While the total value locked (TVL) in decentralized finance (defi) hovers just above the $214 billion mark, a defi protocol called Lido has been moving closer toward taking Curve’s top spot in terms of TVL in a defi protocol. Lido, a liquid staking platform, currently has $19.2 Billion in assets. These funds are derived from five blockchain networks, including Terra, Terra and Polygon.

Lido’s Staked Assets Represent Close to 9% of the $214 Billion Locked in Defi

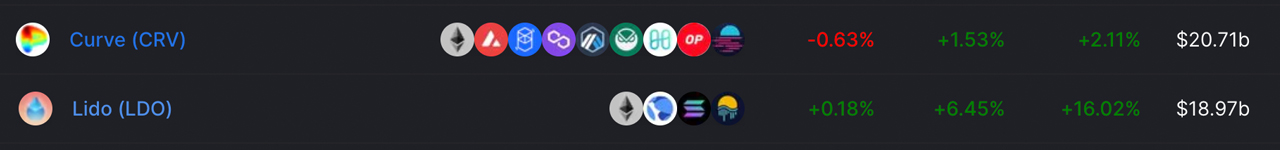

According to defillama.com, there’s $214 billion total value locked in decentralized finance at the time of writing. Curve Finance is the largest defi protocol, in TVL, according to the decentralized exchange platform (dex). According to statistics from defillama.com, Curve is the leader today with $20.71 trillion and an average dominance rate of 9.67%.

Curve is the leader in TVL for defi protocols, although Lido liquid staking solutions may be taking over soon. Lido’s TVL, at least according to today’s defillama.com metrics, is $18.97 billion, up 16.02% over the last 30 days. Lido is seeing significant use because defi protocols allow Ethereum, Terra, Polygon and Kusama users, to leverage their staked assets for yield.

So if a user decided to bond Terra’s LUNA into the token called BLUNA, they would exchange LUNA for BLUNA to start getting staking rewards. BLUNA tokens, which can be used for additional rewards, are also available to bond the stake. The same can be said about other networks like Ethereum, as Lido’s staked ether (STETH) commands the 18th largest market capitalization out of 13,671 cryptocurrencies. Lido’s staked solana is currently the 193rd most valuable market capital, while BLUNA was the 22nd on Wednesday.

While defillama.com notes that Lido’s TVL is $18.97 billion, it only accounts for four of the blockchains that Lido uses for staking. Polygon is missing from defillama.com’s metrics, and according to Lido’s stats on April 20, 2022, there’s $19,220,700,179 staked among 99,606 stakers. Lido stats reveal $10.6 Billion from Ethereum, $8.21B from Terra, $363 Million from Solana and $3.3M from Kusama. The Polygon network is worth $13.8 MILLION.

3.9% and 23.9% APY depending on Chain Rewards or Skipping Validator lock-ups

According to current staking estimates, Lido’s Ethereum staking solution is the lowest with a 3.9% annual percentage yield (APY), while Kusama’s is the highest at 23.9% APY. Lido boasts its ability to increase stake assets by double, however, Lido advises that there may be defi liquidity providers who take advantage of the Lido reward.

Lido’s unique benefit is that users can bypass the validator lock-up (although it does have an unbonding time) and can instead sell their bonds tokens on open markets. This route is not recommended as the user may lose the dex swap fee and approximately 1-2% depending on which bonded token they choose.

Lido Finance is considered a “staking company,” and there are a number of staking companies in the industry. Staking companies include Kyber Network (Celer Network), Blockdaemon and many others. Lido however has huge amounts of value across five different blockchains today and has seen its staked assets increase exponentially.

Let us know your thoughts on the Lido liquid stake solution. Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.