The deadly conflict that started with Russia’s assault on Ukraine has increased crypto-related activity in both countries, according to Chainalysis. The blockchain forensics company found that fiat inflation and sanctions pressure caused several spikes this year in transaction volumes, while Eastern Europe remained a key player in the global crypto ecosystem.

Russians and Ukrainians Choose Crypto to Avoid the Military Conflict

The Russian invasion of Ukraine and ensuing military conflict that’s currently escalating have affected all aspects of life in the two nations, and cryptocurrency is no exception, Chainalysis said in an excerpt from its upcoming 2022 Geography of Cryptocurrency Report. Citizens of both countries have felt the war’s economic impact and experienced high inflation.

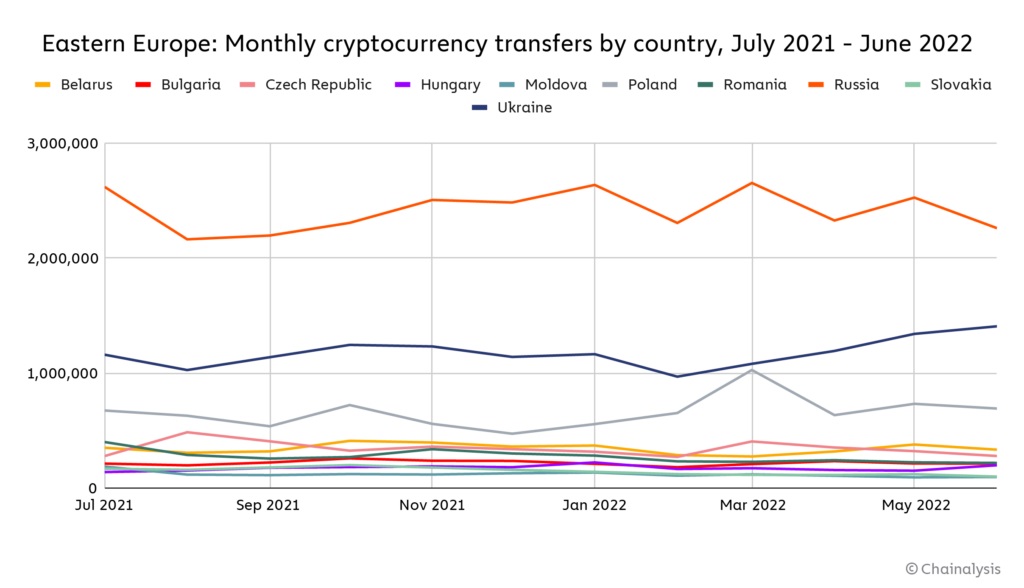

Soon after hostilities in February began, both Russian and Ukrainian cryptocurrency transactions saw an increase. Over the weeks and months that followed, trends diverged. Although Russian transactions fluctuated within a narrow range (possibly due to service restrictions), Ukrainian transactions were steadily increasing through June.

Just after the conflict began, March saw a 121% jump in Ukrainian hryvnia trading volume to $307million, and 3% more Russian ruble-denominated volume to $805 million. “After that, we see volumes drop off for both countries, ebbing and flowing through August, but never reaching their March highs,” the authors of the study noted.

Amid currency controls introduced under the martial law imposed by Kyiv, including restrictions on the cash purchases of U.S. dollars or euros and transfers abroad, some Ukrainians may have looked to exchange their hryvnia holdings for cryptocurrency, according to Tatiana Dmytrenko, a high-ranking adviser in Ukraine’s Ministry of Finance and member of the World Economic Forum’s Digital Assets Task Force. These measures were eased in July, and crypto trading volume fell.

Chainalysis quotes an expert in money laundering who comments on similar activities in Russia where currency restrictions are also enforced. “The major question not just for oligarchs but also ordinary Russians became, ‘How do you get money out of Russia?’” said the expert who chose to remain anonymous. “Many began looking for new places where they could cash out their crypto,” he added citing the UAE, Turkey, Kazakhstan, and Georgia as jurisdictions where Russians could have found such services.

While according to the researchers, crypto markets are hardly liquid enough to support systematic sanctions evasion, cryptocurrency could potentially play a role in financing Russia’s foreign trade, after its banks were cut from the global payment messaging network SWIFT. Expert pointed out that crypto payments can be legalized by the Central Bank of Russia for cross-border settlements. Some companies might have used digital assets to facilitate such transactions. He believes that stablecoins are more suitable as medium of exchange than bitcoin because they don’t have volatile nature.

According to Chainalysis Data, Eastern Europe has a 10% Share in Global Crypto Transactions

Chainalysis stated that Eastern Europe, as a whole is fifth largest cryptocurrency market, with $630.9 Billion in total value on-chain. This is just over 10% of global transaction activity between July 2021-2022. The region’s “comparative role in the bigger, worldwide crypto ecosystem has stayed surprisingly consistent over the last few years” while other regions have seen more volatility, the company elaborated.

“Risky and illicit activity is still prominent when we look at Eastern Europe’s on-chain activity: High-risk exchanges – those with no or low KYC requirements – account for 6.1% of transaction activity in the region,” the report further notes. Chainalysis estimates that more than 18% of the cryptocurrency received in Eastern Europe originates from addresses involved with illicit or risky activities, which is higher than any other region.

If their military conflicts escalate, do you think that crypto activity will increase in Russia and Ukraine? Please comment below with your views.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.