The United Nations Conference on Trade and Development (UNCTAD) has warned that the U.S. Federal Reserve’s interest rate hikes and the slew of other central banks raising rates, could pose harm to the global economy. UNCTAD found that every Fed basis point increase results in a 0.5% decline in the output of rich countries and a 0.8% decrease for those of poorer nations over a period of three years.

UNCTAD Report Criticizes Central Bank Rate Rises during Global Economic Downturn

According to UNCTAD, tightening monetary policy may not be an ideal idea. This intergovernmental entity was established in 1964 to aid developing countries increase their global trade. UNCTAD noted in an annual report the fact that interest rates hikes by the U.S. Federal Reserve, and other central banks across the globe have reduced the economic output of wealthy and poor nations between 0.5%- 0.8% over three years.

“The world is headed towards a global recession and prolonged stagnation unless we quickly change the current policy course of monetary and fiscal tightening in advanced economies,” UNCTAD’s report notes. “UNCTAD projects that world economic growth will slow to 2.5% in 2022 and drop to 2.2% in 2023. The global slowdown would leave real GDP still below its pre-pandemic trend, costing the world more than $17 trillion — close to 20% of the world’s income.”

In the annual report, central banks are criticized for raising their benchmark lending rates. They also have to adopt a more stringent monetary policy. UNCTAD blames the world’s economic hardships on “supply-side shocks, waning consumer and investor confidence,” and the Ukraine-Russia war. “Despite this, leading central banks are raising interest rates sharply, threatening to cut off growth altogether and making life much harder for heavily indebted firms, households, and governments,” the U.N. agency’s report explains.

UN Agency urges governments to increase public spending and enforce price controls on energy and food

The report, authored by UNCTAD’s secretary-general Rebeca Grynspan, says that Latin American countries and specific regions in Africa may “suffer [from] some of the sharpest slowdowns this year.” “The average growth rate for developing economies is projected to drop below 3% — a pace that is insufficient for sustainable development and will further squeeze public and private finances and damage employment prospects,” Grynspan details. UNCTAD’s call on the Fed and the rest of the world’s central banks is quite similar to the complaint written by U.S. Senator Elizabeth Warren (D.Mass.

Warren was unhappy about the Fed increasing the federal funds interest rate following a 75-basis point (bps) increase on July 27. Using the news outlet the Wall Street Journal (WSJ), Warren published an opinion editorial that said the U.S. central bank could trigger “a devastating recession.” Warren further talked about the subject again on CNN’s State of the Union weeks later, after Fed chair Jerome Powell presented his economic outlook at the 2022 Jackson Hole Economic Symposium. Grynspan’s report is in kindred spirit, and it details that “interest rate hikes by advanced economies are hitting the most vulnerable hardest.”

UNCTAD adds the following:

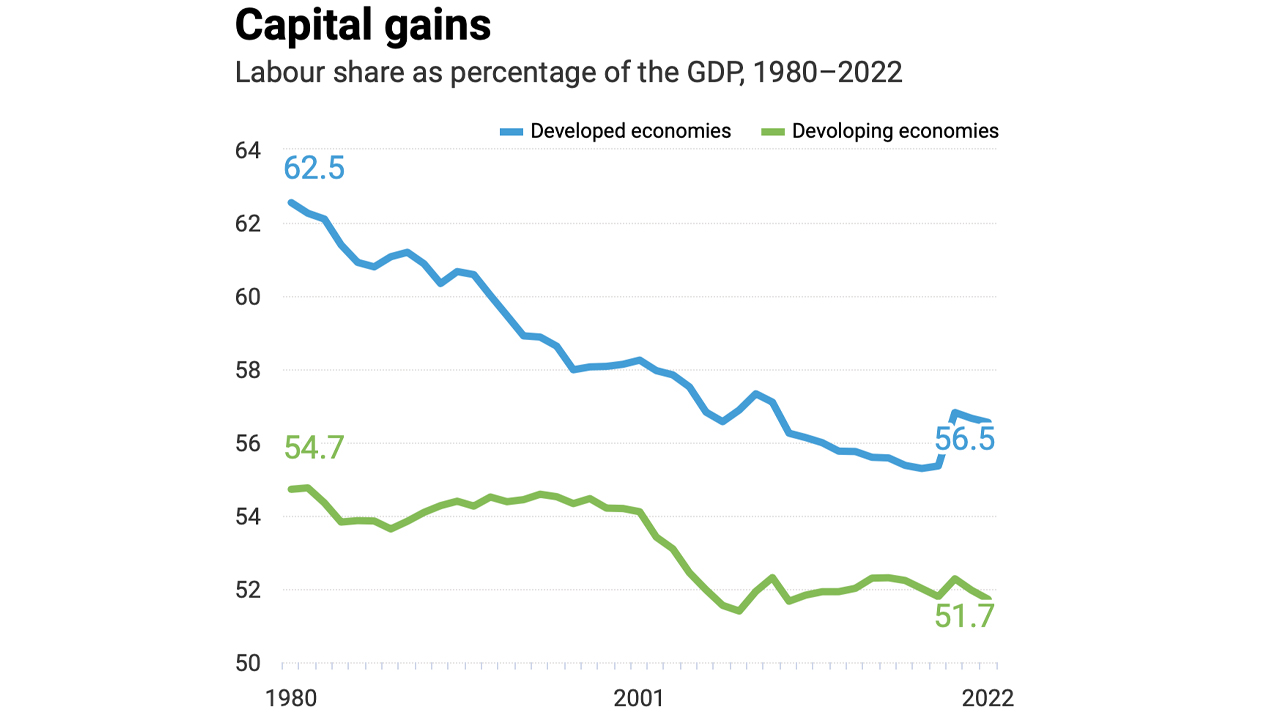

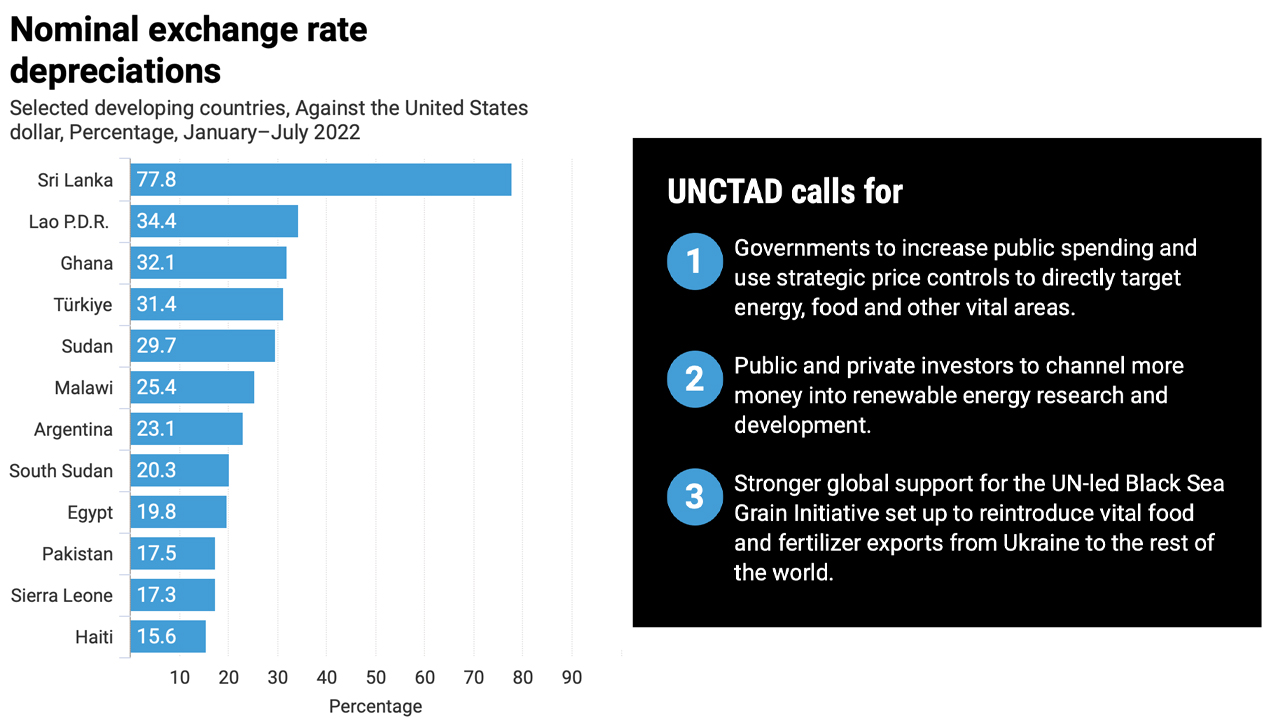

Some 90 developing countries have seen their currencies weaken against the dollar this year – over a third of them by more than 10%.

UNCTAD’s report concludes by highlighting a few ways global leaders can address the problem and one of them is to “increase public spending.” The agency also urges governments to enforce “strategic price controls to directly target energy, food and other vital areas.” The U.N. agency calls on public and private executives to direct more funds toward green energy research and development. Finally, UNCTAD wants world leaders to embrace the Black Sea Grain Initiative. U.N.-led initiatives would permit huge quantities of fertilizer and food exports out of Odesa and Chornomorsk in Ukraine.

What do you think about UNCTAD’s report that calls on central banks to halt interest rate hikes? Please comment below on your views.

Image creditShutterstock. Pixabay. Wiki Commons. Editorial photo credit to Alexandros Michailidis. Shutterstock.com

DisclaimerInformational: It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or allegedly cause any kind of damage.