Despite the fact that bitcoin miners are getting bare minimums in profits per petahash per second (PH/s), and the myriad of headlines showing specific mining operations folding from the crypto winter, the network’s total hashrate continues to chug along at close to 300 exahash per second (EH/s). The current trend of lower bitcoin prices, and a high mining difficulty haven’t slowed down bitcoin miners in any way. The next difficulty retarget, scheduled for October 23rd, shows that another rise will occur.

Bitcoin’s Hashrate Remains High Despite Current Obstacles

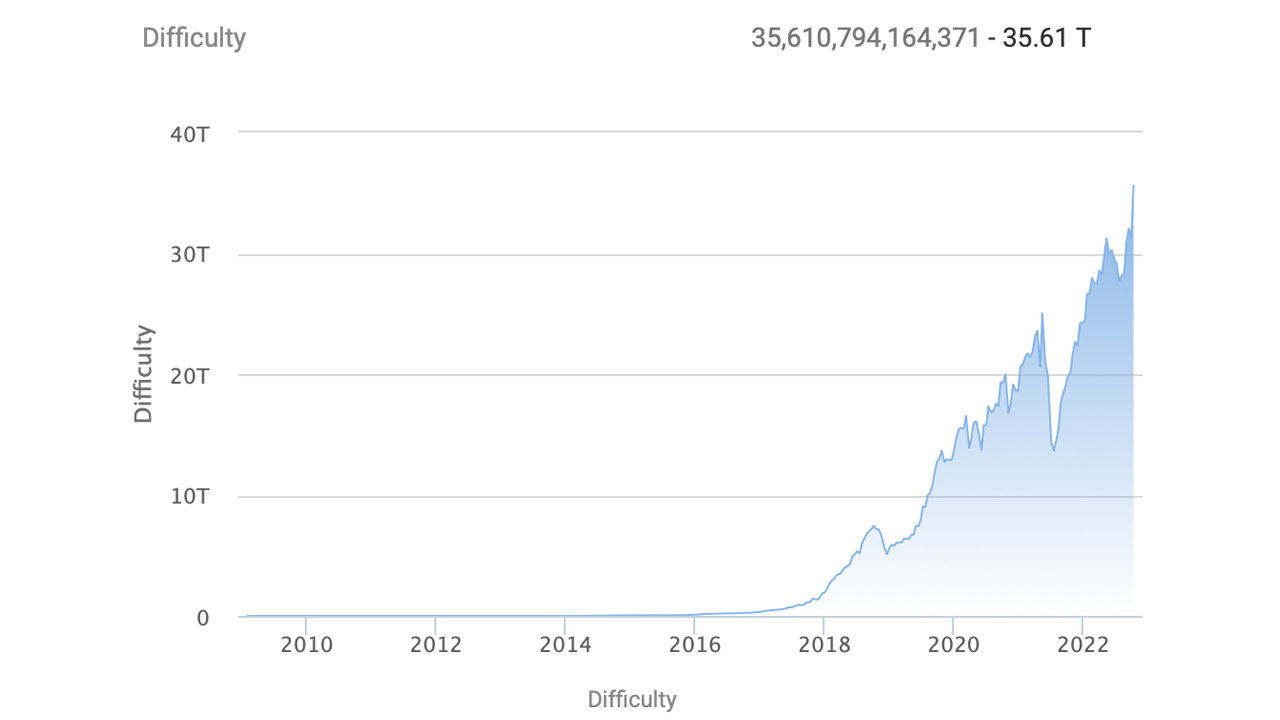

With less than two days left, it looks as though bitcoin (BTC) miners will get another upward increase in terms of the network’s difficulty. Currently, Bitcoin’s difficulty is at an all-time high (ATH) at 35.61 trillion and the next change is scheduled to happen in less than two days on or around October 23, 2022.

While the difficulty ATH makes it a lot more challenging for bitcoin miners to find a block subsidy, miners still have a great deal of hashrate dedicated to the leading crypto asset’s network security. Today, coinwarz.com statistics show BTC’s total hashrate during the past hour has been between 290 to 315 EH/s.

It is slightly below block height 758.138, which was recorded on October 11. The lifetime record for total network hashrate was 325.11 EH/s.

The current block times for Friday are shorter than the average ten minute block time. A few data points indicate that the block times of today range from 8:30 to 9:35. The retarget date for blocks found quicker than the average ten minutes is usually less than two weeks.

When this trend occurs, the blockchain network’s mining difficulty will increase in order to make it tougher for miners to find a BTC block. Satoshi designed the system in this manner, so that block times would remain consistent at a ten minute average.

As of the writing date, difficulty was expected to climb between 4.03%- 4.6% above the current 35.61 billion. The predicted percentage increase would hike BTC’s mining difficulty up to the 37 trillion range.

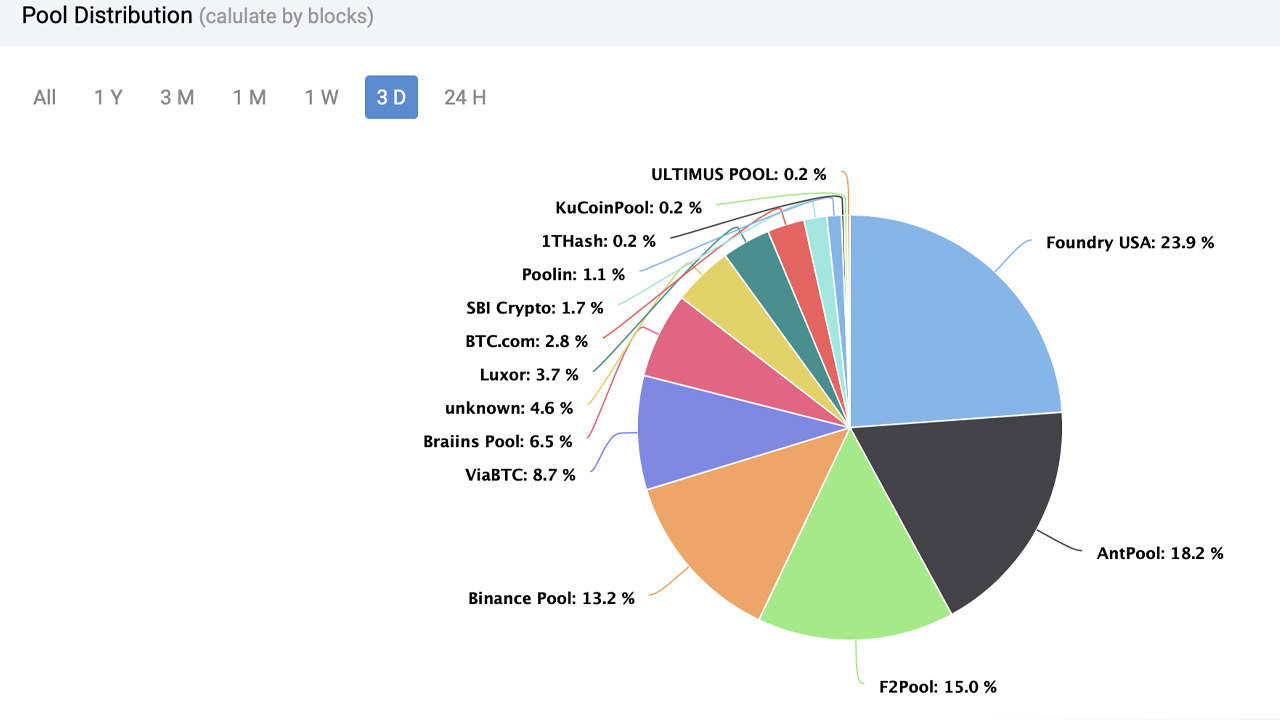

Foundry USA is the current largest pool of mining, with an average of 63.34EH/s dedicated for the BTC Chain during the past three days. Foundry’s hashrate is around 23.86% of the total network’s computational power.

The top BTC mining pool Foundry is below Antpool (48.57 EH/s), F2pool (33.9.73 EH/s), Binance Pool (33.53 EH/s), Viabtc (23.33/EH/s) and F2pool (39.73EH/s). These miners are the five most important hashers. Unknown miners control 4.56% of total network, with 13 mining pools currently dedicating their hashrates to the BTC-chain.

At a time of financial difficulty and bankruptcies, the record hashrate is a good sign. This week the investment bank DA Davison’s market analyst, Chris Brendler, downgraded the shares of Argo Blockchain (Nasdaq: ARBK) and Core Scientific (Nasdaq: CORZ) to neutral.

With the hashrate so high, a person simply observing Bitcoin’s computational power would not be able to tell that some BTC miners are struggling. While a few BTC mining companies have failed, it is possible that larger businesses are picking up the pieces, using their ASICs and offering discounted prices.

What do you think about Bitcoin’s hashrate remaining high despite the obstacles it faces like the difficulty’s ATH and lower bitcoin prices? We’d love to hear your opinions on the subject below in comments.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.