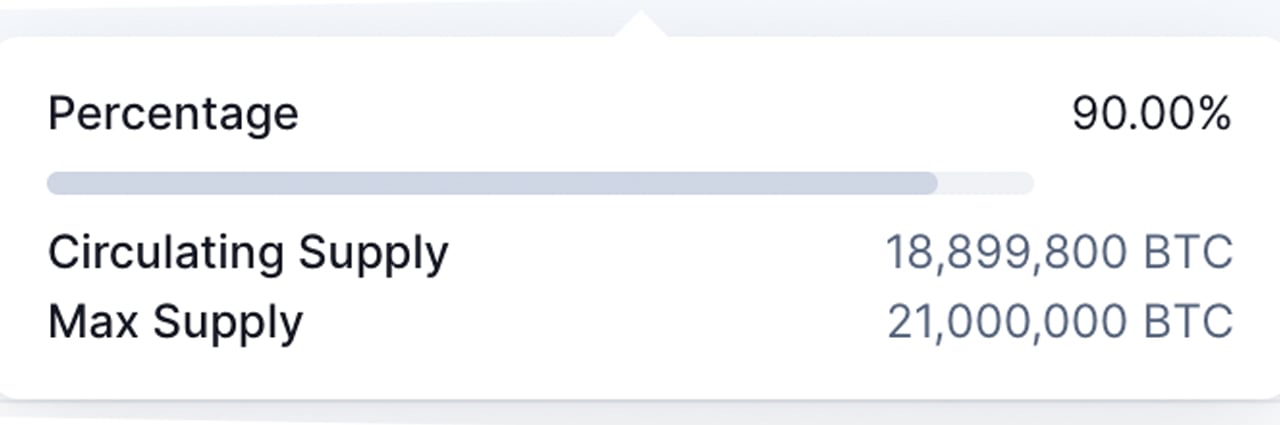

As of this writing, 91% of 21 million bitcoin’s supply has been reached. At the moment, 18,899800 BTC has been mined. 19 million will follow in the very near future.

A decent amount of bitcoin is also lost. Satoshi Nakamoto could have mined approximately 1.1 million BTC prior to leaving the bitcoin community. Coin Metrics published a study on November 19th, 2019, indicating that around 1.5 million coins were lost at block height 600,000.

Today, five exchanges hold 1,673,460 bitcoin or $81.6 billion worth using today’s USD exchange rate. These five exchanges include Okex, Binance Huobi Kraken, Kraken and Huobi. They also all have significant amounts of ethereum. According to Bituniverse and Chain.info metrics, Coinbase has 853,530 BTC.

The company’s ether holdings are not disclosed but in terms of bitcoin, Coinbase holds 51% of the aggregate held on the top five exchanges. Binance owns 290,080 BTC (or $14.1 Billion) and Binance also has 3.59 Million ethereum in reserve worth $14.2 Billion. Binance also has reserves of 1.24 billion USDT of tether.

Top 10 Exchanges Hold 7% of $2.3 Trillion Crypto Economy

Huobi currently has 160,950 BTC, 2.13 Million Ether, and 747,000,000 USDT. According to Metrics, Kraken holds 102.900 BTC and 2.27 Million ethereum in its reserves. Okex has approximately 266,530 bitcoin and only 248,840 of ethereum. Okex is fifth in digital currency trading volume.

Okex is followed by Gemini’s 116,000 BTC and 1.15 million ether, and Bitfinex’s 195,550 BTC and 353,660 ether in reserves. Bittrex (48.1110 BTC and 301.3370 ether), Bitmex (81.1650 BTC) & Bitflyer (75.030 BTC). Between the top five crypto exchanges, in terms of reserves, there’s $132.36 billion held on these platforms.

Combining all of the assets on the top ten exchanges, the total is approximately $165.89 million. For some perspective, there’s more crypto value on the top ten exchanges than the entire stablecoin economy of $162.6 billion. Surprisingly, funds on the top ten cryptocurrency trading platforms account for roughly 7.7% of crypto’s total $2.343 trillion.

How do you feel about crypto-value today held by centralized cryptocurrency exchanges? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki. Commons. Bituniverse. Coinmarketcap.

DisclaimerThe information contained in this article is intended to be informative. It does not constitute an offer, solicitation, or recommendation of products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.