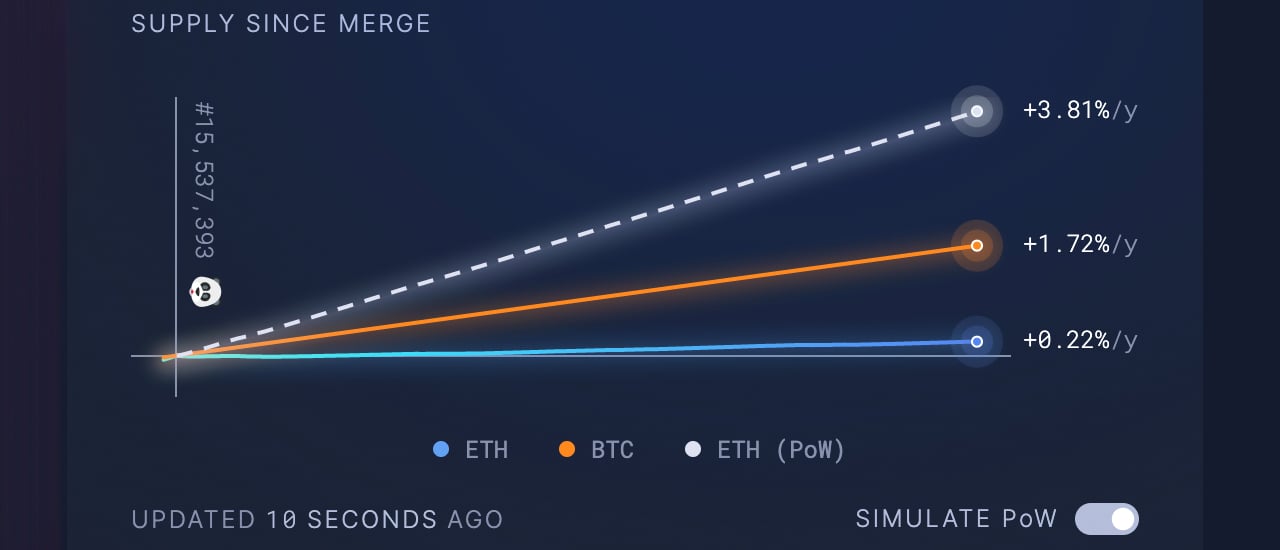

Months before Ethereum transitioned from proof-of-work (PoW) to proof-of-stake (PoS), a simulation of The Merge had shown the network’s issuance rate would drop following the ruleset change. Statistics now show that the simulation’s predictions have come to fruition as the network’s issuance rate has slowed significantly since September 15, following the Paris Upgrade that triggered The Merge.

Ethereum’s Issuance Rate Sinks Lower Post-Merge

Since August 5, 2021, Ethereum has changed from being inflationary to deflationary by introducing the ruleset upgrade EIP-1559. The change changed the algorithm that was tied to the base price per gas. Since EIP-1559 has been codified, Ethereum now pays the base fee for each gas. After the London Upgrade of August 5, 2016, the network had destroyed 263270661 ether, which is worth $8.56 trillion. Since The Merge, however, Ethereum is a lot more deflationary because the change redefined the protocol’s issuance rate.

The web portal ultrasound.money shows that 3,076ETH have been issued to date since The Merge (September 15). The Merge would not have been possible if proof-of work (PoW), miners still mine Ethereum. They would have generated 53,694 Ether since September 15. The current data shows that Ethereum’s issuance rate post-Merge has dropped by more than 94% lower than if the blockchain would have remained a PoW network. ETH’s deflationary characteristics are believed to be beneficial, as they make ether scarce over time.

EIP-1559 and post-merge ruleset changes will make Ethereum 4.6 millions less by next year

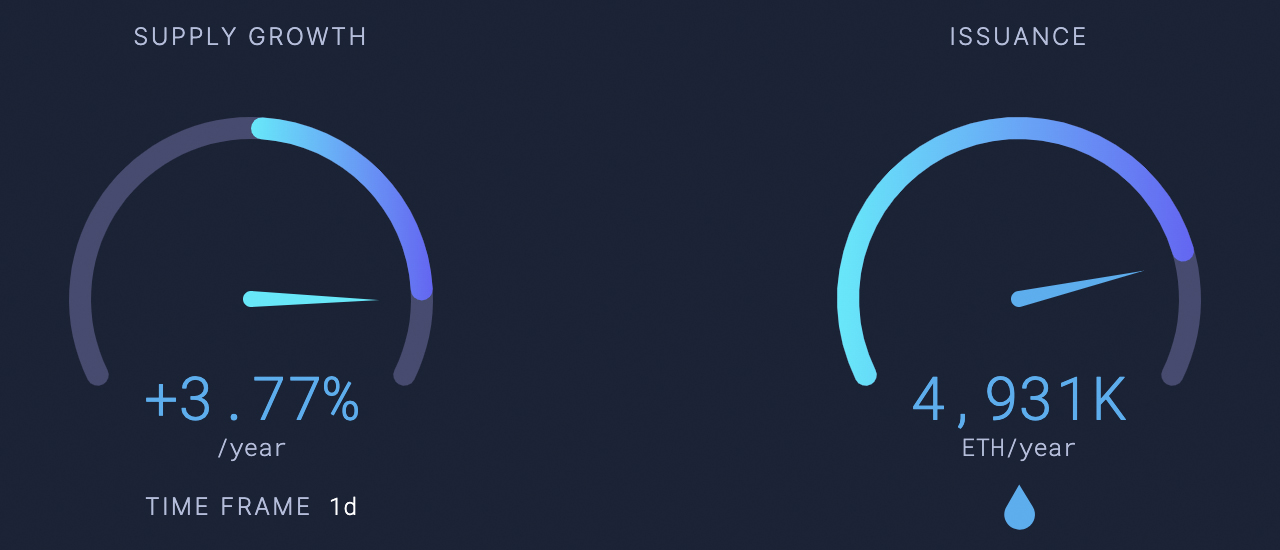

Current data from the Merge indicates that 297,000 ETH is likely to be burnt annually, at current rates. In addition to a drop in issuance (from 3.78% to 0.22% per annum down to 0.25% per annum), The Merge was a time when miners could produce 4,931,000 Ethereum per year. But, since PoS became a protocol, annual issuance has fallen to 603,000 ether.

At current exchange rates, ETH’s total circulating supply is $158.57 billion USD.

This means if Ethereum never Merged, by September 19, 2023, the total supply would be around 125,514,249 without accounting for EIP-1559’s burn rate. With the burn rate and post-Merge rules, ETH’s total supply by September 19, 2023 should be an estimated 120,889,249, or 4,625,000 ether less than it would be under previous PoW consensus rules. Similar to Bitcoin’s halving characteristics, ETH supporters believe the aforementioned ruleset changes will make ether harder than traditional sound money, as proponents these days like to call it ‘ultra sound money.’

What do you think about Ethereum’s issuance rate change following The Merge and EIP-1559 being introduced last year? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons. Ultrasound.money Stats.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.