Ripple Labs managed to stay strong in 2021 despite the Securities and Exchange Commission (SEC)’s “attack on crypto”, AKA the lawsuit against Ripple and its executives. Now the payments solutions company celebrates its “strongest year ever”. Brad Garlinghouse, CEO of Ripple announced the achievements and had some comments to share about the SEC’s case.

Ripple’s first On-Demand Liquidity (ODL) was launched earlier this year during 2021’s Q3. It is a payments solution that “allows customers to instantly move money around the world at any time”. It was originally created as an ODL corridor linking Japan and Philippines using the token XRP. They have recently announced Ripple’s first ODL deployment in the Middle East as well.

| Ripple Announces New Payment Corridor In Japan, As XRP Rallies 23.5%. Are You Looking for More Profits?

A Ripple Report shows, however, that there is no evidence of the RippleNet saw 25% in dollar volume thanks to the XRP-based On Demand Liquidity Payments. Garlinghouse, who celebrated the success, added that ODL tokens have increased 25x since Q3 2020 and are now 130% higher quarter-over quarter.

“All of this growth came from outside the US for (sigh) obvious reasons” tweeted Garlinghouse.

| Ripple Partners with Republic Of Palau In The Development Of National Digital Currency

The report notes that Ripple’s ODL users have access to over 20 countries “for their payment needs”, and transactions over the Ripple network have more than doubled since Q3 2020.

Ripple made sure to mention the effects of regulatory uncertainty, noting that their U.S. ODL flows were “essentially halted”. However, “international ODL volume has continued to surge”.

ODL thrives in jurisdictions that encourage innovation and recognize that crypto is crucial to creating an inclusive, equitable, and efficient global financial system.

SEC CEO Brad Garlinghouse Slams

Gary Gensler, the Chairman of SEC is well-known in crypto. But not because of his good intentions. Many have worried about the prospect of being subject to enforcement action since Ripple’s case was filed against its executives one year ago.

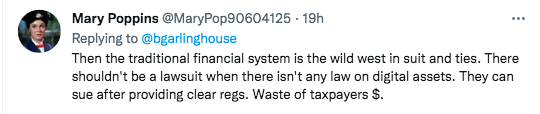

Gesler has repeatedly called crypto the “Wild West of our financial system,” and Brad Garlinghouse doesn’t agree –nor does the community.

The Ripple CEO stated that “Calling crypto the “Wild West” is a farce” noting that Gary Gensler “has taken an aggressively anti-crypto approach”, which he claims is making companies move outside the U.S. He pointed out that “Web2 was built with many American companies” and suggested that Web3 might not be given the same fair chance.

Garlinghouse says that most crypto-related companies “are complying with financial regulators globally” and added that “This industry shouldn’t be punished for asking for regulatory clarity & regulation that is consistently applied with a level playing field.”

Garlinghouse referred to the SEC’s lack of clarity refusing to answer questions about the legal status of Ethereum and questioned: “Is the agency actually living up to its mission of protecting investors w/ regulation by enforcement & what Hester Peirce Calls “strategic ambiguity”?”

Crypto has seen a significant shift in 2021. There has been no greater acceptance and awareness about the potential to attract billions into the global financial market. It’s been incredible to see a lot less ‘maximalism’, and many more builders joining the industry.