The total value locked in decentralized finance (defi), which was close to $100 billion, has fallen short of that mark over the past few weeks. As the TVL fell 3.34% in the 24 hours, today’s value across defi is $86.22billion.

The Value of Decentralized Finance is Not Enough to Cap $100 Billion

According to metrics.defillama.com, around $86.22 million was the total value of decentralized finance protocols as of August 2, 2022. Makerdao dominates the pack by 9.67% with the protocol’s $8.34 billion locked.

Today’s defi TVL is down 3.34% but the value has been steadily rising since the low of $69 billion recorded in mid-June. TVL’s value has risen 24.95% since its low of $69 billion in June and it reached $89.84 million on July 29.

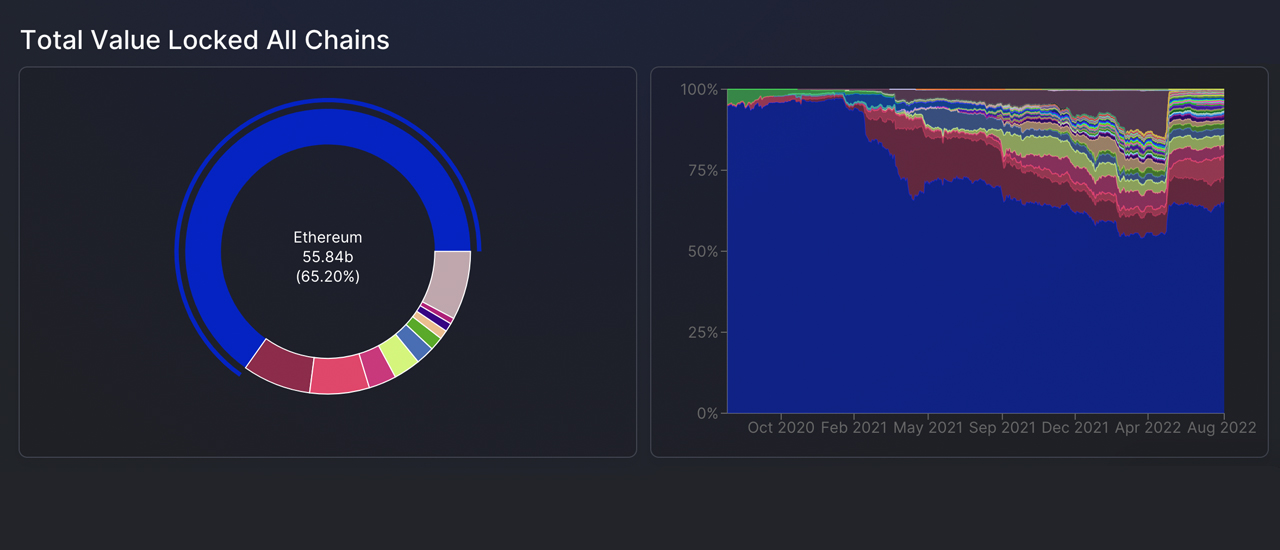

Out of all the defi supporting blockchains, Ethereum is still the dominant leader capturing 65.20% of today’s TVL with approximately $55.84 billion locked on August 2. Binance Smart Chain is following Ethereum (BSC), which has $6.64 Billion locked, which equals 7.75% to the $86.22 Billion.

Tron today is third in defi. It has $5.78 trillion locked. That’s approximately 6.75% off the TVL. While Makerdao is the largest defi protocol, the application’s TVL rose by 5.91% this past week.

Instadapp, Lido Capture Double-Digit Monthly Gains — Cross-Chain Bridge TVL Slides More Than 60% This Past Month

Instadapp saw an increase of 27.38% in TVL over the previous seven days. Lido’s liquid staking protocol jumped by 13.63% and Convex Finance saw an increase of 11.18%.

TVLs saw TVL increases this week for all top 10 defi app, as well as gains over the last 30 days. Instadapp, which is in the tenth position, saw a 49.14% monthly TVL increase, and Lido’s TVL swelled by 44.50% over the last 30 days.

The cross-chain bridge ecosystem has cratered as 30-day statistics show that it’s down 60.4% and the Nomad bridge exploit contributed to this month’s losses. The current smart contract platform token market capization stands at $333 billion. That’s a drop of 2.2% in 24 hours.

Ethereum (ETH), and the ethereum Classic (ETC) have been the largest smart contract platform token gains over this past week. ETC rose 54.9% and ETH jumped 10.5% against the U.S. Dollar. ETC also saw a jump of 121.5% in neblio, (NEBL), and an increase of 72.5% in oasis network (ROSE).

How do you feel about recent decentralized financial (defi), market actions and the collapse of cross-chain bridge TVL? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.