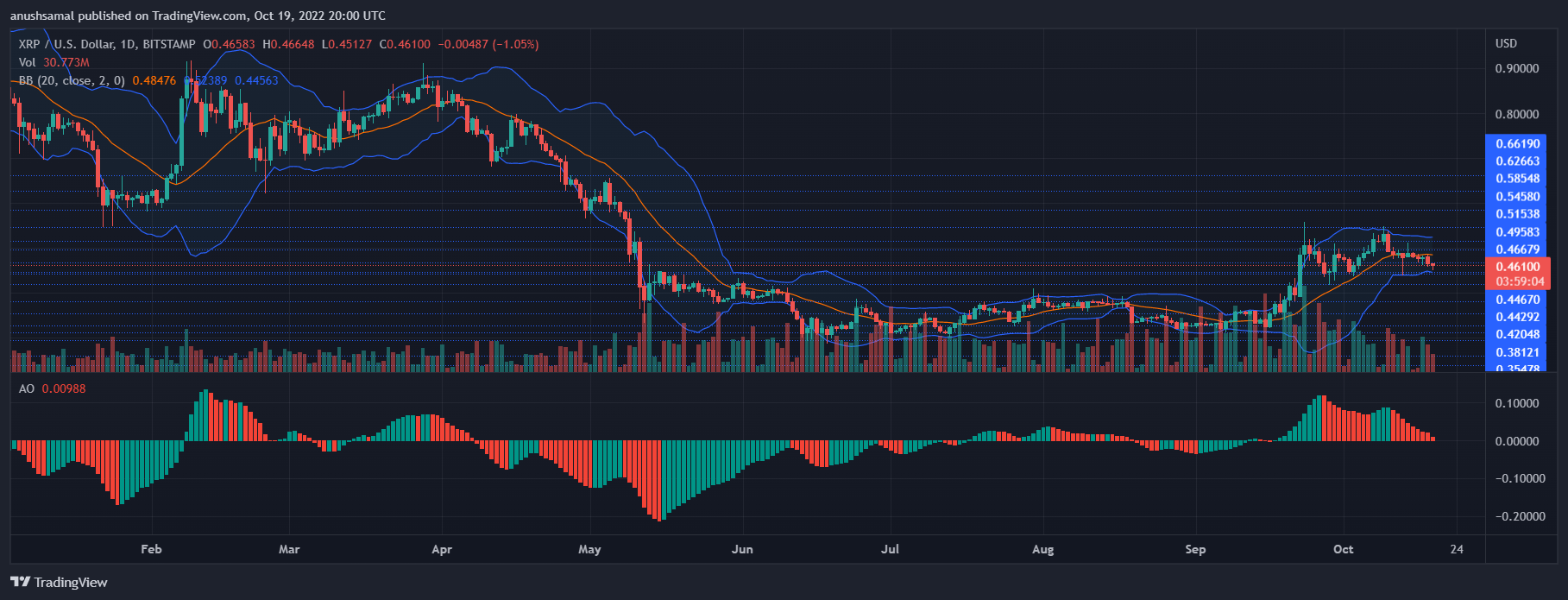

Each attempt to increase XRP’s price beyond $0.48 was met by selling pressure. In the past 24 hour, XRP fell by close to 1%. Altcoin’s value has fallen more than 6% in the last week. Should the coin break above its resistance immediately, then the bulls might be back in the chart.

The technical outlook for XRP showed that the bears were in control. Demand for XRP has fallen. To allow the bulls to prevail, they must see that the demand for altcoins returns to market. All technical indicators are currently showing a bearish picture for altcoin.

The next trading session could see a drop to $0.40 if the buyers don’t change their minds. It could trade at $0.38 if the coin crosses below $0.40. Although XRP’s price has seen a substantial increase in the last month, its buying power has been inconsistent and caused it to plummet. The 2018 XRP high is now trading at 87%.

One-Day Chart: XRP Price Analyse

At the time this article was written, altcoin traded at $0.46. However, it failed to surpass the $0.48 level.

As XRP demand continues to fall, the coin was unable to sustain its recovery. At $0.48, the overhead resistance was present.

The bulls will only be able to take control if XRP trades above $0.48.

The bearish pressure on altcoin will end once it breaks above $0.51.

However, there will be less demand which could cause the XRP to slip even further below its nearest support level of $0.44.

The $0.44 mark is the lowest point at which XRP can fall, and then it will drop to $0.40. Low buying power was evident in the fall of XRP traded during the session.

Technical Analysis

Altcoin has seen a decline in buying power due to the recent rejection at $0.48. Technical indicators suggest the exact same.

Altcoin formed even a death cross, whereby the 200-SMA line (green), is higher than the 20-SMA line (red).

This makes XRP a bearish coin and may cause a further decline in its price. As sellers bought more buyers, the Relative Strength Index fell below half-line.

The XRP’s price fell below the 20 SMA line. This was due to sellers and fading demand.

Altcoin received a sell signal according to the other indicators.

Awesome Oscillator measures price momentum and direction. AO displayed red histograms at the top of the half-line. This was a sell signal for XRP.

Bollinger Bands are used to measure volatility in prices and the likelihood of fluctuations. Parallel bands meant that there was less likelihood of future volatility.

It also means that XRP can move in a sideways fashion over the next few sessions, before finally moving north or south.