One of the most important trends in the Blockchain industry is decentralized finance (DeFi). It’s widely believed that this trend will take over traditional finance. DeFi makes use of DApps, distributed ledger technology (DLT), to enable permissionless financial transactions to be carried out within a peer to peer network.

Experts predict that DeFi adoption will explode because of DeFi products such as efficient stablecoin trade, Decentralized lending, Yield Farming or decentralized lending, DEX (Decentralized Exchanges), DeFi insurance and liquidity mining.

Read on for CoinStats ultimate guide to learn everything you need to know about the DeFi space, popular DeFi protocols, DApps, and download our CoinStats wallet that lets you coordinate all your DeFi activity from one place.

Let’s dive in!

What is DeFi?

The umbrella term DeFi refers to peer-to-peer finance services. It is one of the major innovations in blockchain technology that has revolutionized the world economy. It works on the blockchain-powered, decentralized network. DeFi is a disruptive disruptor of traditional financial services, such as investment, lending, trade, brokerage, payments and insurance.

DeFi is permissionless and decentralized and bordersless. Regular financial services, however, are centralized and managed by financial institutions and government agencies.

To better understand Decentralized finance, let’s look into how centralized finance works.

What is centralized finance?

Your money is held in an account at a financial institution that acts as a central authority. Third-party intermediaries often charge a fee for every transaction you make with your account (e.g. using credit cards). A fee is also charged by banks for holding funds and performing financial transactions.

It can take weeks, if not months, to get a loan through a central financial system. The loan can only be secured after credit history and credit scores are verified.

All financial transactions in a central financial system are monitored by and controlled by one authority. This makes them complicated, long-lasting, and costly.

What is the difference between centralized finance and decentralized financing?

Distributed ledger technology (DLT or blockchain) can eliminate the need to have financial intermediaries. In decentralized finance, intermediaries are replaced with smart contracts that enable peer-to–peer transactions and payment almost instantly. DeFi’s low cost and instantaneous transactions play an important role in scaling. DeFi also allows anyone to access financial services via the internet. You can use the money just as regular money by storing it in a decentralized wallet such as CoinStats Wallet.

How does DeFi work?

DeFi uses blockchain technology to act as a distributed ledger that stores data on all transactions made over the blockchain. It eliminates control over financial institutions, money and products. DeFi is a trustless network where users are given complete control over their assets and investments; they don’t need third-party authentications. Decentralized apps, also known as DApps (decentralized applications), handle all transactions on the Blockchain. The verification for the transactions stored on the blockchain is made by other users’ connections over the blockchain. This verification process uses the computing power of the users’ devices on a Proof-of-Work blockchain. If the Proof-of-Work blockchain is used, transactions can be verified by using the tokens staked over the blockchain.

Services and Financial Applications Decentralized

DeFi applications and transactions are carried out within a peer–to–peer network. Transactions occur directly between two parties without the use of intermediaries. Smart contracts are the key feature of DeFi. They allow for transparency and visibility through the blockchain. A smart contract creates an automated and self-executing contract by each party entering predefined conditions. This allows the contract to execute without the need for a third party or central authority.

The DeFi protocol aims to ensure equal access to financial services around the world. Think about how traditional finance works. You’d have to request it from your financial institution or another middleman, and you’ll have to pay tax and processing fees to use the lender’s facilities if you’re authorized. These restrictions are removed for DeFi users, because blockchain technology allows no one to control the platform. Smart contracts are used to remove the necessity for intermediaries on DeFi lending platforms. After submitting personal data and passing verification, an applicant can apply for a loan through DeFi. The DeFi application connects them to another person who is willing to lend the money. The loan is given in digital assets like stablecoins and other digital assets, at specific interest rates that are agreed upon between the lender and borrower.

A DeFi application is essential as:

- Financial companies are no longer required to charge fees for their services.

- This allows you to save money in your virtual wallet and not keep it in banks.

- Everyone can connect to the Internet without permission.

- This allows for faster transactions.

These types of DeFi are the most well-known:

- Placement platforms

- Platforms to liquidity mine

- Decentralized Exchanges

- Apps and protocols for decentralized lending

- Non-custodial wallets

Common uses for DeFi

Popularity of Decentralized finance apps is due to their ease-of-use for transactions. DeFi apps and financial services have seen a dramatic increase. These most commonly used cases of DeFi include:

Decentralized Exchanges

Digital marketplaces that trade cryptocurrency NFTs can be used to make investments in tokens or stake them for interest. There are two types of cryptocurrency exchanges: centralized or decentralized. A central cryptocurrency exchange works in the same manner as traditional trading platforms, except that it allows for digital asset trades. These exchanges are managed by a central system that charges specific fees to their users for their services. Binance and Kucoin are just a few of the well-known crypto exchanges.

A decentralized exchange, or DEX, is not controlled by any central authority. Instead, it runs over blockchain and does not charge any fees, except the applicable gas fee on that particular blockchain (e.g. the Ethereum blockchain). Sushiswap and UniSwap are the most well-known decentralized exchanges. Smart contracts are used to enable people to trade crypto assets in these exchanges without the involvement of a regulator. The exchanges use an automated marketmaker to eliminate intermediaries and provide complete control to the users over their funds. The risk mitigation aspect is high, even though this gives users a lot of power and freedom. For example, if a user sends money to the wrong address or loses the keys to their wallets, recovering the lost funds won’t be possible. Most beginners prefer trading on centralized exchanges because of this. Although there are risks, the number of decentralized exchanges has been increasing in recent years. Virtually all major blockchains around the globe have their own DEX.

Transferring money

With smart contracts, DeFi makes it possible to instantly send money all over the world using decentralized funds. Transactions similar to traditional finance take several days to process. These transactions will incur a fee. DeFi applications ensure that these transactions are immediate and occur immediately, with the exception of the delay for the transaction on the Blockchain. DeFi apps can make it easy to transfer money without the assistance of an intermediary. DeFi apps offer lower transaction fees than traditional services, thanks to blockchain’s efficiency and the immutability of smart contracts.

Stablecoins

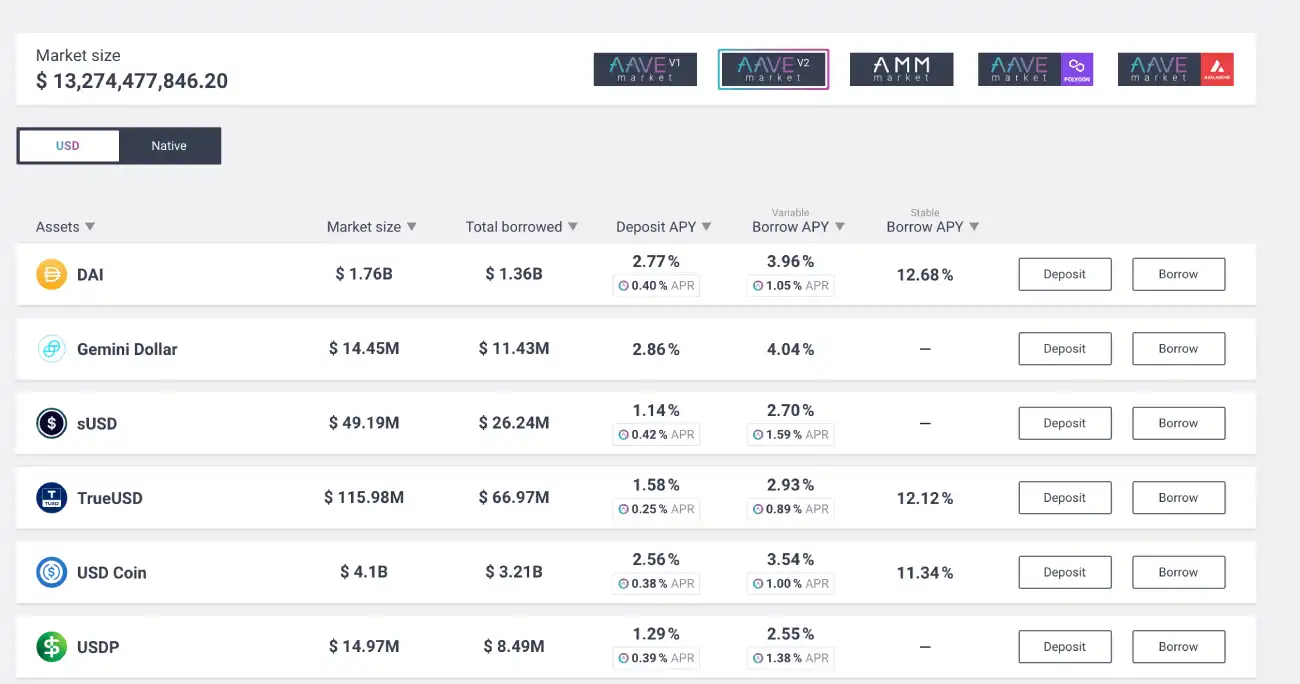

Stablecoins can be described as digital currencies that are backed with assets like fiat currency or other cryptocurrency. Stablecoins can be pegged to the U.S. Dollar, so their prices are never a fraction of what they cost. USD Coin (USDC), DAI and USD Tether are the most popular stablecoins. USDT, USDC and USD Coin are both centralized stablecoins that are issued by one central authority. DAI however is a stabilizecoin that’s pegged against US dollars and issued via MakerDAO.

DeFi Borrowing

DeFi lets users borrow money using a digital asset. There are two types of borrowing – peer-to-peer borrowing and borrowing from liquidity pools. Peer-to-peer borrowing allows individuals to borrow directly from each other using smart contracts. In a liquidity pool-based loan, the lenders lend liquidity in cryptocurrency assets to lending pools. Traditional borrowing requires credit checks, as well as other forms of documentation. However, smart contracts allow for borrowing without these formalities. The borrower’s collateral is automatically transferred to the lender if the borrower fails to repay on time.

Flash loans

These are some of the most advanced and technical features in the DeFi ecosystem. Flash loans have no collateral and can be accessed in an instant. A flash loan is only possible if you have technical knowledge about how smart contracts, blockchain and coding work. Flash loans allow you to borrow, lend, and then return the loan. To understand how it works, let’s say you borrow an asset from an exchange or lender for $1 and then sell it on another exchange for $1.5. The transaction can be repeated so that you return the money borrowed as well as the difference between the prices on the different exchanges. This will give you a profit. To make money, many experienced crypto traders use this technique. If the transaction fails to go through for some reason, the money is returned to the lender’s account automatically. Flash loans are instantaneous because all these steps occur simultaneously.

Yield farming

Yield farming, also known as liquidity mining, is one of the most popular ways to generate yield. DeFi has many uses and is the basis of decentralized borrowing. It’s based on the principle of decentralized lending, whereby lenders act as liquidity providers to the liquidity pools, and borrowers borrow tokens from the same pool. Liquidity providers get interest and fees. They are divided according to how much liquidity they provided. Yield farming is an option on many cryptocurrency exchanges. This means that the commission or fees associated with yield farming are shared among liquidity providers.

Prediction Markets

Another example of DeFi is the prediction markets. These are where you can bet on what will happen in the future. One of the DeFi’s most promising and profitable opportunities is prediction markets.

Non Fungible Tokens

We distinguish between fungible and Non-fungible tokens (NFTs). A fungible token can be exchanged for another, while NFTs aren’t interchangeable and are built over the blockchain. NFTs have been made possible by DeFi. NFTs are a phenomenon that has taken the globe by storm in recent years. They have impacted the global economic system, with many major companies and organizations recommending them. While NFTs are based on Ethereum, they can now be found across many blockchains including Binance’s smart chain.

The most popular DeFi application, NFTs, has seen the largest number of use cases. It also made millions for artists. OpenSea has been the most popular NFT platform with more than $3.5 billion USD in trading. Many other such platforms, like Rarible, are also available. You can also find CoinStats NFT collection on Opensea

Margin Trading

Margin trading is one of DeFi’s most profitable, but also more risky aspects. Margin trading is when a trader takes capital from a broker to use it for leveraged trades in open markets. To be eligible to trade in margin trade, you must deposit a certain amount of capital. In the event that you can’t repay your funds, the collateral or guarantee of the market is the capital you have deposited. Margin trades are just like other types of trades. A fee is also collected from the trader.

Conclusion

DeFi is a service that has seen rapid growth in the short time it has been around and allows users to make the most of this opportunity. Services such as DeFi lending, yield farming and flash loans have made the world a better place and allowed everyone to achieve financial freedom. It is the main reason the crypto market attracts more people every day, and that cryptocurrencies will soon be mass adopted.

DeFi is currently backed by Ethereum, but other blockchains, such as Solana or BSC, have their own services and products that offer many new possibilities to users. DeFi solutions are also in development, which are based upon the Bitcoin blockchain.

DeFi would also be widely adopted if gas prices for Ethereum 2.0 drop significantly.