Sushiswap Pros

- Available in 100+ ERC-20 Tokens

- There are many ways to make passive income.

- Liquidity: Largest and most decentralized exchange

- Trading fees that are affordable

- High-quality user interfaces and experiences

Sushiswap Cons

- Inaccessibility of fiat payment portals

- It is hard to follow for beginners

- Gas prices are more expensive than those charged by centralized exchanges.

- There is no constant innovation

Worldwide adoption of blockchain technology and cryptocurrency has led to a major shift in global finance. One of the most prominent trends in the blockchain sector is decentralized finance (DeFi). Many people believe this will surpass traditional finance. DeFi utilizes DApps (Decentralized ledger technology) and DLT to permit permissionless financial transactions like decentralized lending and Yield farming, DeFi insurance, liquidity miners, and DEX (Decentralized Exchanges). These operations can all be performed within a peer–to-peer network.

DEXs are a key component of the existing DeFi environment, and it won’t even be exaggerating to say that there won’t be DeFi without the existence of DEXs. Choosing the DEX to suit your needs among a staggering number of cryptocurrency exchanges in the market doesn’t seem easy.

Our SushiSwap review will reveal everything you need to know about the SushiSwap exchange, its features, services, trading fees, etc., to help you decide if it’s a suitable exchange for you. SushiSwap (an Ethereum-based decentralized Exchange (DEX)) is known as an automated market maker or (AMM). It allows users to exchange tokens and receive rewards through yield farming. It’s a fork of Uniswap, with variations and additional features, the most notable of which is the SUSHI token.

Let’s take a closer look at what you can expect from the SushiSwap trading platform!

What is SushiSwap?

SushiSwap has been a popular DEX on the marketplace. This decentralized exchange is built on Ethereum Blockchain and serves as an AMM technology for many other popular DEXs around the world.

SushiSwap users have the ability to Trade, stake, SwapYou can access hundreds of crypto tokens from a decentralized platform. Trades on SushiSwap, unlike other well-known exchanges such as Coinbase and Binance, aren’t managed or controlled by any central authority. The system uses mathematical formulas to automatically set the prices for crypto pairs and smart contracts to settle trades.

SushiSwap has created liquidity pools in order to address the liquidity issues faced by centralized exchanges. These liquidity pools are nothing more than a pool of funds within SuhsiSwap where crypto users can lend or stake to earn interest and rewards.

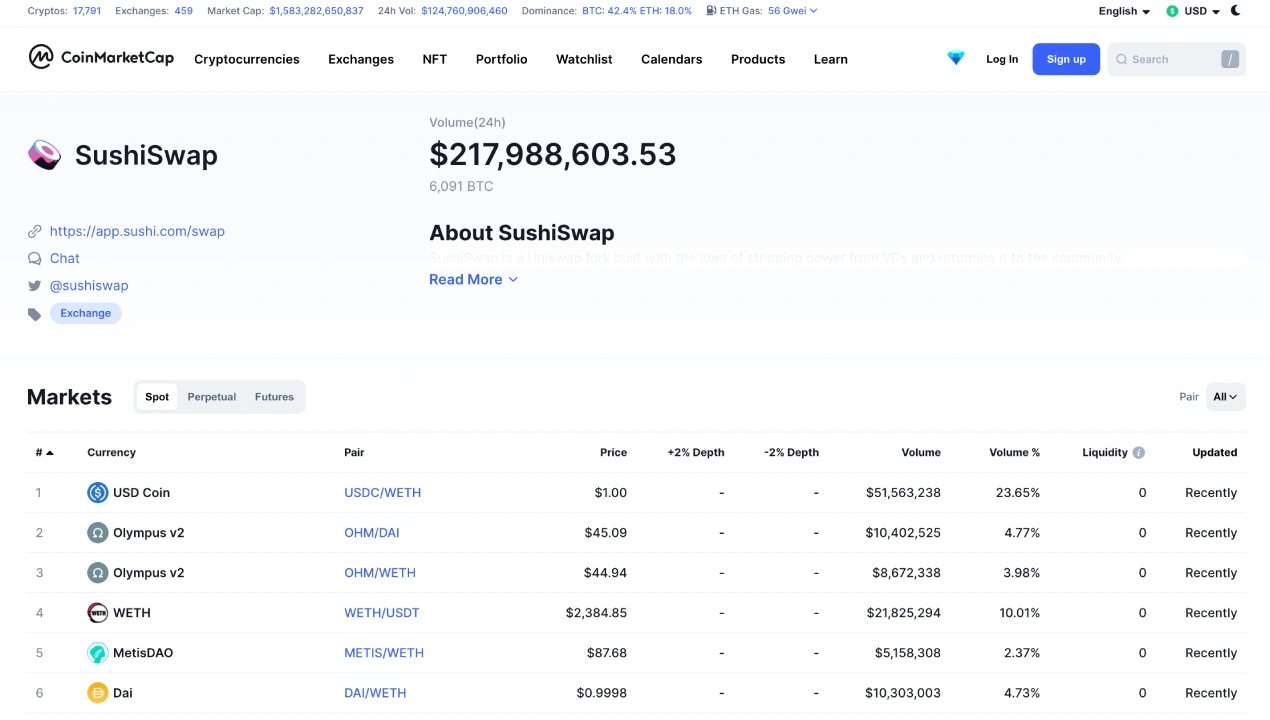

SushiSwap accepts over 100 altcoins Cryptocurrency: More Than 480Enjoy swapping of pairs 100 millionDaily trading volume and a staggering $5.1 BillionsIn TVL (Total Value Locked).

An Intense History

SushiSwap can be described as a fork in Uniswap. It’s based on AMM, ensuring that assets are priced using a trading algorithm rather than an order book used in traditional exchanges.

Both founders of SushiSwap — Nomi, Chef 0xMakiTo this day, you can remain anonymous. Chef Nomi was the core developer who created SushiSwap by performing a hard fork on Uniswap’s open-source code in August 2020.

SushiSwap founders, along with their team, used an innovative and efficient approach to promote the decentralized exchange. Initially, they applied a “vampire mining” scheme using the Uniswap liquidity provider tokens (LP tokens) issued to users who provide liquidity to the Uniswap pools. SushiSwap rewarded the users who stoked their LP tokens via the SushiSwap protocol with their native utility token, SUSHI. Within a few weeks the staked tokens had been migrated to SushiSwap’s native pools. The LP tokens then became exchangeable for the original assets that were put in the Uniswap liquidity pool, creating liquidity for SushiSwap.

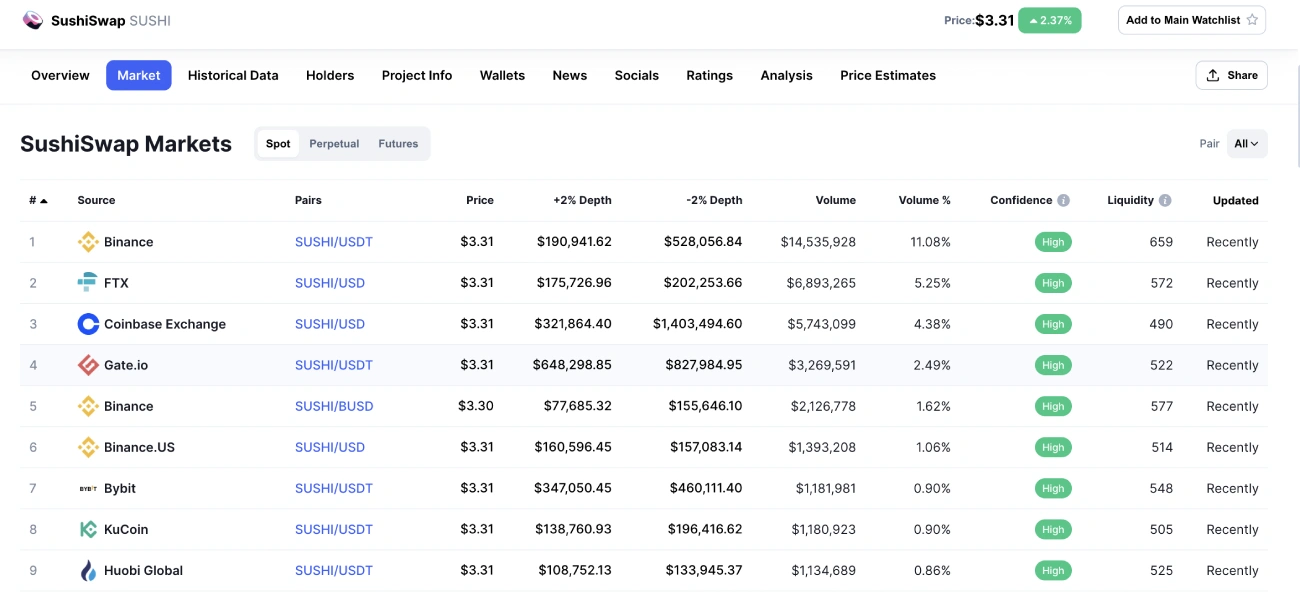

SushiSwap offers more advanced DeFi features than UniSwap. Most importantly, its SUSHI tokens are listed on prominent central exchanges such as Binance and Coinbase.

What does SushiSwap do?

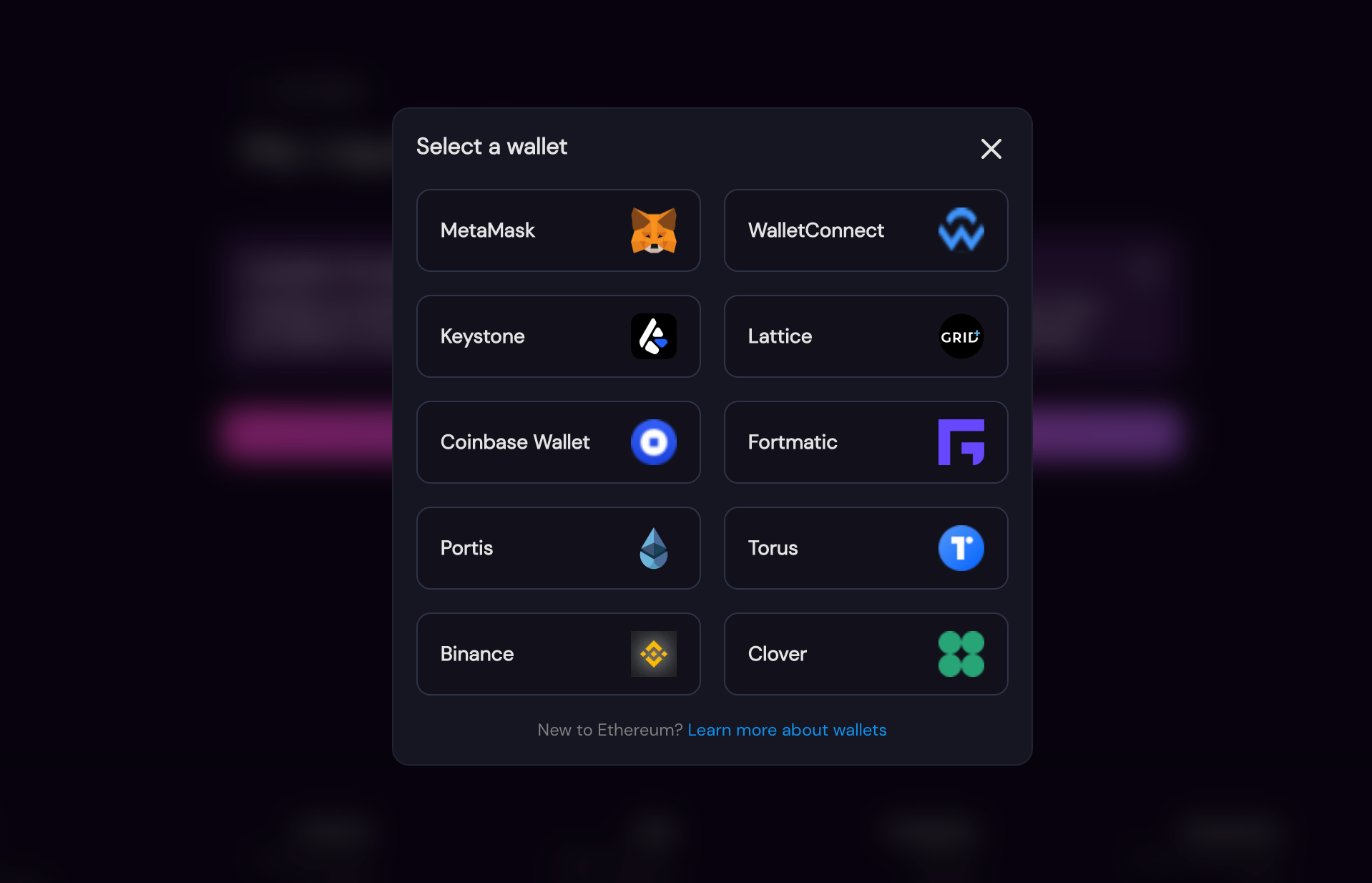

SushiSwap’s goal is to allow decentralized cryptocurrency trades. Unlike a typical crypto exchange, you don’t need to create an account on SushiSwap to start using their services. Connect a Internet 3.0Compatible wallet with Ethereum Network

SushiSwap has many liquidity pools that support different altcoins. Two crypto assets are included in each pool. Users can either stake one of the assets or both to earn trading fees and interest.

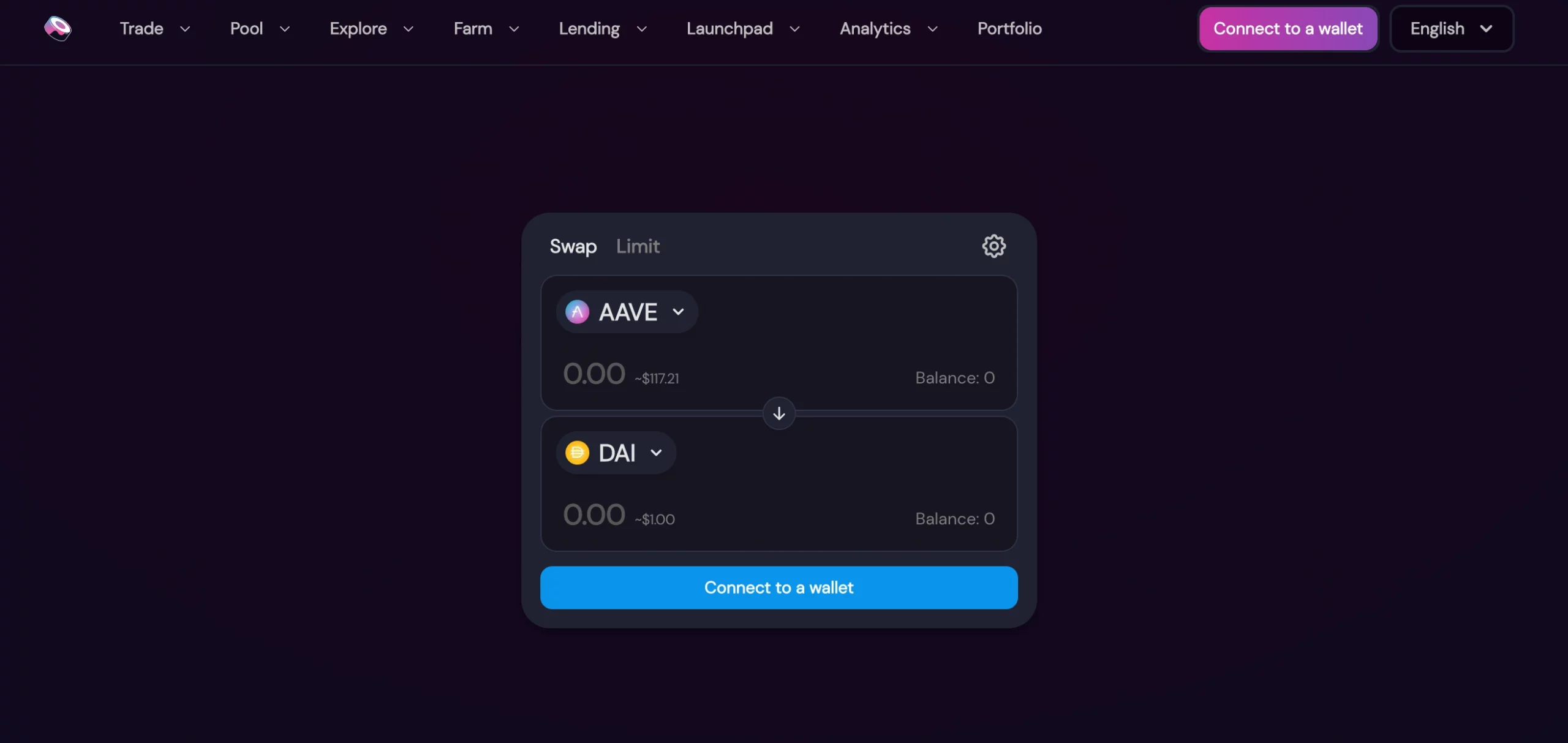

Take, for example, the AAVE/DAI To earn rewards in the liquidity pool, stake either AAVE or DAI to gain cash.

You must have Ether (ETH), in order to get started on SushiSwap. Any trusted centralized crypto exchange will allow you to acquire ETH with fiat currency. This can’t be done on SushiSwap because it doesn’t support fiat. After you’ve done this, ETHYou can use SushiSwap by connecting your cryptocurrency wallet. Once you have the SushiApp, connect to any web 3.0 wallets such as MetaMask. The screenshot below shows some of the compatible wallets.

You can then choose your preferred liquidity pool on SushiSwap and start to earn rewards by investing your tokens or coin in the platform. It’s crucial to perform due diligence before investing in any projects on SushiSwap, as there’s no mandatory verification for projects to get listed on the platform.

Supported Cryptocurrencies

SushiSwap offers support for over 100 altcoins 500 Crypto pairs. Many of these altcoins work well with other stablecoins (USDC, USDT), DAI, DAI, etc.) or popular DEX-friendly cryptos such Wrapped Ethereum (WETH).

SushiSwap: Key Features

If you are a user of Uniswap, you’d be surprised to see how similar both platforms are, as they share the same source code, blockchain (Ethereum), and even the UI and UX. However, the functioning of SushiSwap’s liquidity protocols is more advanced and offers additional convenience.

SushiSwap’s main difference is their use of the native symbol, Sushi, which will be discussed in the next sections.

SushiSwap has many key attributes, including:

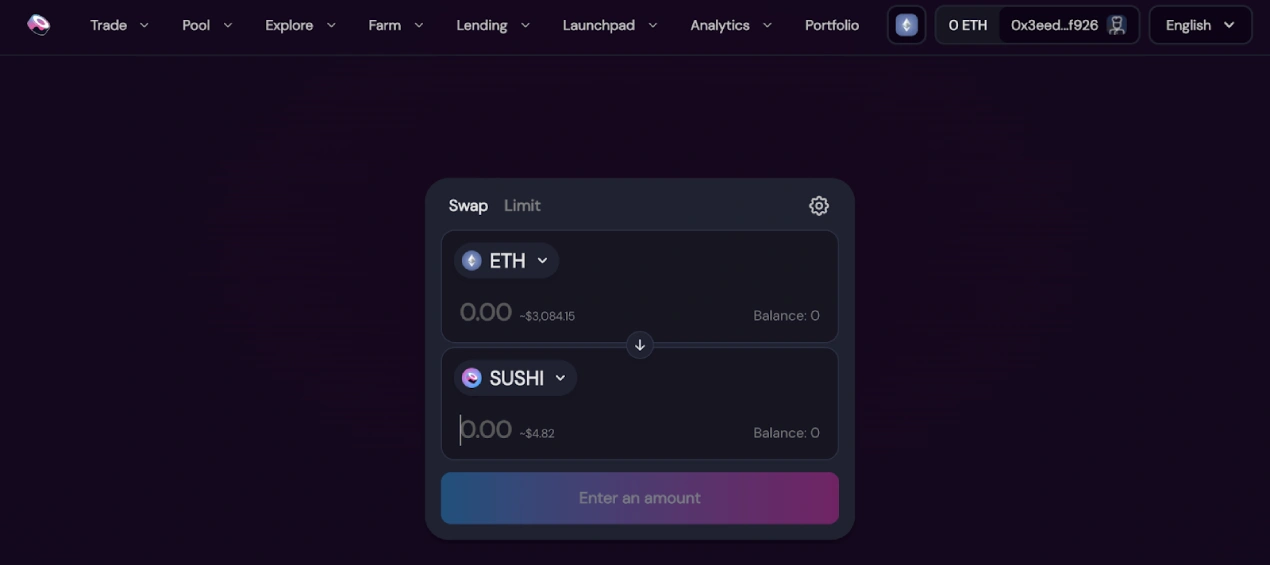

Swap – The SushiSwap Exchange

You can swap ERC-20 tokens easily on the SushiSwap Exchange, as mentioned. The platform supports over 100 Ethereum based tokens, and you don’t need to go through any KYC verification to get started.

You will be ready to make SushiSwap swaps with a MetaMask decentralized wallet and some Ether for gas fees.

Pool – SushiSwap Liquidity Pools

To become a liquidity supplier to SushiSwap’s pools, stake your cryptos into the various liquidity pools that are available. A liquidity provider is entitled to 0.25% of all trading fees from trades which occur in your pool. This percentage corresponds to your share. You have two options: you can either deposit the same amount of tokens to any pool already in existence, or you could create your own pool. In this way, you will also be able to earn SushiSwap liquidity pools tokens (SLP), that can be used in a variety of other ways on the platform.

Farm – SushiSwap Farming

With SLP tokens, users can benefit from the platform’s yield farming functionality to earn attractive interests. SUSHI token farm can be started after you stake your SLP tokens.

The platform also allows you to stake SLP tokens. Each farm has its own APY and risks. The USDC/WETH Farm has the best TVL and highest yields, as you can see from the screenshot. 10.5% Annual Percentage Yield.

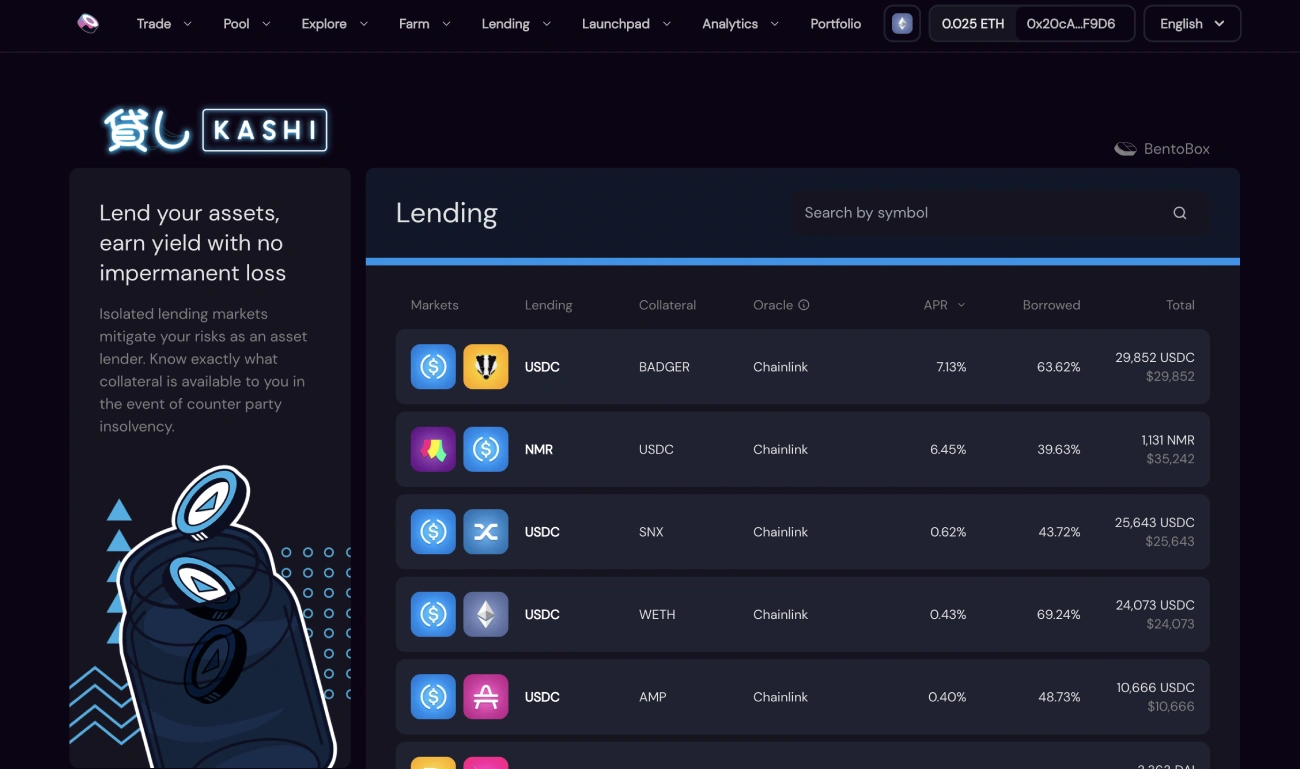

Lend – Lending of Cryptos

The lending and borrowing of cryptos on SushiSwap are powered by the platform’s native Kashi trading portal built on BentoBox. This platform allows users to create custom markets that allow them to borrow and lend various altcoins and stable coins as well as synthetic crypto assets. The Kashi trading platform allows each money market to function independently. Kashi is not like traditional DeFi markets, where volatile assets can affect all protocols. However, there are no other money markets that could be affected by volatile assets.

The screenshot below shows the various markets where SushiSwap allows you to lend tokens for high interest.

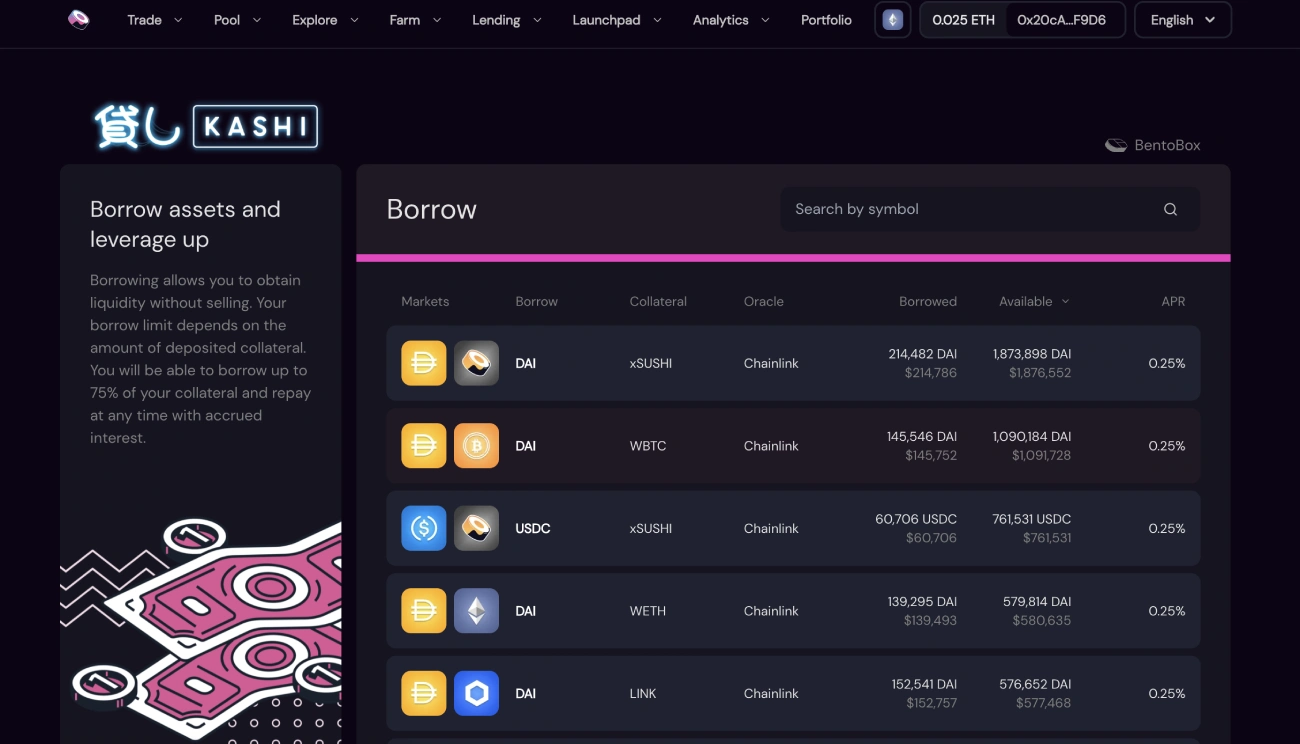

Borrow – Borrowing of Cryptos

By providing collateral, you can also borrow cryptocurrency on the platform. Borrow assets at minimal interest to make a profit and trade or offer liquidity to get higher APRs.

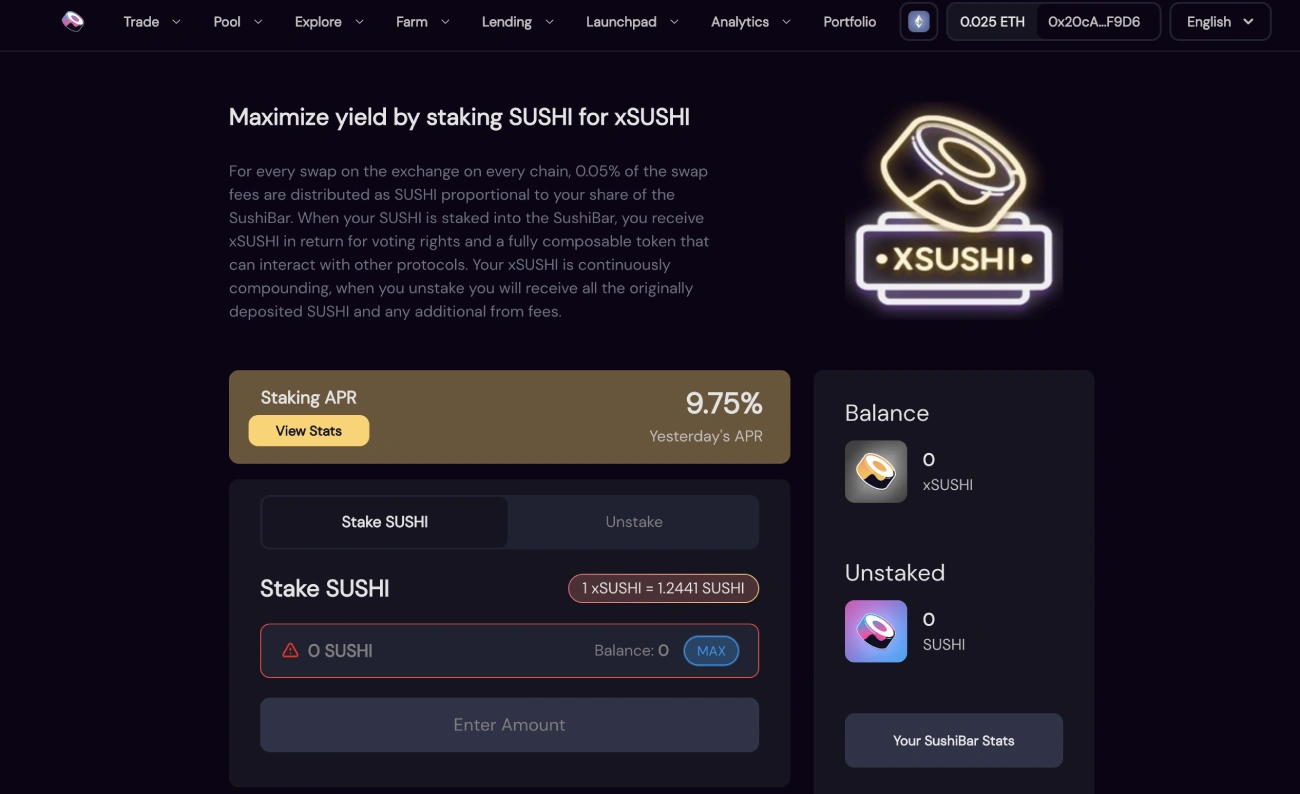

Stake – Staking

To earn even more SUSHI, you can use your SUSHI tokens on the SushiSwap Platform to stake them. You need to convert your SUSHI tokens to xSUSHI and stake them in SushiBar to participate in SushiSwap’s governance and earn 0.05%All the swaps occurring across various chains.

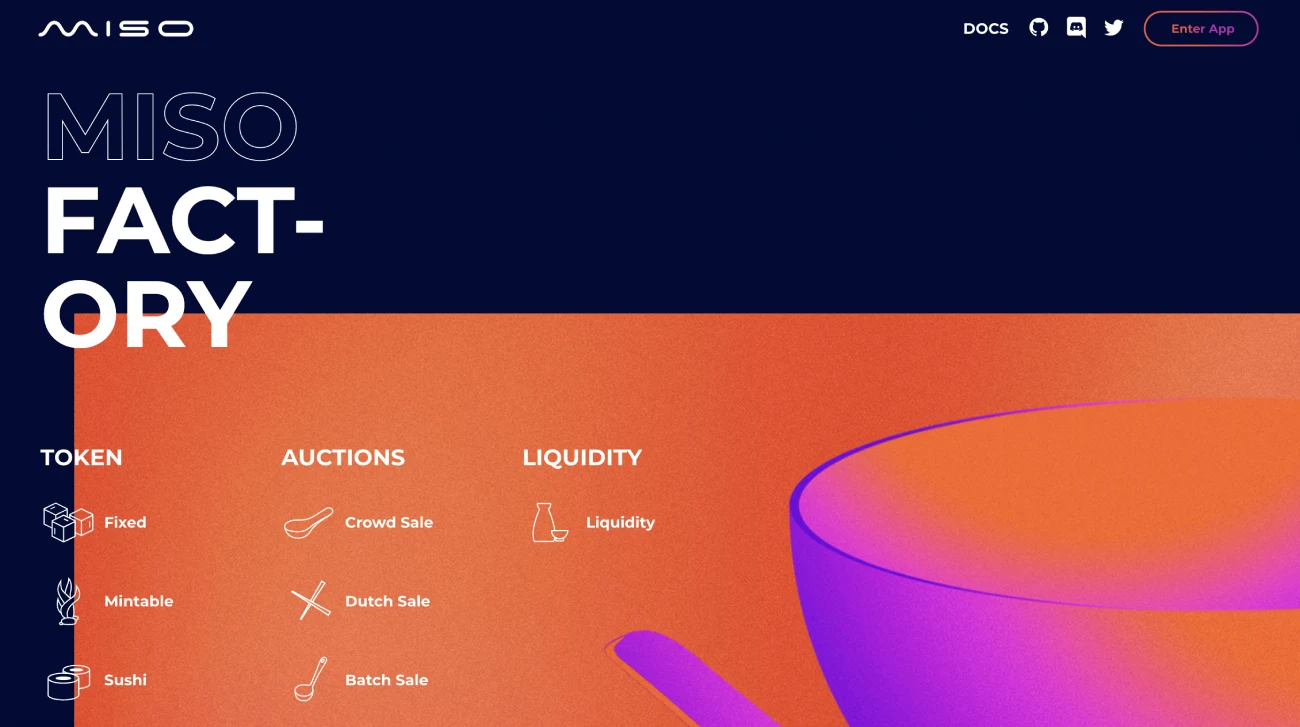

MISO – Minimal Initial SushiSwap Offering

Another innovative DeFi initiative, MISO was developed by SushiSwap. The platform’s primary purpose is to encourage developers to launch their own token on SushiSwap.

MISO acts as an accelerator for token makers. This platform allows founders without technical backgrounds to have access to everything needed to launch and develop their token on SushiSwap.

SushiSwap App Review

You can access all DeFi functionality on the SushiSwap App. As highlighted in the below screenshot, you can visit the official SushiSwap website and click “Enter app” to get started with the exchange.

SUSHI – SushiSwap’s Native Token

The native utility token for the SushiSwap exchange is SUSHI. As a holder of SUSHI, you are eligible to participate in the platform’s governance and vote on various proposals, thereby having an active involvement in the future direction of the exchange. For a fraction of the Swap fees generated by the exchange, holders of SUSHI tokens can be staked on the SushiSwap application.

Is There a Sushi in Every Home?

As of writing, the circulating supply of SUSHI is over 127 million, which is close to 51% of the token’s total supply (240 million). Its 24-hour trading volume is $160million.

SUSHI Tokens – How To Purchase

SushiSwap tokens can be purchased on nearly all reliable and trustworthy centralized cryptocurrency trading platforms like Binance or Coinbase. These exchanges allow you to buy SUSHI tokens using fiat currency.

You can trade your cryptos on DEXs for BTC and ETH, or swap them out for SUSHI via SushiSwap or Uniswap.

Selling Your SUSHI Tokens

SUSHI tokens can be used in conjunction with USDT (the most trusted stablecoin) on reliable exchanges such Binance and Bybit. By placing market orders or limits, you can also sell existing SUSHI tokens. You can swap your SUSHI tokens with other tokens via DEXs. But, centralized exchanges will be the best option if you want to make it fiat.

Storage Guide SUSHI

The purpose of your SUSHI tokens will determine the storage option you choose. SushiSwap offers a non-custodial wallet that allows you to use your SUSHI for passive income such as lending or staking. This wallet allows you to move your SUSHI easily when needed.

If you intend to trade SUSHI to profit from the price fluctuations, you can use your exchange’s software wallet or hot wallet, which offers great convenience but less security. This option is only available if you’re actively trading SUSHI. Also, make sure that your hot wallet has a limited amount of tokens.

Cold storage is the best choice for large amounts of SUSHI that you want to keep safe and secure. There are many reliable wallets on the market that offer great convenience and security.

Analysis of the SUSHI Price

Since August 2020, the SUSHI market has fluctuated. The below weekly price chart shows the gradual, organic increase in SUSHI’s price over time.

Since the token reached its current ATH ($23), price action has been heading South. The crypto bear market began in Q2 2021. Experts think that SUSHI currently is undervalued. It could reach its current ATH or higher in the next bull market.

You can check the SUSHI current price, market capital, supply and trading volume as well as detailed information about several of the fastest growing cryptocurrencies at CoinStats. One of the most popular crypto platforms is CoinStats.

Sushi is a good investment

SushiSwap is one of the most prominent DEXs globally, and its market cap and the token’s TVL speak for themselves. To see the future potential of a crypto asset, it’s important to know if the token is inflationary or deflationary. A fiat currency such as USD can be infected by governments creating unlimited amounts of dollars bills. This could lead to a decrease in the USD’s value over time.

SushiSwap does not have a constant token supply. Instead, it rewards its users with 0.05% of their revenue in SUSHI. The platform does not create more SUSHI. Instead, it acquires more SUSHI for its users. This method helps stabilize SUSHI’s price and contributes to the SUSHI token’s buying pressure. The SushiSwap cryptocurrency has high potential for future growth according to WalletInvestor algorithm. SUSHI’s price could rise from $4.8 to $7.7 before 2022, and even reach $8.8 by 2022. $22 within 5 Years.

Lastly, as the innovations and developments by SushiSwap in the DeFi space continue to grow, the token’s value tends to increase shortly.

SushiSwap is it safe?

SushiSwap places security of user funds and network networks first. However, it’s important to know that the exchange had a fishy past. Right after the SUSHI’s launch on the Binance exchange, the token’s price skyrocketed. In the same month (September 2020), the anonymous founder — Chef Nomi, created a rug pull, cashing outMore 25%, over $14,000,000 of SushiSwap’s developer funding pool. A small portion was later returned by the investors. Later Sam Bankman Fried, CEO of FTX derivatives trading exchange, a prominent personality in the cryptocurrency space, took control of SushiSwap operations.

The SushiSwap team has maintained a high level of security since the beginning. There have not been any hacks or attacks against the exchange.

Commissions for trading

For all trades, swaps or transactions on SushiSwap’s platform, there is a flat 0.3% fee. 2.25 percent of the 0.3% is returned to liquidity providers. The remaining 0.5% is transferred to SUSHI token holders on the SushiBar Platform. The withdrawal fee is not charged by the DEX.

Support for Customers

Like all DEXs, SushiSwap doesn’t have real-time customer support like phone support, live chat, etc. However, users can post their queries on SushiSwap’s Customer Support and Engagement Forum, use the email support, and reach out to the SushiSwap team on their social media pages for a quick resolution.

SushiSwap FAQs

- Is the Sushi Token Infinitely Inflatable?

No. The initial stage of SushiSwap’s exchange saw the decision to allow unlimited SUSHI tokens. The maximum amount of tokens available is 250 million SUSHI tokens after a thorough community vote.

- How does the Sushiswap governance work?

SushiPowah’s snapshot page is the voting system used for governance. Each SUSHI/ETH liquidity token that is locked in the SushiSwap farms receives one vote.

xSUSHI, another token important to the Sushi network can also be created by staking SUSHI tokens via the SushiBar platform. At the time of this writing, 1 xSUSHI token is equivalent to 1.24 SUSHI coins.

What’s the Bottom Line?

SushiSwap is a trustworthy decentralized marketplace that has grown despite the controversy. SushiSwap has been constantly innovating to attract DeFi enthusiasts and it is well on its way to being the best. The most used DEXAll over the globe.

Although the platform made good use of Uniswap’s user interface, the improvements made on top of that have helped many crypto novices get accustomed to the DeFi environment. The growth in TVL, daily trading volume, and SUSHI’s market cap, achieved by SushiSwap in such a short time, indicates the high future potential of the exchange and the SUSHI token.

We trust you find this CoinStats SushiSwap reviews useful and informative. Which sentiment do you have about the SUSHI token Do you feel bullish or bearish about the SUSHI token Let us know your thoughts below.