Franklin Noll (an academic and monetary history expert) has stated that crypto can both be a security and currency. Noll points to U.S. history and says that crypto can be both a security and a currency.

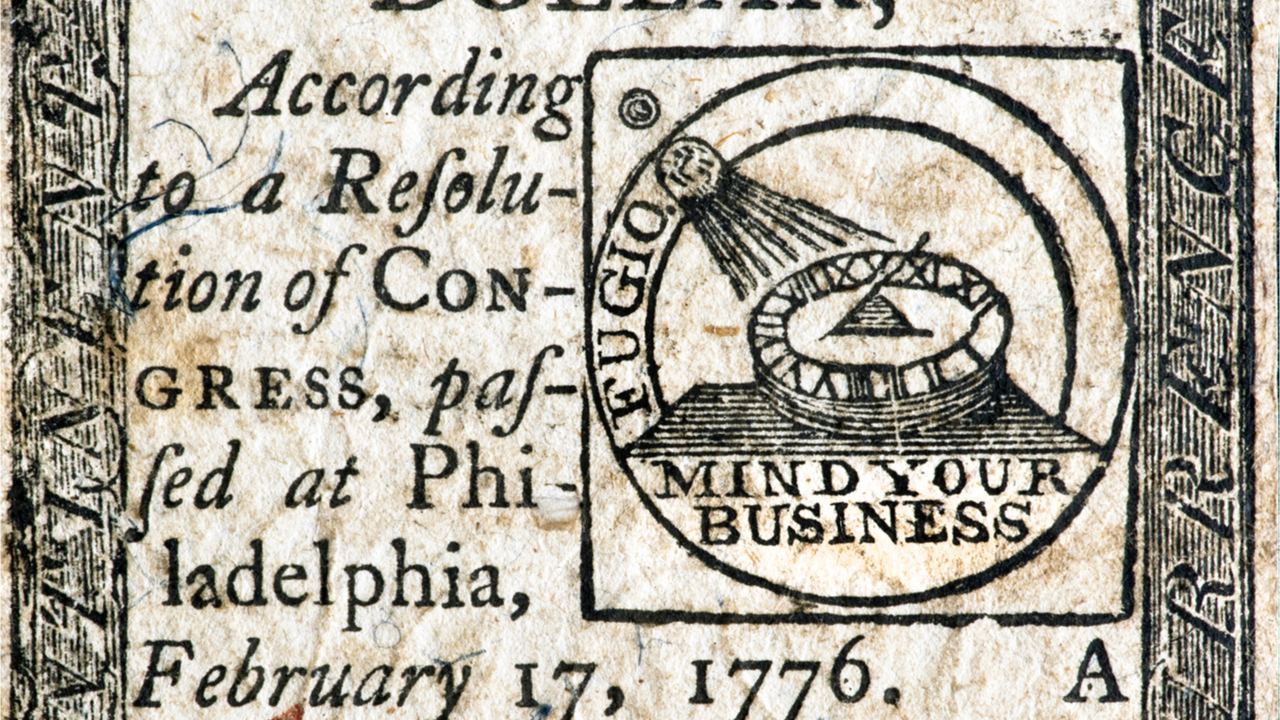

The ‘Infamous’ Continental Dollar Coins

Franklin Noll (a U.S.-based monetary historian) has stated that having a currency as well as a security does not seem contradictory, and that crypto could be both.

Noll Historical Consulting president made the assertions. This comes as the ongoing debate about cryptocurrency’s status is contentious. For instance, Bitcoin.com News recently reported on current U.S. SEC chair Gary Gensler’s comments on the subject.

In a recent blog post, Noll begins by citing the example of continental dollar coins as support for his claims. According to the historian, these now “infamous” coins were an attempt “to fund the American Revolutionary War by printing money” that ultimately failed.

The coins of the Continental Dollar were not only used to fund war funds, but also functioned as security. Noll explains:

Farley Grubb [a professor in economics and history]As a matter of fact, Continentals are basically zero-coupon bonds that were issued in very small amounts. Congress altered the repayment terms, rendering the plans worthless.

Besides the continental dollar, Noll also points to the creation of interest-bearing notes which were in fact “a grouping of Civil War-era paper money-related emissions of the U.S. Treasury.”

According to Noll, these notes were intended “to act both as currency and as a security.” However, unlike the continental dollar coins that ultimately failed, interest-bearing notes were successful.

“The interest-bearing note was created to act both as currency and as a security. The notes were issued in $10 denominations and paid 5% interest. When the notes matured, the Treasury would receive the interest. These notes were a success and were paid off as promised by the U.S. Treasury,” explains Noll.

The New Paradigm

Noll, however, said to Bitcoin.com News that regulators may take time to realize that cryptocurrency can also be a security, and currency. He argues that “regulatory agencies don’t think that way.” To them, something is either a security that should be monitored by the SEC or it is a form of money that must be monitored by the U.S. Treasury or some other agency.

“I think it will take some time for regulators to move to a new paradigm (or really, return to an old one that hasn’t been seen for a century) where the categories for payment methods are different or merged. I think we are talking at least 5 years,” he concluded.

Do you agree with Noll’s argument that crypto can be both a security and a currency? Let us know what you think below in the comments.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.