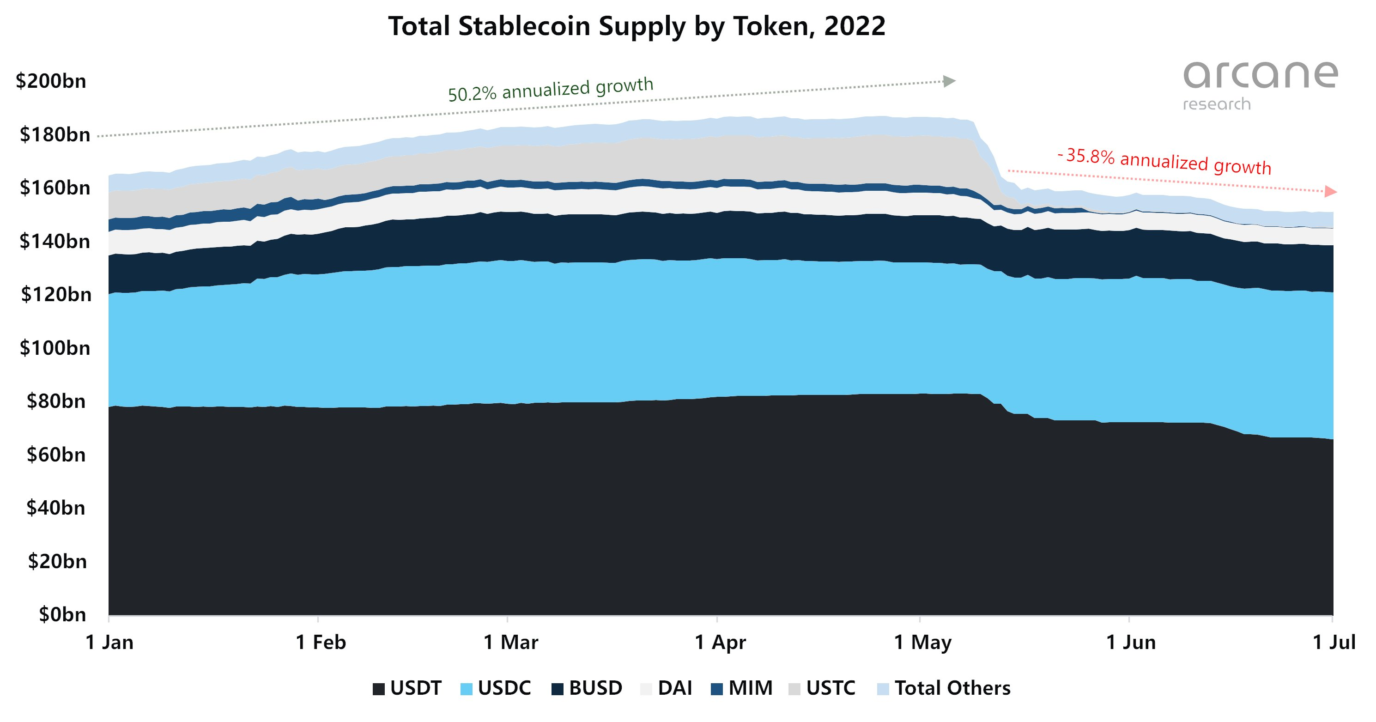

As a result, stablecoin supply fell globally by 18.8% during the second quarter. The equities markets are experiencing volatile times as risky assets and equities suffer from rising inflation.

Stabelcoins Supply Drops in the Second Quarter

These digital tokens known as stablecoins can be linked to fiat money such the dollar. These currencies can be supported with a mixture of cash reserves and commercial holdings. They also make use blockchain technology.

Arcane Research has released this paper, which details the supply pattern. Arcane analyzed supply information for popular tokens, such as USDT and USDC.

The May 2022 data showed that there was an overall surplus of $180 billion. The amount was $151.3 billion at the end of quarter 2, indicating an 18.8% drop in world supply.

According to the report, the $35.1 billion reduction in supply is the largest quarterly drop in stablecoin supply history. The report comes at a time where the cryptocurrency market has been struggling, and when market leaders such as Bitcoin are experiencing dramatic drops in their prices.

In 2022, the crypto ecosystem was in seven oceans. Stablecoins did not go unnoticed.

To understand how stablecoins navigated the stormy market conditions and whether Arcane’s stablecoin predictions for 2022 stand the test of time, click below:https://t.co/uL5tTWFQlT

— Arcane Research (@ArcaneResearch) July 26, 2022

Recommended Reading: TRON Bulls Return To Pump Energy into TRX Coin| TRON Bulls Are Back To Pump Some Energy Into TRX Coin

USDC to the Top

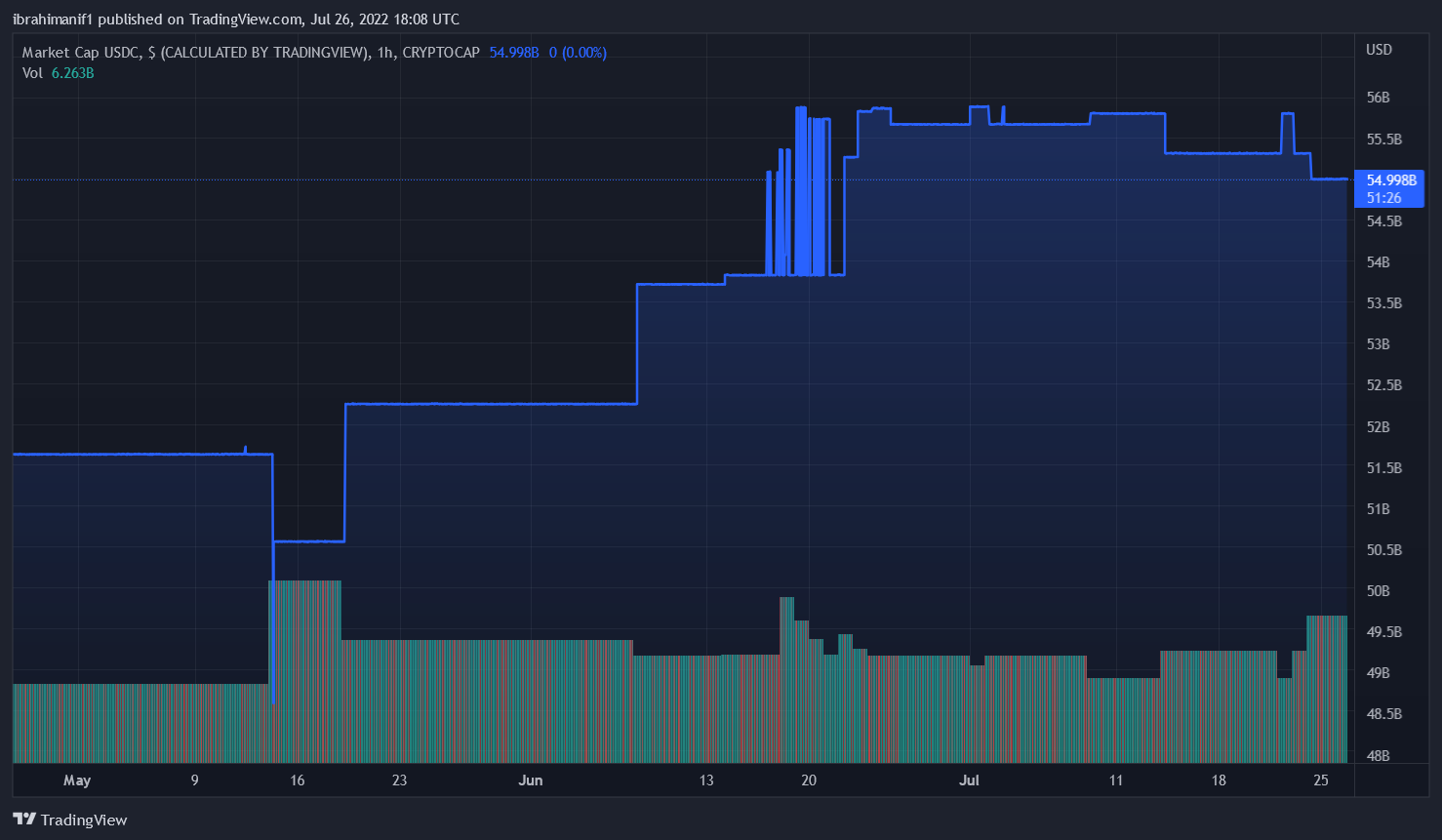

In particular, Arcane’s report anticipates a rise of USDC to the top. The analysis actually predicted that USDC’s market value would rise by approximately USDT in October 2022.

According to Arcane, Tether (USDT) has been the market’s largest stablecoin, fully utilizing the first mover advantage. In November 2021 it fell 50%. This continued as USDT’s market capitalization fell to $78 billion from $66.3 billion in 2022.

USDC market cap at $54 Billion. Source: TradingView

USDT and USDC are the top stablecoins for cryptocurrency as of this publication. Both tokens have a market cap of more than $50 billion. With a market value of approximately $17.83 trillion, Binance USD (BUSD) is the closest rival.

Similar Reading: Ethereum Merge – How ETHBTC Could Indicate A Return of Risk Appetite| Ethereum Merge: How ETHBTC Could Hint At A Return Of Risk Appetite

Featured Image from iStock Photo. Charts from TradingView.com. Arane Research.