Bitcoin Gold (BTG), one of the first hard forks, is a Bitcoin Gold. It was established in 2017.

BTG’s goal is to make mining more democratic and accessible for everyone by eliminating the need to use specialized equipment.

Learn everything you need about Bitcoin Gold. How to hold it, how to trade it, and what to do with it.

Bitcoin Gold’s History

Bitcoin Gold (BTG), also known as Bitcoin Gold, is a cryptocurrency made from hard forks of Bitcoin (BTC). Bitcoin Gold was officially separated from the original Bitcoin Blockchain on October 24, 2017.

Bitcoin Gold’s purpose was to restore Bitcoin mining at its original decentralization. Bitcoin (BTC), as it was originally known, could still be mined on regular computers. However, as the network has grown, the only way to profitably mine BTC is to use ASICs (application-specific integrated circuits). Bitcoin mining is now almost impossible to do without ASICs. Large companies hold the majority of the network’s hash rate. This gives them the power over transaction history revisions and to prevent any new transactions being confirmed.

Jack Liao is the CEO of Lightning ASIC in Hong Kong. He first reported the Bitcoin Gold Project in July 2017. Bitcoin Gold changed Bitcoin’s proof-of-work (PoW) algorithm to create a digital asset that didn’t require ASICs for mining. Bitcoin Gold, instead, used GPU (graphics processing units) mining. This made it accessible and restored decentralization.

Community members criticised the team for pre-mining 100,000 BTG coins after it was officially launched on November 1, 2017. According to the team, the funds were used for Bitcoin Gold’s growth. Five percent of them would also be given as bonuses.

Bitcoin Gold was also compromised that month. In this scheme, more than $3.3million was stolen.

Attackers hacked Bitcoin Gold in May 2018. Hackers stole $18,000,000 in BTG, which was taken from many exchanges, including Bittrex.

Hoping to prevent future attacks, in June 2018, the Bitcoin Gold project changed their proof-of-work (PoW) algorithm from “Equihash” to a new hashing proof-of-work algorithm, called “Equihash-BTG.”

BTG algorithm can be mined by anyone with a computer that is powerful enough to withstand ASIC. A mining pool is another way to increase your earnings.

How to buy Bitcoin Gold

You can purchase Bitcoin Gold through a Regulated broker and on many exchanges. The official Bitcoin Gold website allows you to choose the cryptocurrency exchange best suited for your needs.

Before registering with an exchange, consider checking if it’s available for cryptocurrency trading in your country.

Some exchange fiat currency nationals such as US Dollars for Bitcoin Gold. Others only trade for Bitcoin and Ethereum.

CEX.IO is a good choice if Bitcoin Gold can be bought with fiat currency. It’s one of the only exchanges that allow you to purchase Bitcoin Gold with USD. You can register with CEX.IO if you have previously purchased Bitcoin. After you confirm your account you will be able to search for Bitcoin Gold/USD.

YoBit, DSX and other exchanges support Bitcoin Gold using fiat currencies.

Another easy way to buy Bitcoin Gold is via Contract for Differences (CFD’s). A broker that offers multiple payment options, such as wire transfer and credit card, may be able to help you buy Bitcoin Gold CFD. It is easy to use a broker to purchase cryptocurrency with leverage.

If you want to purchase Bitcoin Gold using digital currency, then you need an exchange that allows you to use the BTG/BTC/ETH pairing.

This step-by-step guide will help you buy BTG.

Step 1:To open an account at an exchange that supports BTG, you will need an email address, a phone number and proof of identification.

Step 2. Identity verification: Some platforms offer 2-factor authentication. A standard KYC process will require you to show proof of identity.

Step #3To buy Bitcoin Gold, deposit money into your account.

Step 4:Bitcoin Gold. You can complete your order.

Step 5: Buy a wallet. Consider moving coins to a physical wallet. The Ledger Nano and other wallets offer long-term, secure storage.

To sell Bitcoin Gold, you need to transfer BTG from your wallet back to exchange.

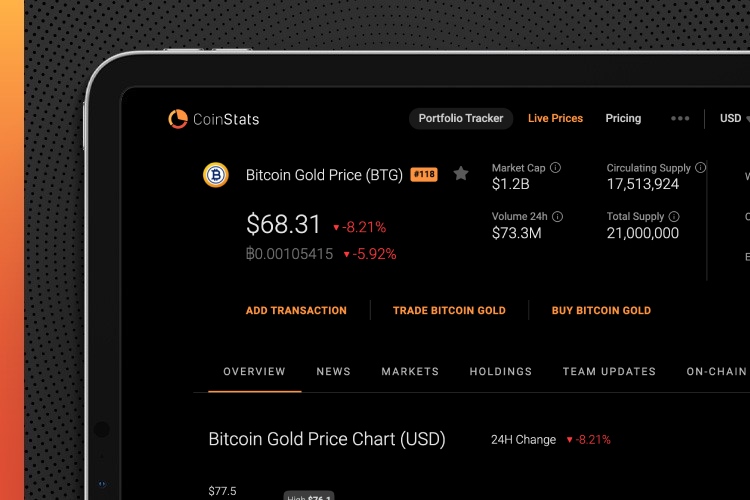

CoinStats – How to buy BTG

CoinStats has been voted one of the top crypto platforms. This platform allows you to see current market prices and provides detailed information on many of the fastest growing cryptos.

CoinStats provides investors with valuable investment information as well as portfolio tracking and cryptocurrency research. Investors will appreciate educational blogs and guides such as BTG prices and how to purchase Bitcoin via Coinstats.

You just need to create an account and search for the right thing. Bitcoin GoldIn the search section, choose Buy Or Commerce BTG.

There are some things to consider when buying crypto

You should fully comprehend the risks and legalities involved in buying cryptocurrency. This includes currency fluctuations. You can seek out independent accounting, financial and tax advice if you’re unsure.

Below are some important points that you need to remember:

Panic buying

It’s not a great plan to buy crypto if you’re only doing so because you’re scared you’ll miss out. Panic buying rarely works out well, and we simply don’t know what will happen to crypto prices in the future.

Exchange consideration

You need to look at several factors in order to find the right exchange for you. These include security, liquidity and fees. Legal aspects. Technology. User experience.

Adequate Research

Before investing in coins, it’s essential to look meticulously into the history of the networks and the identity of the founders. Take the time to explore the project’s white paper. It should tell you everything about the developers’ aim, including a timeframe, a general overview of the project, and specifics.

Bitcoin and Bitcoin Gold: A Short Overlook

One of the primary goals of Bitcoin Gold has been “re-decentralizing” Bitcoin and making a more accessible digital asset that could be more fairly and efficiently distributed among small miners. In so doing, it changed the algorithm from Bitcoin’s SHA-256 hashing algorithm to Equihash-BTG. This means that the Bitcoin Gold mining process runs on any standard PC system as well as specialized equipment.

Bitcoin Gold’s developers also focused on protection and transparency issues. Unlike Bitcoin, Bitcoin Gold sought to increase anonymity by not publishing transaction details or wallet addresses.

Bitcoin Gold, a smaller proof of work blockchain is more susceptible to 51% attack. Three 51% attacks on the blockchain and numerous BTG wallet thefts have been experienced.

Security Questions and Controversy

Bitcoin Gold is a small proof-of-work cryptography, so it is less vulnerable to 51% attack. In the blockchain, a 51% attack is where the attacker seeks to gain control of 51% or more of the blockchain’s computing power or hash rate.

Bitcoin Gold has been the victim of several hacks in the past. The most recent was January 2020. It saw 29 blocks being reorganized, and over $70,000 in BTG stolen via double-spend attacks.

The first attack occurred in May 2018, leading to the platform’s official delisting from a major crypto exchange platform: Bittrex. Bitcoin Gold developers responded by updating the mining algorithm to Equihash BTG.

Bitcoin Gold, which had reached its record high of $474 in December 2017, fell to $260 by the end 2017 and then dropped to $12.64 by the end 2018. It was $5.41 at 2019’s end. Bitcoin Gold has lost over 98% of its total value within two years.

Bitcoin Gold is also being brought along as Bitcoin surpasses the $55,000 mark in October 2021.

BTG: To buy or trade

You can trade BTG if the price of BTG rises so that you can buy crypto coins.

A contract for difference (CFD), on one cryptocurrency, is required to speculate on BTG’s price differences. A long (speculating on the price rising) or short (speculating the price falling) position can be held. CFDs can be considered short-term investments as they are typically used for shorter periods of time.

You can buy BTG, but you cannot trade CFDs in crypto markets. While you store your crypto in a wallet for future use, CFD traders have to keep the position in their trading account. This is controlled by financial authorities. CFDs offer more flexibility because they aren’t tied to any asset. You are connected only to the underlying contract.

Conclusion

To sum up, here are the key benefits of BTG:

Fungibility 1 BTG equals 1 BTG any time. BTG can be used as a fungible digital currency. It is interchangeable, convertible, and identical to other currencies.

Decentralization – It’s decentralized and community-driven.

Faster Transactions – It makes for faster transactions as a result of its enhanced design. Bitcoin Gold produces up to 27 transactions per second, while Bitcoin generates about five transactions per second.