According to on-chain data, $44.2 Million in Bitcoin was discarded in a matter of minutes. The price of Bitcoin then dropped to $46k.

Large Bitcoin Inflows of 1923 BTC are Observed by Exchanges

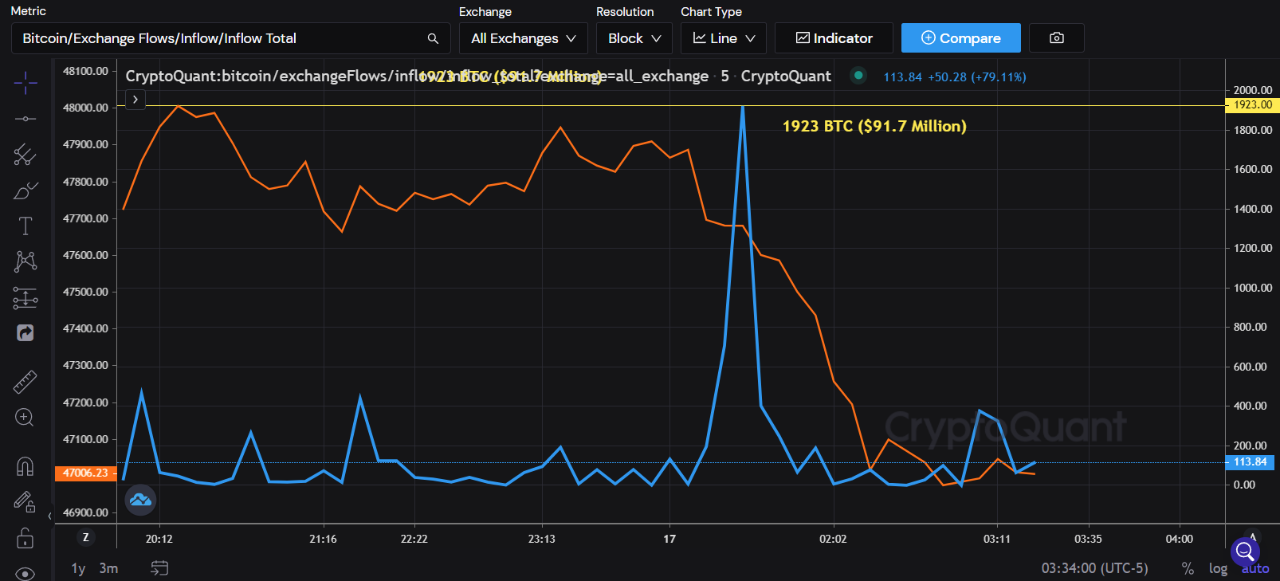

An analyst pointed this out in a CryptoQuant article. On-chain data showed that approximately 1923 BTC were today deposited into exchange wallets, as he said.

The relevant indicator here is the “inflow” metric, which measures the total amount of Bitcoin being transferred to exchanges.

Large inflows can cause volatility and bearishness for crypto’s prices, as investors often send their coins to an exchange to withdraw fiat money or buy altcoins.

On the other hand, low inflow values can be bullish for Bitcoin as they may mean there isn’t much selling pressure in the market at the moment.

Below is a chart that illustrates the change in BTC flows over the past 24 hours.

The indicator shows a significant spike today. Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the inflow indicator experienced a huge spike today, which was around 1923 BTC.

It means that some owners deposited $91.7 million to their exchange wallets at the time the transaction occurred. Shortly thereafter, BTC’s price dropped to $46.7k.

Data Shows Bitcoin Short-Term Holders Realizing Significant Losses| Data Shows Bitcoin Short-Term Holders Realizing Significant Losses

A look at the “taker sell volume” chart reveals some additional info about this decline. This is an additional indicator which shows how many perpetual swap sell orders have been placed.

It seems that the indicator's current value has risen. Source: CryptoQuant| Source: CryptoQuant

The graph shows us that about $44.2million in buy orders were placed onto perpetual swap exchanges approximately 50 minutes after the inflows. In less than a minute, all this Bitcoin volume had been dumped.

Similar Reading: Bitcoin heads for short squeeze?| Bitcoin Heads For Short Squeeze? This scenario could show why ETH might outperform in this situation

Because of the short timeframe, it’s looking likely it was just a single investor selling these coins. It’s also possible that rather than a single holder, it could be a group pulling off a coordinated dump.

According to the analyst, this may cause additional fear and inflows within the Bitcoin market. Therefore investors need to remain alert.

BTC Prices

At the time of writing, Bitcoin’s price floats around $47k, down 4% in the last seven days. In the last month, crypto lost 21%.

Below is a chart showing the change in BTC’s price over the past five days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin has been in consolidation within the $45k to $50k range for a while now, and the trend doesn’t look to be breaking anytime soon.

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.