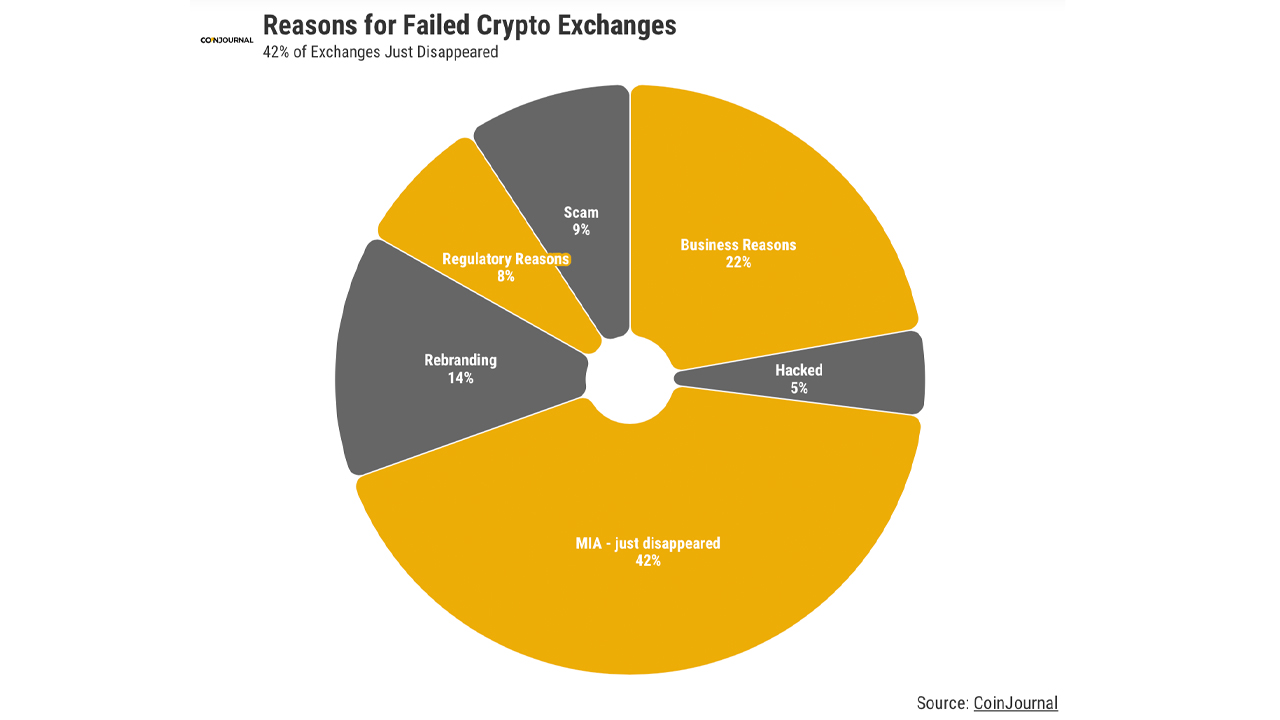

Coinjournal.net recently published an analysis that showed how many cryptocurrency exchanges have collapsed in the past eight years. Interestingly, the researcher’s data shows that 42% of failed crypto asset trading platforms disappeared without a trace, giving users no explanation as to why the exchange shut down.

Over the past 8 years, research shows that only 22% have left crypto exchanges due to actual business-related reasons

- Reports on digital currency failures show that 42% failed exchanges since 2014. They haven’t given any reasons and all trading platforms disappeared.

- 22% of the failed crypto exchanges during the last eight years left due to actual business-related reasons, according to coinjournal.net’s research. From the start, 9% of these trading platforms proved to be frauds and scams.

- “Following 23 exchanges going under in 2018, this number exploded upwards by 252% in 2019, before increasing a further 17% in 2020,” coinjournal.net’s report explains. “Remaining at the same level in 2021, this year there has finally been improvement, with a 55% reduction in failures if the rest of the year follows the first six months.”

- CFA Dan Ashmore of coinjournal.net explained in a reply to Bitcoin.com News that these metrics need to be fixed. “If cryptocurrency is to be taken seriously and fully establish itself, it needs to continue to clean up its image and leave damning statistics like these behind,” Ashmore remarked.

- Additionally, although the report states that 2022 does not yet have an end, it is predicted that there will be a 55% decrease in the number of crypto-exchange failures over the next year. “In regards to the amount simply vanishing into thin air, one could expect this to lower – regulation is still far behind, but it has at least made progress and should make it more difficult for exchanges to vanish without a trace,” the coinjournal.net report adds.

- This report is coming at a moment when many crypto businesses are suffering from financial difficulties due to the crypto winter. Over the last several months, thousands of people in crypto have been fired.

- Three significant insolvencies, Voyager Digital, Three Arrows Capital (3AC), & Celsius have all forced them to file bankruptcy protection. Minimum half of the digital currency platforms have blocked withdrawals.

- The trading platform Zipmex was launched Wednesday. paused withdrawals and said it was suffering from “financial difficulties [from] of our key business partners” caused by the crypto market downturn.

- The Thailand Securities and Exchange Commission has written to Zipmex asking why the suspension of withdrawals was made. This letter was published Wednesday.

How do you feel about coinjournal.net’s research report? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki commons. coinjournal.net

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.