MATIC is Polygon’s native token. This Ethereum scaling solution improves speed, efficiency, and costs by reducing ETH gas charges through Layer 2 sidechains.

Polygon has the Plasma Chains Scaling Model and the Ethereum Matic PoS Chain Sidechain that is based upon Proof-of-Stake. These are popular scaling options for many applications. ERC-20 tokens that work on Proof-of-Stake (MATIC) allow crypto investors to reap the benefits of staking and MATIC.

To stake, you lock up crypto assets within your cryptocurrency wallet and for a specified period. You can then contribute to the safety and performance of the blockchain network or earn additional tokens and coins.

This article will provide all the information you need about Polygon Matic stakestaking.

Let’s get right to it.

What exactly is MATIC?

MATIC, the main currency and native token of the Polygon Network is MATIC. It serves as a staking token for Polygon’s Proof-of-Stake (PoS) blockchain, making Polygon a unique Layer 2 solution. MATIC tokens are used as collateral in the staking process, enabling users to participate in Polygon’s consensus mechanism to validate transactions in return for staking rewards.

Polygon, formerly known as Matic Network, was renamed in February 2021. Polygon Network is Layer 2 scaling that aims to reduce transaction fees and increase throughput for Ethereum developers and users.

Polygon was founded when Ethereum became too congested by transactions due to its increased demand in decentralized finance and NFTs. As a consequence, ETH fees rose and Ethereum became more expensive for developers and average users running decentralized apps (DApps). The Polygon Network was designed to enhance Ethereum’s transaction processing speed, reduce gas fees, and enable the launching of sovereign blockchains and decentralized applications and the building of interconnected blockchain networks.

Polygon also fully supports Scalability. Ethereum Virtual Machine (EVM)., i.e., it supports Solidity as a smart-contract language, which means that DApps built on the Polygon Network will benefit from Ethereum’s Network effect without sacrificing its robust security.

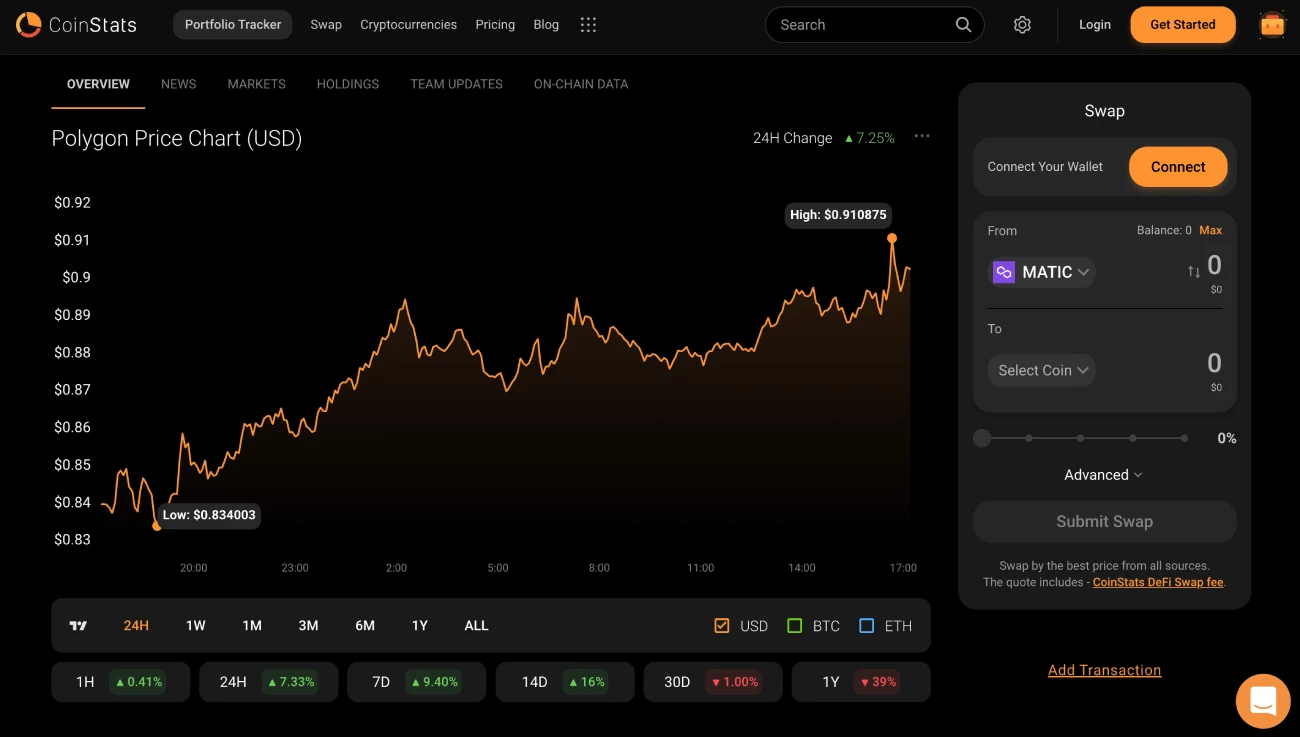

The value of Polygon’s scaling technologies is also reflected in MATIC’s price action. See the Polygon MATIC prices, market cap, live trade volume, 24h trading volume, total supply and other metrics at CoinStats.

Follow the CoinStats Blog to get the most current crypto news and trading tips.

Polygon: Why choose it

Polygon gained popularity quickly in crypto-space due to a few reasons, which are highlighted below.

Use of high-quality DApps

Polygon’s aim to provide a solution to the increased transaction fees and slow transaction times on the Ethereum network has made it an attractive chain for decentralized finance applications (DApps). Polygon’s Ethereum Virtual Machine- (EVM)-compatible Proof-of-Stake (PoS) blockchain hosts prominent DApps, such as nonfungible token (NFT) marketplace OpenSea, Metaverse platforms Decentraland and The Sandbox, DeFi lending platform Aave, etc.

High Scalability

Polygon recently introduced the Polygon ZkEVM, an Ethereum-equivalent scaling system that integrates seamlessly with existing smart contracts and developer tools. ZkEVM leverages Zero-Knowledge-based optimistic roll-ups to make scaling compatible with Ethereum. The one-of-a-kind scaling solution is designed to cut down ETH fees and even outpace Visa’s transaction throughput.

High Security

Polygon Matic offers three security models that developers can use to create their DApp:

- Evidence of stake security

- Plasma security

- Hybrid: Plasma + POS

How does stake work?

Blockchains built upon the Proof-of-Stake(PoS) consensus system are exempt from stake. PoS is a system that allocates responsibility for maintaining the public ledger of a participating node according to how many virtual currency tokens they hold. Participants staking their crypto in a PoS blockchain for an agreed-upon ‘staking period’ to provide value to the network and earn rewards in return are called validators. Based on how many staked coins are held, PoS validators will be selected. Anybody who has the required amount of coins can validate transactions, and receive staking rewards.

Proof-of Work (PoW), a consensus algorithm, requires miners compete to solve complicated mathematical problems in order to verify transactions and then add them to the blockchain. While the PoW system of verifying transactions via blockchain is reliable and secure, it requires a higher energy consumption and takes more time to complete. This reduces the total number of transactions that can go through a blockchain at once and creates a problem with scaling.

Proof-of -Stake Blockchains are less powerful and therefore solve the scaling problems faced by Proof of Work (PoW).

What’s Polygon Staking?

Polygon, which is PoS network, allows crypto investors to stake Polygon MATIC to make a contribution to network security. They also get a handsome yield on their staked tokens. Staking Polygon can provide a substantial return on your investment. Polygon claims that the average APY to stake Polygon is 8% and there are more than 2.39 million MATIC tokens being staked at various staking companies.

Polygon is dependent on validators who use their MATIC tokens to stake collateral and secure the network. They also earn rewards for providing their services. Validators manage a complete node and produce new blocks. They also validate transactions and participate in consensus. Validators must stake MATIC tokens and sign management contracts to become validators.

Inflation-funded block rewards, network-based transaction fees and validation bonuses are available to validator nodes in exchange for their good performance. Staker stakes are proportional to each other at checkpoints. If a validator is found to be doing malicious acts, such as double signing or invalidator downtime, then slashing staked cash can put at risk.

Token holders, called delegators, who cannot or don’t want to run a validator node themselves, can participate indirectly by delegating their tokens to a validator. Delegators are responsible for securing the network and choosing validators. They then delegate their stake to validator nosdes. For running the service, validators will charge a fee. Delegators are eligible to share in the rewards of validators but also take on some risk.

What to stake MATIC

There are many centralized exchanges that can stake MATIC tokens, including Coinbase, Kraken and KuCoin. Any of these exchanges can be used to stake MATIC tokens. You can stake Polygon tokens on any decentralized exchange, but you will get higher rewards if you stake your MATIC on a central exchange.

You must choose a staking platform that has a good track record and reputation. It should also be audited and certified by Certik blockchain security auditors. To find out which platforms offer the highest staking rewards, you can visit stakingcrypto.io.

Staking on many exchanges works in a very similar way. For you to create an account and pay for the Ethereum gas fee in an Ethereum-compatible wallet with MATIC tokens, and also have enough ETH.

Polygon: What is MATIC and How Do You Stake It?

MATIC tokens are required to be staked. You will also need ETH in order for the Ethereum gas fees to be paid. You’re welcome to visit the CoinStats step-by-step guide for buying MATIC tokens first if you don’t already have any.

You can follow our MATIC staking tutorial below on the Polygon site.

Step 1: Go to the Polygon website

Visit the Polygon site to see the stake page. You’ll be presented with an overview.

Step 2: Connect your wallet

On the page’s top right, click “Connect to a Wallet” and select the wallet (Metamask, Trust Wallet, etc.) You will need to insert the MATIC tokens.

Step 3: Pick a Validator

Navigate to the staking page, where you’ll see links to the staking calculator, support, Polygon explorer, the network overview stats, etc. You can review this chart to find out important statistics that will help you choose a validator. You must ensure ‘Checkpoints Signed’ are 100%, i.e., a validator hasn’t missed any checkpoints not to lose any tokens through slashing. The “Commission” column shows the percentage of rewards the validator takes from the total stake. For more reward opportunities, the commission should be kept as low as you can.

Step 4: Become an instructor

Delegate your tokens by clicking on the ‘Become a Delegator’ button. After you click “Approve” and “Confirm,” your tokens will be staked and earning rewards!

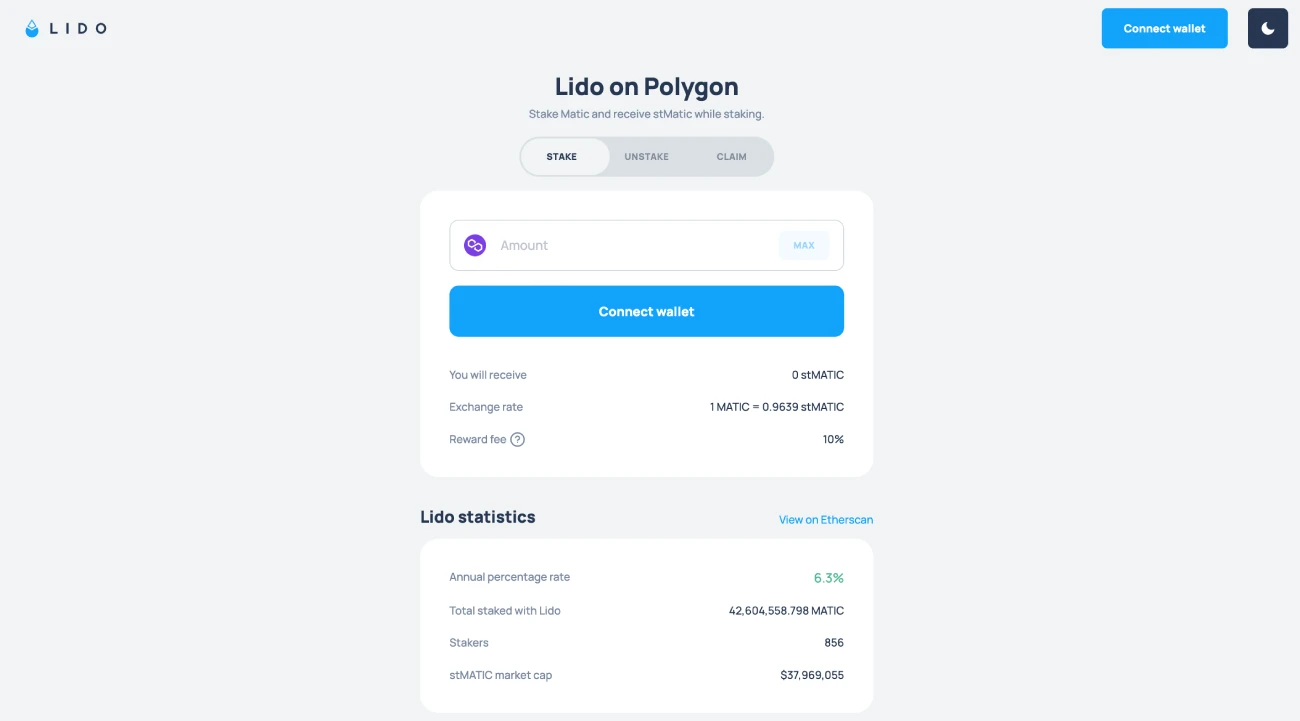

Liquid Staking MATIC

Lido Finance allows you to stake liquid tokens and earn rewards. You will receive $stMATIC liquid tokens when you stake your tokens. You will also need MATIC tokens, ETH and an Ethereum compatible wallet to pay the Ethereum gas fee.

Step #1: Visit Lido Finance

Visit Lido Finance and click on “Stake MATIC”.

Step #2: Connect Your Bank Account

Click “Connect to a Wallet” and follow the instructions to connect the wallet (Metamask, Trust Wallet, etc.) You will need to insert the MATIC tokens which you would like to stake.

Step 3: Swap MATIC

Enter the number of tokens you wish to stake and click on “Unlock tokens.” Your MATIC tokens will be swapped for $stMATIC tokens. Your wallet must be verified to confirm the transaction.

Step #4: Settling MATIC

Once you’ve received the $stMATIC tokens, click “Stake now” and confirm the transaction in your wallet.

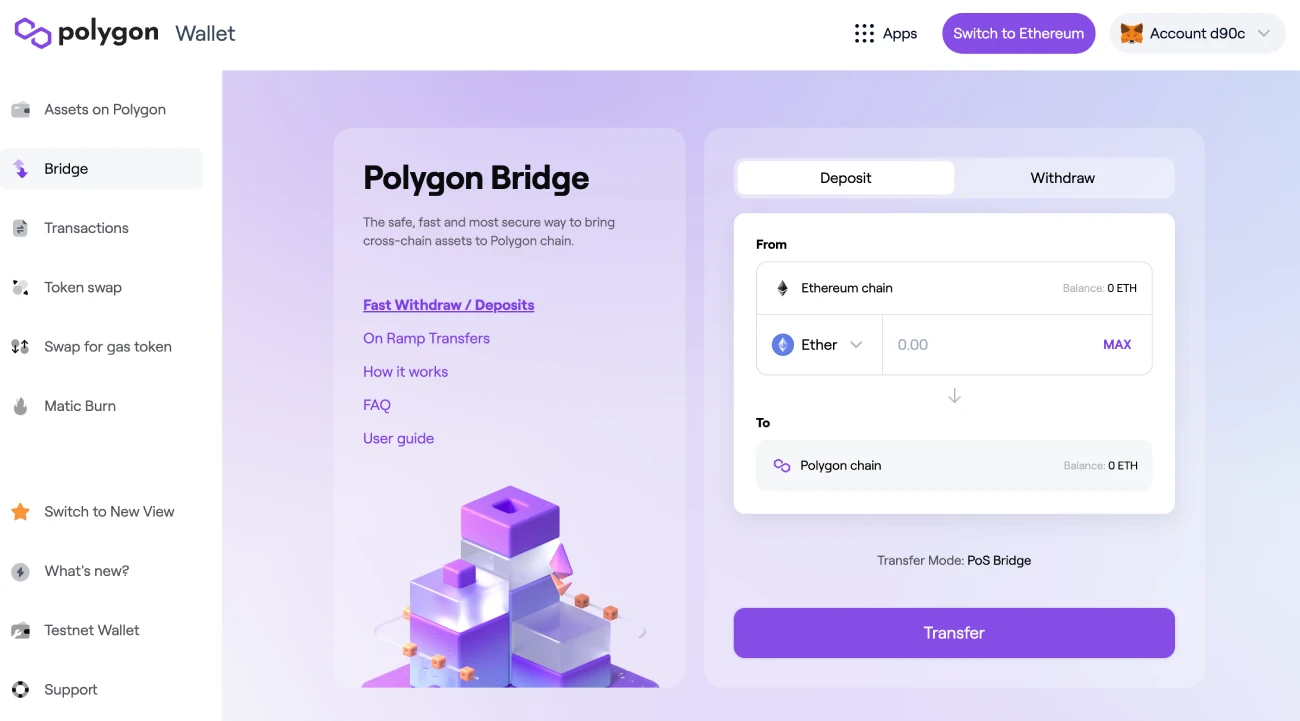

How to use the Polygon bridge

Polygon Bridge facilitates cross-chain token transfers instantaneously without third-party risk or market liquidity restrictions. The Proof of Stake Bridge allows token transfers from Ethereum to Polygon as well as from Polygon into Ethereum.

The transfer will take around 2 hours with PoS and seven days with the Plasma Bridge.

For token transfers from Ethereum to Polygon Network you will need a compatible wallet like Metamask. Then follow these steps:

- Log in to the Polygon Web Wallet by clicking on Polygon Bridge.

- Your crypto wallet can be connected.

- You must sign to confirm that your wallet is connected.

- Click the Bridge link in the menu.

- On the “Deposit” tab, click on the token name you want to bridge, enter the number of the tokens, click “Transfer,” then “Continue.”

- Review all the transaction details and click on “Continue” again.

- Confirm the transfer.

Here are the steps to transfer tokens from Polygon to Ethereum using the Proof of Stake Bridge.

- Click on Polygon Bridge, then “Withdrawal,” and enter the number of tokens you want to bridge to the Ethereum blockchain.

- Click “SWITCH BRIDGE” and select the PoS Bridge.

- Click “Transfer,” then “Continue” after you’ve reviewed the estimated gas fees for the transaction.

- Check the transaction details, sign, and click “Confirm.”

You can view the Tokens after you have processed the transaction in your Metamask account.

Pro Tip: Always send small test transactions to new wallet addresses or when using a new platform to prevent losing all your tokens. #CoinStatsTips @coinstats Click To Tweet

Final Thoughts

Polygon is aiming to build an Internet of Things for Ethereum. This project allows existing and new blockchain projects to use Ethereum as a framework without worrying about scalability and with no compromise on security or decentralization.

The staking of Polygon’s token, MATIC, on the Polygon blockchain enables users to earn interest for helping validate transactions on the blockchain.

It is a great way to help Polygon and earn rewards by staking MATIC tokens. Staking can have some downsides, including the possibility of hacking and loss of funds. These risks can be minimized by using proper precautions, storing your money in a safe wallet, and making sure you take all necessary precautions. Staking can be a wonderful way to get rewards for your investments and help grow the cryptocurrency ecosystem.