Wazirx is a major Indian cryptocurrency exchange. Its bank assets of over $8 million were frozen by Directorate of Enforcement. Binance was said to have acquired the exchange in 2019. However, Binance CEO Changpeng Zhao (CZ) now claims that the acquisition was “never completed.” Wazirx, however, maintains that it was acquired by Binance.

ED’s Action Against Wazirx

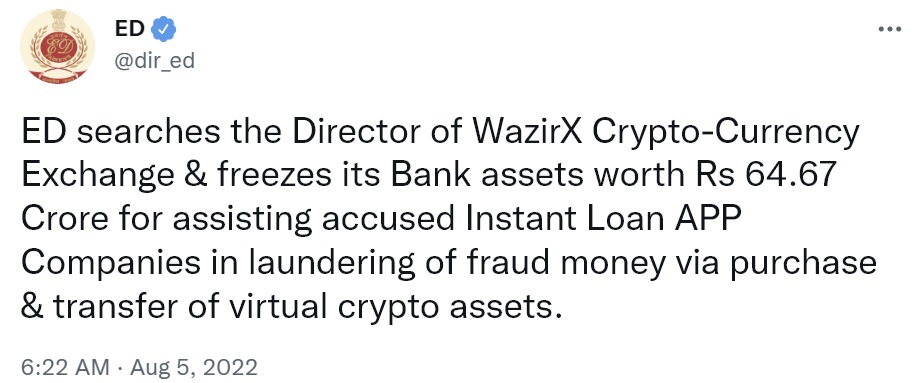

India’s Directorate of Enforcement (ED) issued a press release Friday concerning Wazirx, a major crypto exchange in India. The Indian government’s law enforcement and economic intelligence agency, ED. Details of the announcement:

Directorate of Enforcement has searched one of M/s Zanmai Lab Pvt Ltd’s directors and issued a freeze order for their bank accounts to the sum of INR 64.67 million.

ED stated that this action is part of its money laundering investigation against non-bank financial companies (NBFC) and their fintech partners for “predatory lending practices in violation of the RBI [Reserve Bank of India] guidelines.”

The announcement describes: “ED found that large amount of funds were diverted by the fintech companies to purchase crypto assets and then launder them abroad. These companies and the virtual assets are untraceable at the moment.”

ED alleged that Zanmai Labs created a web of agreements with Crowdfire Inc. (USA), Binance (Cayman Island), and Zettai Pte Ltd. (Singapore) “to obscure the ownership of Wazirx.” The authority further claimed that Wazirx gave “contradictory” and “ambiguous” answers “to evade oversight by Indian regulatory agencies,” noting that the exchange failed to provide crypto transactions of suspected fintech companies.

“Because of the non-cooperative stand of the director of Wazirx exchange, a search operation was conducted,” ED stressed. “It was found that Mr. Sameer Mhatre, director of Wazirx, has complete remote access to the database of Wazirx, but despite that he is not providing the details of the transactions relating to the crypto assets, purchased from the proceeds of crime of Instant Loan APP fraud.” The law enforcement agency further alleged:

The lax KYC norms, loose regulatory control of transactions between Wazirx & Binance, non-recording of transactions on blockchains to save costs and non-recording of the KYC of the opposite wallets has ensured that Wazirx is not able to give any account for the missing crypto assets. These crypto assets have not been traced by Wazirx.

“By encouraging obscurity and having lax AML norms, it has actively assisted around 16 accused fintech companies in laundering the proceeds of crime using the crypto route. Thus, Rs. 64.67 crore was spent on equivalent movable assets. 64.67 Crore [$8.14 million] lying with Wazirx were frozen,” the ED announcement concludes.

Binance’s Statements on Acquisition of Wazirx

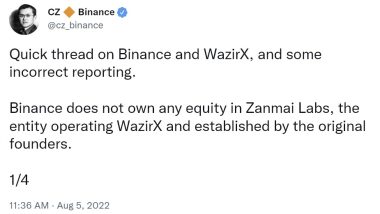

Changpeng Zhao (CZ), Binance CEO, has seen media mentions of his exchange in connection to Wazirx. stated on Twitter that his company “does not own any equity in Zanmai Labs.”

Zhao claimed:

On 21 Nov 2019, Binance published a blog post that it had ‘acquired’ Wazirx. The transaction never took place. Binance has never — at any point — owned any shares of Zanmai Labs, the entity operating Wazirx.

“Binance only provides wallet services for Wazirx as a tech solution. To save network fees, there is integration via off-chain.tx. Wazirx is responsible all other aspects of the Wazirx exchange, including user sign-up, KYC, trading, and initiating withdrawals,” CZ explained.

“Recent allegations about the operation of Wazirx and how the platform is managed by Zanmai Labs are of deep concern to Binance. Binance works with international law enforcement agencies. We would be happy to work with ED in any way possible,” the Binance boss emphasized.

CZ’s clarification shocked many in the Indian crypto community since they were under the impression that Wazirx is a Binance company.

Clarification by Wazirx’s Founder, Binance’s Warning

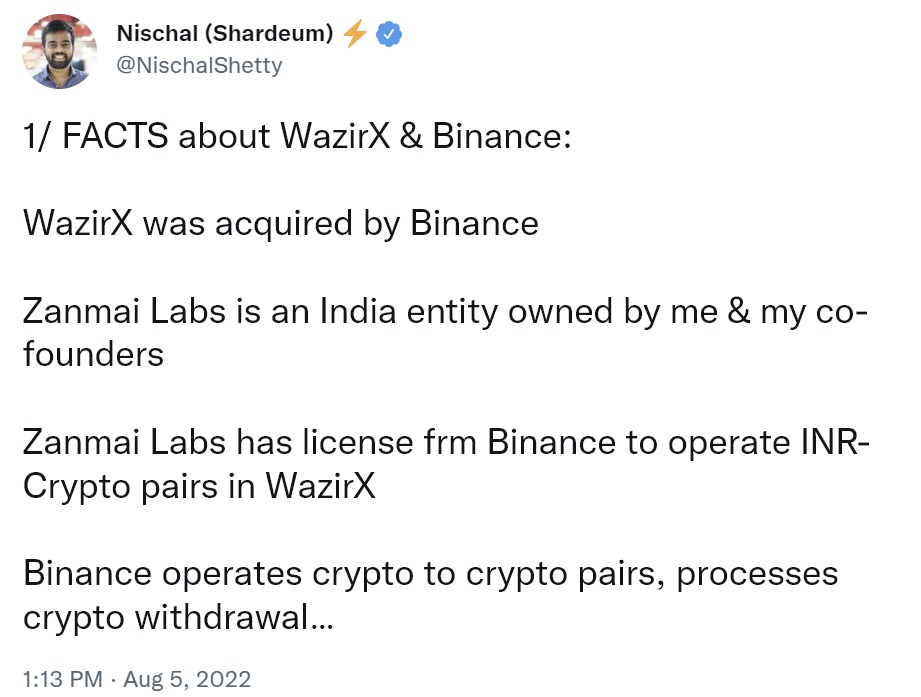

Nischal Shaetty is the founder of Wazirx. He attempted to make clear the connection between Wazirx (and Binance) insistedTweet by Binance confirming that Binance did indeed acquire his exchange.

He also stated that Zanmai Labs (an entity owned by him) has been licensed to Binance to trade INR-crypto on Wazirx, while Binance processes crypto withdrawals and operates crypto-tocrypto pairs.

When he asked investors not to mistake Zanmai Labs for Wazirx, he said that Binance owned the Wazirx Domain name and had root access to AWS servers. Binance has all of the crypto assets and the cryptocurrency profits.

Responding to Shetty’s tweets, CZ confirmed: “We could shut down Wazirx. But we can’t because it hurts users.” He added that Binance does not have operational control, including “user sign-up, KYC, trading and initiating withdrawals,” noting that they are controlled by Wazirx’s founding team. The Binance CEO stressed: “This was never transferred, despite our requests. The transaction was not closed. No share transfers.”

Further information about CZ tweeted:

Binance should be notified if funds are available on Wazirx. This is it. We could disable Wazirx wallets on a tech level, but we can’t/won’t do that. And as much debates as we are enduring, we can’t/won’t hurt users.

How do you feel about Indian cryptocurrency exchange Wazirx? We’d love to hear from you in the comment section.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or imply loss.