Bitcoin Innovation: First major upgrade for four years

Bitcoin had briefly exceeded all-time records due to alarming inflation figures. However, Bitcoin ended the week in 2% loss as Taproot was activated.

Bitcoin touched the $69K mark on Wednesday at its high. Within a few hours however, fresh fears of an Evergrande-induced financial collapse swept over the market, dragging cryptoassets down alongside the S&P 500. The Securities and Exchange Commission also denied a spot Bitcoin ETF application Friday.

The volatility in altcoin markets halted gains, and most small cryptoassets ended the week at the same level they began. Zcash and Litecoin both have DNA in common with Bitcoin. They enjoyed double-digit gains after their brother received an upgrade.

This Week’s Highlights

- Taproot upgrades to speed up Bitcoin innovation

- Bitcoin hit a record-breaking high due to inflation fears

- eToro has SushiSwap (Axie Infinity), Quant, and Chiliz

Taproot upgrades to speed up Bitcoin innovation

Bitcoin’s first major upgrade in four years rolled out on Sunday, introducing Schnorr signatures and scripting capabilities to the flagship cryptoasset.

Taproot is now known as Taproot. The upgrade allows for better privacy and lower transaction costs, especially for complex transactions. It also improves programmability for simpler applications like multisignature schemes.

It is anticipated that the additional functionality will accelerate Bitcoin innovation over coming years and may even boost values. SegWit, Bitcoin’s last major upgrade, took place in August 2017 and was followed by a monster rally that saw prices quadruple.

Bitcoin makes record for inflation fears

Ever since legendary investor Paul Tudor Jones said Bitcoin was the “fastest horse in the race”, the cryptoasset been more widely considered an inflation hedge and a viable alternative to gold.

The safe-haven appeal of Bitcoin was demonstrated on Wednesday when it bolted out of the stable based on hot inflation statistics, leaving gold behind. It soared to near $69K, breaking all records.

Although the price fell shortly afterwards on fears of an Evergrande default, Bitcoin’s reaction to the news cemented its newfound role as an inflation hedge. This reflects the view of Bloomberg analysts, who found in a recent study that “the importance of inflation and hedging against uncertainty” have become more important drivers for Bitcoin, “accounting for 50% of price moves in the latest cycle relative to 20% in 2017.”

eToro has SushiSwap (Axie Infinity), Quant and Chiliz

eToro listed SushiSwap(SUSHI), AxieInfinity/AXS, Quant (QNT), Chiliz (CHZ) and Quant (QNT). This brings the total amount of available cryptoassets to 40.

SushiSwap is a decentralized exchange based on the automated maret market model (AMM), Axie Infinity is a Pokémon-inspired blockchain-based game, and Quant is an enterprise-grade interoperability solution for connecting public blockchains.

Last but not least, Chiliz is the leading blockchain for sports and entertainment — an industry close to eToro’s heart as one of Europe’s biggest football club sponsors.

Please note that these cryptoassets have not been made available yet in the US.

Week ahead

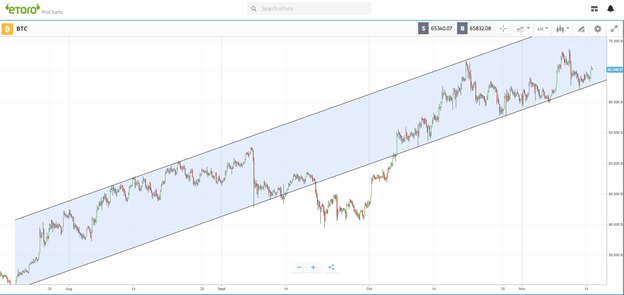

Bitcoin continues to consolidate at historic highs. Traders are eagerly waiting for a catalyst to push prices up towards $70K (or the anticipated meme level of $69,000.

The talk about inflation could boost prices in the weeks ahead. This is despite earnings reports from traditional markets.

Stellar may be featured in other places as altcoin holds its annual community conference Wednesday and Thursday.