Bitcoin follows what Senior Commodity Strategist for Bloomberg Intelligence, Mike McGlone, calls an “enduring trajectory”. According to a new report by Bloomberg Intelligence, the benchmark crypto has been one of the most successful assets ever. It could be poised for further gains in the second quarter of 2022, according to McGlone.

At the time of writing, BTC’s price trades at $23,900 with a 3% profit over today’s trading session and a 2.4% profit over the past week. The cryptocurrency seems to be trending upwards on the back of a decrease in inflationary expectations for July’s Consumer Price Index (CPI) print.

The metric has reached multi-decade heights, forcing the U.S. Federal Reserve to reduce its balance sheet and raise interest rates. This creates a risky economic environment that favors assets such as Bitcoin or equities.

McGlone thinks that deflationary forces could be a benefit to cryptocurrency. Bloomberg’s Commodities Index, and the price of key commodities, such as Oil and Copper, are hinting at this trend.

The experts believe assets that have fixed supply will rally in this way. The long-term outlook could be that Bitcoin and Gold will reach $100,000 and $2,000, respectively.

McGlone feels that the benchmark cryptocurrency is steadily becoming more stable and less risky. This could translate into BTC operating as a “high-beta version of the metal (Gold) and Treasury bonds”.

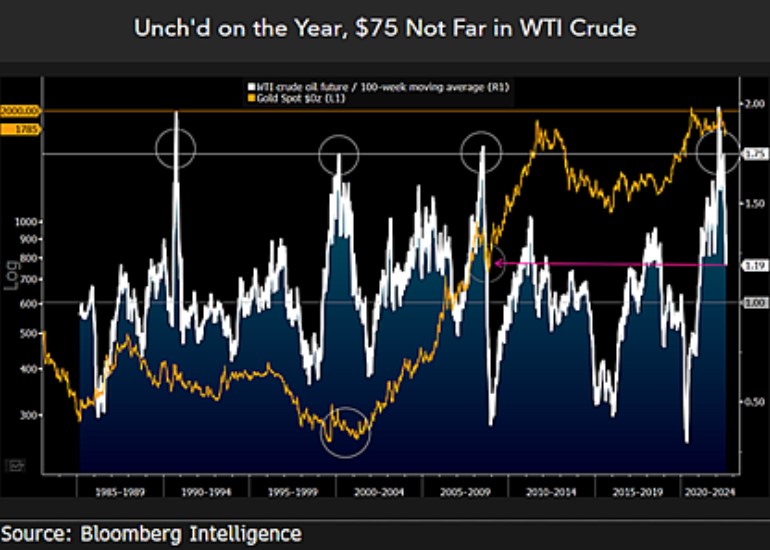

The price of Bitcoin and Gold might start “accelerating”, the report says, if the West Texas Intermediate (WTI) oil, a benchmark for oil pricing, follows the downside trend in commodities. McGlone wrote:

It’s a question of supply, demand and adoption in the next 14 years that should drive prices, and we see little reason to complicate what appear to be enduring trajectories, notable in advancing technology (…).

What Bitcoin could do to sustain its gains?

The price of WTI crude oil broke below an important resistance level, as shown in the following. This was 2021. McGlone pointed out that historically, the prices of oil and Gold have been inversely related.

This is why he believes that oil may be hinting at an appreciation of the precious metal, and its 2.0 variant, Bitcoin. Bloomberg Intelligence Expert:

Our bias favors more of the exact same pendulum (Oil Down with Gold Rising) and a swinging tendency to see oil continue falling in 2H. As global deflationary trends are likely to be triggered by the sinking of copper and potential end to Fed rate increases, gold will need support in order for it reach $2,000 per an ounce.