In mid-September, Ethereum had completed one its most significant upgrades. Merge was the catalyst for the transformation from Proof-of-Work to Proof-of-Stake. The blockchain was hit hard by the deflationary effects of the Merge.

According to some experts in crypto, Ethereum prices have dropped dramatically after the transition to PoS. The supply dynamics have also changed since the upgrade.

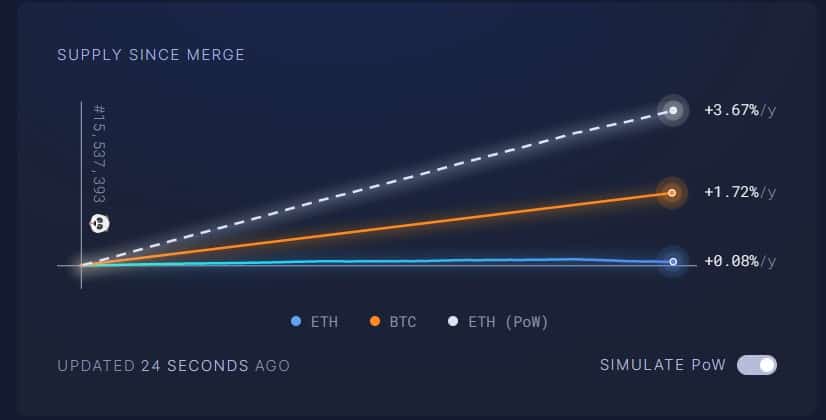

According to data from Ultrasound Money, there’s a reduction in the daily amount of ETH that hit the market. The data also revealed that the Merge had led to a decline of 90% in the market’s daily ETH supply. This change could be because Ether is no longer mined since it’s now a PoS network.

Ethereum Supply Reduced By The Burning Mechanism

The supply of Ethereum has been dropping over the last five working days, according to a careful analysis. This trend has seen the supply of Ethereum, which is the second most valuable crypto asset, drop by approximately 5,500 ETHs over the past five days.

EIP-1559 is a key factor in the decline. The token’s burning mechanism and the implications of it are also factors. This means that a proportion of fees received for ETH transactions will be burned.

Prior to the switch to PoS, miners received approximately 13,000 ETH as rewards from the Ethereum network. To secure the network and process transactions, payments are made daily. However, the Merge changed this sequence.

Today, the Ethereum network offers a $1600 daily reward to validaters. Because the base fees used to process ETH transactions have been burned, this reward is being offered daily. Ethereum could become deflationary if this practice is continued, particularly if usage rises.

As a result of the Merge, nearly 7,525 ETH have hit the markets today. Its operation as PoW blockchain would have seen the value reach around 340,000 Ethereum.

XEN Crypto Project Is A Key Player

The ETH-burning mechanism needs to take additional tokens from circulation. The ETH Foundation estimated that ETH could be considered deflationary if it reached 15 gwei.

On Sunday, XEN Crypto launched on Ethereum. It is a new Ethereum gas guzzler and users have begun to mint the cryptocurrency XEN. This sudden spike in activity caused Ethereum gas fees to soar over the weekend.

Every address in the Ethereum network can mint XEN. This accounts for higher Ethereum gas prices. An incentive exists for minting XEN in order to immediately sell them. Users can lock the tokens to receive even more money. The airdrop scenario is reminiscent of the gold rush. This airdrop uses XEN to mine gold, and Ether for mining.

Etherscan found that it cost 1,470ETH to make XEN per day. This amount represents 40% of total Ethereum network gas expenses. As a result, ETH supply drops as stakers receive more reward ETH than they burn.

Featured image by Pixabay, chart from TradingView.com