Is it possible that Bitcoin’s price has fallen to $56k? Is this a shakeout or a decline in Bitcoin’s price? Here’s what the SOPR indicator says about it.

The Bitcoin SOPR Indicator

BTC Spent output profit ratio, or SOPR as it is commonly known, can be used to estimate whether an investor sells at a profit.

When the metric’s value is above one, it means coins that were moved during the period were sold, on an average, at a profit.

SOPR values lower than 1 indicate that the market overall has sold at a loss over the time period.

The indicator trending upward could indicate that holders have realized their gains and that a correction is possible.

Conversely, sellers might be selling their coins at loss and those with profitable coins could still hold onto them for potential price appreciation.

Similar Reading: Bitcoin MVRV shows top isn’t in yet, but BTC still has room to grow| Bitcoin MVRV Shows Top Isn’t In Yet, BTC Still Has Room To Grow

What can the indicator tell us about shakeouts and tops?

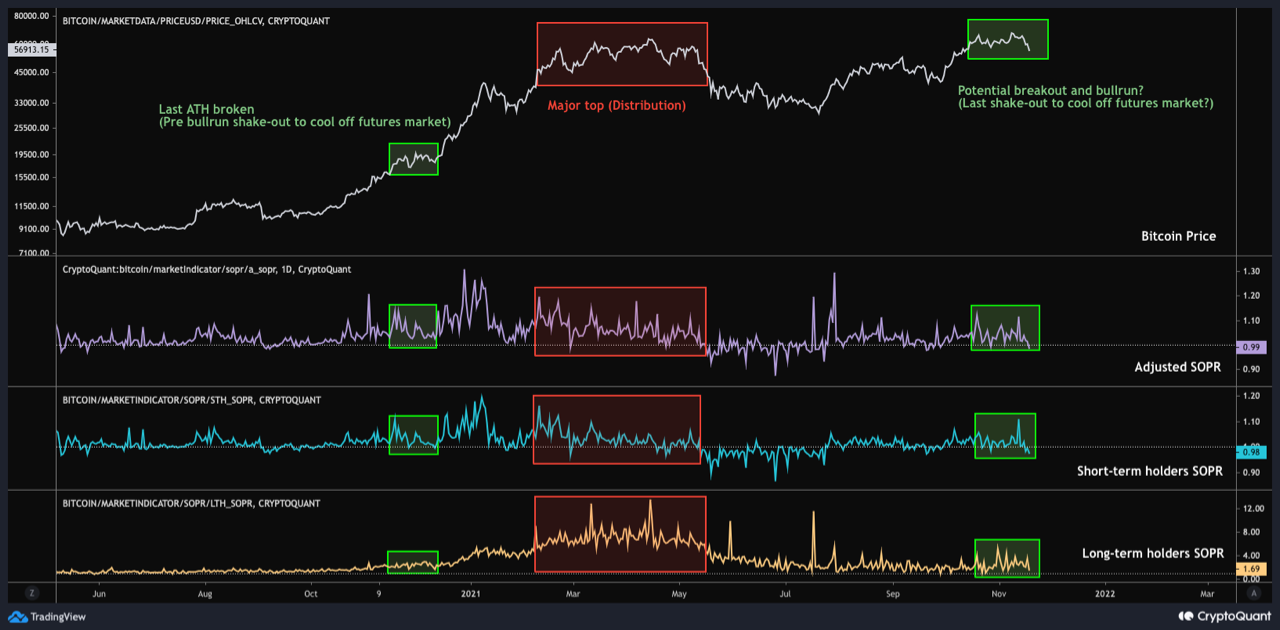

In a CryptoQuant posting, an analyst made a chart showing the increase in value for the indictor in the past year.

Comparison of now and the trend in SOPR at the beginning 2021. Source: CryptoQuant| Source: CryptoQuant

Below are graphs that show the different versions of this indicator. Both the LTH SOPR and STH SOPR metrics indicate whether long-term or short-term investors are making profits.

It is based on coin age that the coins are separated. Coins that haven’t been moved since 155 days fall into the LTH category. Anything less than that falls under the STH category.

We can now see from the graph that the Bitcoin SOPR metrics all had very high values at the time the 2021 peak.

Inflation fears sparks Bitcoin rally before Taproot – Crypto Roundup, Nov 15, 2021| Inflation fears sparks Bitcoin rally before Taproot – Crypto Roundup, Nov 15, 2021

Before the bull run began, the STHSOPR rose and other indicators increased in value. It was a shakeout before the bull run, so there wasn’t a top formation.

Similar trends are evident in current times. The STH SOPR is high right now, but long-term holders don’t seem to be realizing that much profits.

This fact makes the analyst believe that the latest decline in Bitcoin’s price was possibly just a shakeout, and not a top formation.

Here is a chart that shows the current trend in BTC’s price:

BTC continues to fall in price | Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts