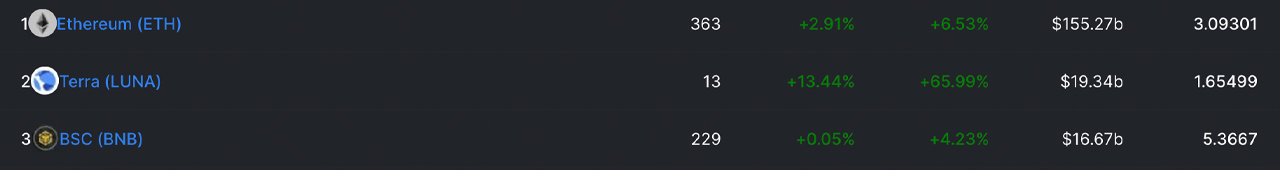

After suffering losses over the last week, decentralized finance’s total value locked (TVL), has seen a rebound in fiat values. According to statistics, the decentralized finance TVL at $248 billion has increased by 3.46% over the past 24 hour and blockchain Terra has surpassed the Binance Smart Blockchain in terms TVL in Defi.

Terra Protocol’s Defi Value Swells, LUNA Taps an All-Time High

The Terra protocol has been making waves as the blockchain’s native crypto asset (LUNA) has increased more than 45% over the last week. The cryptocurrency recently reached an all-time peak (ATH), and LUNA now ranks ninth in market value. In addition to LUNA’s recent ATH, the blockchain network has overtaken the Binance Smart Chain (BSC) in terms of TVL in defi.

BSC was for the majority of 2018 the second-largest network of blockchain networks in terms defi TVL. The Terra protocol, however has now surpassed BSC in terms of defi TVL by only a few billion. Terra’s TVL today, according to defillama.com, is around $19.34 billion while BSC is around $16.67 billion on Tuesday. Terra TVL is 16.1% higher than BSC, and has increased by 65.99% in the past week.

Terra TVL is 7.79% for all chains of Aggregate Value Locked in Defi

Lots of the swelling value is due to Terra’s native token LUNA reaching new price highs, Terra protocol’s stablecoin UST increasing its tokens in circulation. Bitcoin.com News has recently reported that UST outperformed DAI as a stablecoin and its 30-day stats show that UST’s growth rate was 29.2%. LUNA’s biggest trading pair is tether (USDT) today with 62.25% of all LUNA trades, and BTC follows behind tether with 14.81% of trades.

Global pairs reveal that LUNA is in a strong relationship to BUSD (10.12% of all LUNA transactions), BNB (3.49%), USD (3.09%) and KRW (2.25%). Binance, Okex Kucoin Kuobi Pro and Bithumb Global are the most active exchanges that swap LUNA. While Terra protocol’s TVL in defi has increased a great deal, it still has a long ways to go to catch up with Ethereum’s TVL in defi.

Ethereum currently has $155.2 Billion, or 62.58% of $248B. Terra protocol’s TVL in defi is only 7.79% of the aggregate $248 billion locked in defi and BSC has 6.72% of that total. Avalanche, which saw a 19.25% increase and Chronos’ (CRO network seeing an 16.29% rise in the past seven days were two other TVLs that have seen a significant improvement in decentralized finance.

What do you think about the Terra protocol’s recent increase in decentralized finance surpassing BSC? Please comment below to let us know your thoughts on this topic.

Image credit: Shutterstock. Pixabay. Wiki commons. Defillama.com. Tradingview.

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.