Bitcoin is slowing down its bullish momentum since it crossed the barrier of $22,000 and $23,000. Although the cryptocurrency has retained some gains, it could be ready for a retest at lower levels.

At the time of writing, BTC’s price trades at $22,900 with a 2% loss in the last 24 hours and an 8% profit over the past week.

It’s not 2020, but this Bitcoin Bear Market might be different

The crypto market players seem to want a swift and consistent uptrend like that of 2020. At that time, BTC’s price drop to a low of $3,000 and then began an ascend to its current all-time highs.

QCP Capital, a trading company believes that Bitcoin and large cryptocurrency prices could see greater sideways movements and downward pressure than before it regains lost ground. This could be more in line with the 2018 bear markets.

The firm believes BTC’s price will benefit during Q3, 2022. The firm believes that the cryptocurrency will attempt to rebound to higher levels over this period. However, it could also break through critical resistance zones. These areas are capped by increasing selling pressure from Bitcoin miners and companies affected by the bearish trends.

BTC’s price action might continue to operate on uncertain grounds with “choppy moves” with an alternative narrative between bullish and bearish with a critical resistance at $28,700 to the upside and critical support at $10,000 to the downside.

The latter matches the 85% crash that BTC’s price experienced during the 2018 bear market.

The Crypto Recovery will be slow but it spells long-term bullishness

The crypto market experienced a huge rally in 2017, when Bitcoin’s price reached $20,000 at its highest point. The crypto market entered a bear market in 2018, when the major cryptocurrency prices had lost over 80%, reducing trading liquidity.

QCP Capital thinks the sector is entering a new age that emphasizes maturity and resilience. The sector is currently experiencing downside selling pressure due to high liquidity and less volatility in large cryptocurrencies.

Additionally, institutional interest has been strong in Ethereum and Bitcoin despite the downturn in prices. In fact, QCP records an increase in “both trading and investments” from these entities.

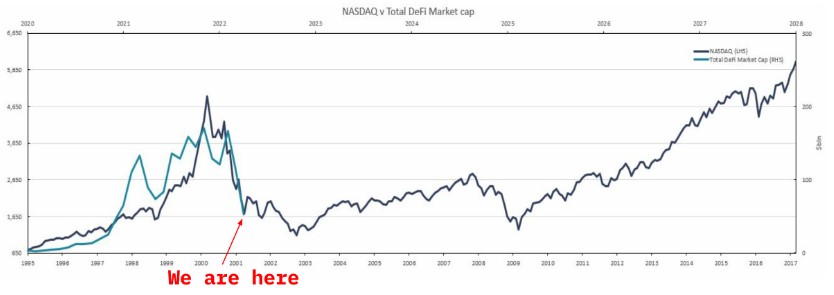

This resilience will lead to a huge rally in the long-term, despite high inflation and the Federal Reserve being hawkish. Trading firm, Xetra, compared crypto’s potential growth in the decentralized financial sector to the Nasdaq 100.

The crypto sector, as shown below, has followed the Index’s initial years and may trend lower in the future before global adoption. The next decade will show:

(…) that the future will be a crypto-dominated one. In the same manner that every business in the world today can be considered an Internet company, so too will all of them. Our belief is that in 5-10 years’ time, all companies will be a crypto-company.