Blockchain technology and cryptocurrency have enormous potential, and are not just assets one can trade in or invest. The reality is, trading crypto tokens and investment are only a part of the technology. Blockchain technology will revolutionize how people view banking and finance.

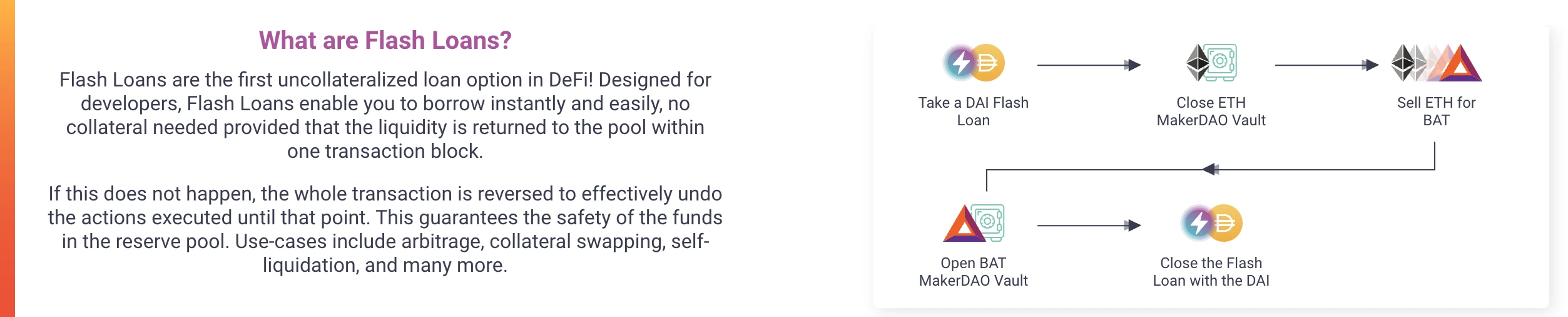

It is designed to give people financial independence and empower them. This is why it’s so important to know how loans are obtained. Flash Loans can help. We will answer questions like “What are Flash Loans?” and “What can they do for developers?”

Decentralized finance, or DeFi to the delight of enthusiasts and niche experts alike, aims to change the way finances are viewed around the globe. The idea behind Decentralized Finance is to give people full control of their finances and not be governed by a central authority such as a bank. DeFi Space is aiming to make financial change possible by offering flash loans.

What’s a Flash Loan?

Understanding what a flash loan really is the first step to understanding it. To understand the DeFi flash loan process, it is important to first understand what a regular loan looks like.

Let’s take a look at what a loan is and how it works. Simply put, a loan refers to a borrowing amount taken from an entity, individual or business by a business. You must repay the borrowed amount within a pre-determined time at an agreed rate of interest. The institution or individual that is providing the loan keeps or demands something from the loanee as collateral in case they don’t return the loan and interest.

Banks, companies, and other institutions are involved in a typical loan. They act as facilitators or middlemen for the loans. In return for their assistance, they receive a fee. This makes it very centralized as the banks are often the ones providing loans.

Flash Loan

DeFi Flash Loans can be used to address the centralised nature of traditional loan companies. To put it simply, a flash-loan is the simple answer to the question of what? A flash loan can be used as a trading tool where the borrower borrows money directly from the lender.

Decentralized finance is one the key uses cases of blockchain technology. This technology is gradually but surely gaining traction on a worldwide scale and being adopted. El Salvador was the latest country to recognize Bitcoin as legal tender. DeFi flash loans are one way to get cryptocurrencies adopted by a larger number of people.

DeFi Flash loans differ from traditional bank loans in that they are completely unsecured. There are two types of loans in traditional banking: unsecured and secured. Secured bank loans require collateral/security to be secured. Unsecured bank loans do not require collateral. Instead, the amount of these loans is dependent on past CIBIL/CRIF scores.

Flash loans are unsecured but that does not mean that the lender will lose everything if the loanee doesn’t pay it back. The smart contracts which execute flash loans have pre-established conditions. In the event that the loanee fails to pay, the borrowed amount will be returned to the lender.

DeFi Flash Loans: Attributes

DeFi flash loan or crypto flash loan as it is more commonly called is a short-term loan, hence the term “flash” is associated with it. We will take a deeper look at the characteristics and aspects of flash loans to better understand them. Here are some of the key factors that determine flash loans.

Smart Contracts Govern the Future

Smart contacts are used to manage Defi-related flash loans. All conditions of the smart contract must be met before the smart contracts can be executed. The lender is protected from any loss by this. The smart contract reverses if the loanee fails to repay and the loaned amount is returned to the lender’s account.

Nature is instantaneous

These loans can be accessed instantly. Flash loans have instantaneous nature. This is why they are so popular. The transaction or trade for which the loan is intended has been identified on all flash loans. The loanee must complete the transaction within the given time frame, which in most cases is less than a minute. Flash loan transactions are extremely fast, with the process from application to using the loan and then returning it to the lender in just seconds.

No Security/Collateral Required

Flash loans are not like conventional or normal loans in that the borrower does not need to provide collateral or security to obtain the loan. The smart contract’s underlying conditions must be met in order for the loan to go through smoothly. There is no need to use middlemen or guarantee the process. It is enough to allow the loan process to proceed because of the smart contract.

These are three key attributes to a flash loan. To sum up, flash loans are possible because decentralized finance uses smart contracts executed over the blockchain to allow people to access quick loans with no collateral and without waiting periods.

We now know the basics of flash loans and how they work. Let’s look at how you can get one.

How to get a flash loan

It is impossible for everyday users to obtain a flash loan, no matter how easy it may sound. To get a Flash Loan, you must know how code smart contracts. Aave, DYdX and others offer flash loans. These platforms allow users to get flash loans. Aave users have the option to either be a borrower (or a lender/depositor) and can also choose their preferred role. Aave, an open-source liquidity platform that uses cryptocurrency AAVE as its token, is also known as AAVE. You can learn everything you want about Aave as well as its native token AAVE by visiting the CoinStats web page and CoinStats mobile app.

Users can either earn passive income or earn interest as lenders/depositors on the loans they make to borrowers. For borrowers, uncollateralized loans are available without having to deal with a middleman.

We now know what flash loans look like and how you can get them. Let’s find out what makes flash loans so profitable and the best uses for flash loans.

Flash loans: What are the uses?

Here are some of the most commonly used flash loans

Arbitrage Trade

Different exchanges have different prices for cryptocurrency tokens. This can occur due to trading volume, time differences and other factors. A cryptocurrency trader could profit from this price differential and make a profit. Arbitrage trading is where the trader takes out a loan at a low price for a crypto token and then sells the token to the highest price exchange. After returning the loan, the trader gets the profits.

Transaction fees are reduced

Transaction costs for transactions using the Ethereum blockchain can sometimes be quite high. Tradespeople and expert users can avoid this by taking out a flash loan to purchase the cryptocurrency they need. Flash loans come with very low fees.

Swap Collateral

Expert-level traders and users also use flash loans to earn money. This is done by replacing the poor-quality collateral from one loan with high-quality collateral from another. It is one the most popular flash loan use cases and slowly growing in popularity.

There are risks associated with flash loans

The fast-paced nature flash loans transactions can make flash loans sound attractive and offer a way to quickly get some money. Flash loans come with risks. Flash loans and DeFi ecosystem pose the greatest and most dangerous risk. Flash Loan Attack.

Flash Loan Attack

The smart contract is what enables a flash loan to be granted without the need for collateral. Smart contracts are the core of flash loans’ strength. However, this is also its most dangerous flaw. A hacker, or cyber-attacker can modify the smart contract to take away the crypto tokens that were loaned out under the contract. In the past, there have been attacks on platforms and exchanges that offer flash loans. These are the two most well-known examples of Flash Loan Attack.

1. dYdX, a decentralized lending application (DApp), was attacked by multiple DeFi protocol attackers to manipulate the market in 2020. The attacker did not alter the smart contracts, but he used various DeFi protocols in order to break the rules.

2. PancakeBunny Flash loan attack: PancakeBunny can be described as a DeFi yield farm platform. In May 2021 the attacker bought a large amount of BNB tokens. He then manipulated prices for USDT/BNB, BUNNY/BNB, and other tokens. The attacker was able to absorb large quantities of BUNNY tokens and then dump them to cause an artificial crash in the prices. According to BSCScan data the attacker stole $3 million US dollars.

It is clear that flash loans can be a powerful tool for allowing mass adoption of cryptocurrency, blockchain technology and DeFi. This technology is still in its early stages. These attacks are still possible. It is more complicated than most because of its complexity, which makes mass adoption difficult for those who don’t have any technical or programming knowledge.