Staking cryptocurrency is an important concept in the cryptoworld.

Worldwide, cryptocurrency traders and miners enjoy the high income generated by cryptocurrency mining or trading. You’ve probably heard of the success stories of crypto investors making millions of dollars by investing early and selling when the crypto-assets’ prices are high.

Making a profit with cryptocurrency fluctuations is difficult and takes time and specific skills. The same goes for crypto mining, which requires technical know-how and significant upfront capital in highly specialized hardware.

If you’re trying to figure out how to make money from the cryptocurrency markets without investing lots of money and time, you might consider staking on decentralized finance (DeFi) networks. DeFi protocol offers great incentives to those who invest in crypto.

Staking cryptocurrency is the simplest way to make money with cryptocurrency you have in your wallet. It’s the process of investing money into digital coins and collecting interest and fees from blockchain transactions.

You can use cryptocurrency stake to lock up your coins and tokens in your own cryptocurrency wallet.

This article will provide all the information you need about how to stake Ethereum and earn ETH-staking rewards. We’ll also explore Ethereum’s upgrade to Ethereum 2.0 by switching from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism and provide a quick tutorial on how to stake Ethereum.

So, without further ado, let’s get started!

What’s the Deal with Staking

If you intend to keep your cryptocurrency for a certain period of time, then staking can be a great way to make extra money with them. Staking is an option on most cryptocurrency exchanges. This allows you to make passive income by holding crypto currency.

Only blockchains using the Proof-of-Stake consensus mechanism (PoS), where staking is used for transactions validation, can be staked. A participant node in a PoS consensus is given the responsibility of maintaining the public ledger. Users are randomly assigned the right to verify transactions on a Proof of-Stake blockchain based upon the amount of tokens staked. Holders of the required amount of coins are eligible to receive staking rewards as well as participate in validation (i.e. verify transactions when necessary). It is possible to stake coins instead of trading them.

Validators are those who stake assets on a PoS Blockchain for a set period of time to receive rewards. PoS Validators add value to the network. They are chosen based upon the highest number of staked coins.

The Proof-of–Stake blockchain uses less energy and solves the scaling issues of a Proof-of–Work blockchain. In this blockchain, miners must compete to solve complicated mathematical problems in order to process and verify transactions, and then add them to a block on the blockchain. Although the PoW method of verifying transactions on the Blockchain is secure and robust, it can also be slow and consumes a lot power. This limits the amount of transactions that can simultaneously be processed on a blockchain and causes an issue with scalability.

Ethereum is switching from a Proof-of-Work to a Proof-of-Stake consensus mechanism, called Ethereum 2.0 (ETH 2.0), aiming to improve the Ethereum network’s scalability and security. By 2023, the complete upgrade will have been completed.

To learn more about staking and how it’s different from yield farming, go to “What Is Staking.”

What’s Ethereum 2.0?

Ethereum’s blockchain acts as a foundation for many applications, networks of blockchains and tokens. Ethereum’s unique ability to support smart contract, which is the foundation for decentralized applications, makes it stand out. Developers can create ERC-20 tokens on the Ethereum blockchain and integrate them in their protocols. Additionally, the majority of altcoins, NFTs etc. are created on Ethereum and use ERC-20 or ERC-721 tokens.

Although these characteristics of Ethereum’s blockchain are enabling mass adoption across the globe of crypto, it also means that the Ethereum network is limited by its capabilities. Transaction costs, also known as gas fees on the Ethereum network, have risen dramatically, making it hard for decentralized non-finance apps to use the Ethereum blockchain. These limitations have created the need for “scaling solutions,” aiming to increase transaction speed (faster finality) and transaction throughput (high transactions per second) without sacrificing decentralization or security.

This is the reason why Ethereum 2.0 has been so long awaited. The ideas behind the upgrade are to make Ethereum simultaneously more scalable, secure, and sustainable – while remaining decentralized. The Merge is the name of this upgrade, in which Ethereum switches from a Proof of Work to a Proof of Stake system. As a result, the network’s ability of processing transactions would reach up to 100,000 transactions over a second, in contrast to the 15 transactions per second of the Ethereum network. Additionally, the Ethereum 2.0 network will see a significant reduction in gas fees.

What does Ethereum Staking look like?

The Beacon Chain, the new consensus mechanism for Ethereum 2.0 is now. Stakers are known as validators and they process transactions, store data, add blocks to the Beacon Chain, and also act as stakers. In return for their work, validators earn interest on staked ETH.

A minimum 32 ETH tokens is required to become a validator. Validators must produce and verify new blocks. If a validator fails to validate a block assigned to them by going offline or engaging in collusion or other mischievous activities, they’ll lose a large portion or the entirety of their stake. This provides an increased level of security for the network, and helps protect regular users against problems that may arise from network failures or invalidators.

In Ethereum’s blockchain, under the PoS mechanism, 32 blocks of transactions are bundled during each round of validation, which lasts on average 6.4 minutes. An Epoch refers to each such bundle. Once two Epochs have been added, the Epoch becomes irreversible and finalized.

Ethereum’s blockchain is divided into shards, and the Beacon Chain divides a validator node or stakers into a “Committee” of 128 and assigns them to a specific shard block. Each committee is allotted a ‘slot’ to propose a new block and validate the inside transactions. Each epoch contains 32 slots. To complete validation, 32 sets of members are required. A validator node randomly selected from the 128 validators proposes a block while the other 127 members validate and vote. The new block is added to the blockchain, and a “cross-link” is formed to authenticate its insertion once a majority of the committee has attested it. The native block reward is given to the random validator that proposed the new block. The blockchain will only approve a block if two-thirds are in agreement. Validators who attempt to reverse the decision later by using a 51% attack could lose their entire staked ETH.

What is Ethereum worth?

Now that you know what staking is and how staking works let’s look into the reasons you should be staking Ethereum:

- Take part in Staking: Staking Ethereum will require a minimum 32 Ethereum tokens. The APR (annual percentage rates) for staking ETH can be anywhere from 6 to 15%. For a minimum 32 tokens you must stake Ethereum tokens in order to receive rewards. You can get between 2-5 ETH and 5 ETH depending on the current price. The more Ether tokens that you stake, you will earn more reward ETH. You can start by looking at the Ethereum price.

- Stronger Security: If you’re a blockchain enthusiast wanting to contribute to providing stronger security to users, start your Ethereum staking asap. A greater amount of Ethereum tokens staked will ensure stronger security. An attacker would have to be able to access the majority of Ethereum tokens within the network in order for them become a threat.

- Environment Friendly: It is easier to stake Ethereum and other cryptos than it is mining. It’s important because the energy consumption for Bitcoin mining has become a real issue. With ETH 2.0, we’re moving towards an environmentally sustainable blockchain.

How to Take Ethereum

Now that you know why you should be staking ETH let’s proceed to a detailed guide on your staking options for staking Ethereum and learn where and how to stake Ethereum.

1. Solo Staking

Solo Staking can be the best method to stake Ethereum. Solo staking is the best way to stake Ethereum. You run your own Ethereum node over the internet. The rewards that you receive for staking Ethereum remain entirely yours. Solo staking Ethereum has its limitations. For example, to stake Ether you must have 32 ETH. This is a large amount of money. You must also be online at all times as nodes are penalized for going offline by the Ethereum network. To stake Ethereum alone, one must be proficient in technical terms, which is something most people do not have. If you’re interested in staking Ethereum by yourself, you can do so at ethereum.org.

2. Staking Services

Multiple service providers are able to run validator nodes on your behalf. This eliminates the requirement of being online at all times or having technical knowledge. You can use their service to staking Ethereum. All you need to do to begin earning rewards is to deposit 32 ETH tokens. They charge you a minimal monthly fee to stake Ethereum for your account. Your staked ETH cannot be controlled by you, therefore it is important to trust the provider. Gemini is a reliable exchange that offers reasonable staking rates.

3. Pools of Staking

The most widely used staking platform allows users to join various staking platforms and get rewards. A staking pool is simply a liquid staking solution where you don’t need 32 ETH for staking ETH. For the operation of the node, staking pool users collect a limited amount of ETH from each other. Protocol rewards are divided amongst those who have staked crypto assets according to their stake. There is a minimal fee for liquid staking platforms. A staking pool is one of the most viable solutions for users that don’t want to stake 32 ETH but are into earning rewards through Ethereum staking. Rocket Pool and Lido are the two most widely used liquid staking methods for secure staking Ethereum.

4. DeFi Staking

Although many of the staking pool providers have central control over Ethereum stakes, Yield.finance and other decentralized staking protocol allow you to stake Ethereum without any centralization. Decentralized staking gives you greater control of your staked Ethereum. You can also use these platforms to obtain stETH tokens in order to trade-stake ETH tokens or get a loan.

5. Crypto Exchanges: Ethereum stakes

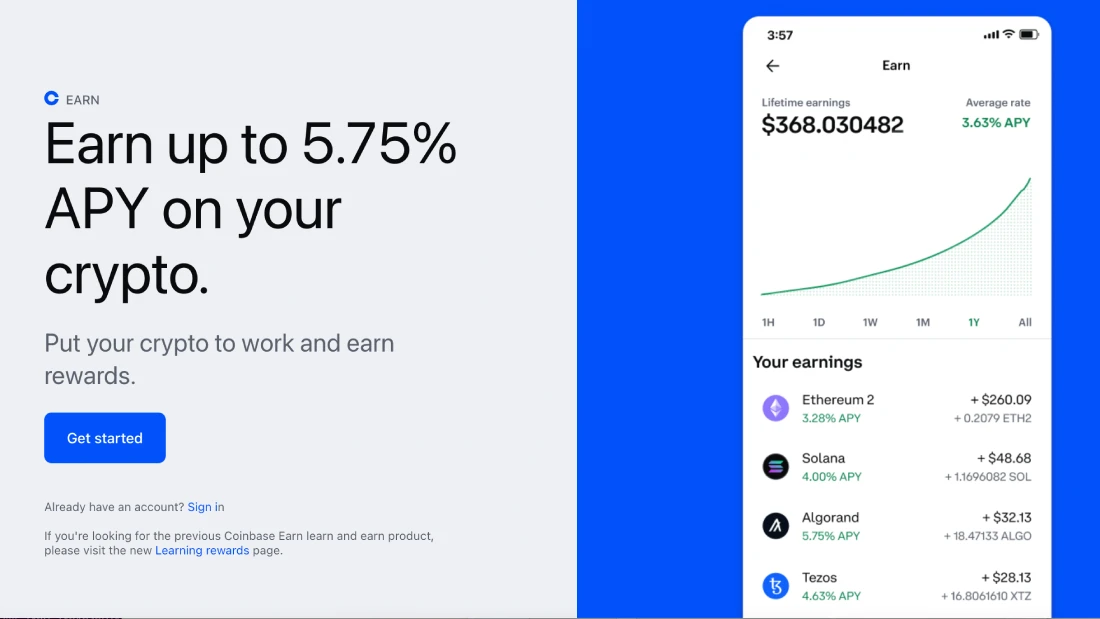

Many crypto exchanges provide Ethereum staking services for their customers. We’ll take the Coinbase exchange as an example for staking Ethereum tokens on an exchange platform. Follow the below steps to stake Ethereum on Coinbase

- Register for a Coinbase account

You must create an account on Coinbase’s website, or through its mobile app. To use Coinbase, you must provide a valid email address. - Ethereum Investments

You can send Ethereum tokens you’ve already stored in another cryptocurrency wallet to Coinbase. You will need to have an Ethereum wallet that supports Ethereum tokens in order to stake. Coinbase also allows you to buy Ethereum tokens. To learn how to buy Ethereum (Ether) tokens, check the CoinStats guide “How to Buy Ethereum.” - Take Ethereum

After you’ve got enough Ether tokens in your wallet you are able to stake Ethereum easily. There is no minimum Ether token amount required for you to stake ETH at Coinbase. However, the maximum staking limit is subject to change. Remember that if you stake ETH on the Coinbase crypto exchange, it’ll keep your ETH locked. Crypto investors can view their staked Ether tokens as ETH 2.0 balance under lifetime rewards, but they won’t be able to withdraw the staked coins until the Ethereum 2.0 (ETH 2.0) Merge is completed.

You should also see: How to Take on Coinbase

Risques associated with Ethereum Staking

As with any aspect of the blockchain industry there are inherent risks involved with ETH staking. The most common risks associated with Ethereum staking include:

- Gain of Control over Funds

This is a risk that comes with ETH staking, or any other form of staking. Once you’ve decided to get your ETH staked, you’ll temporarily lose control over your assets. Be sure to verify the trustworthiness of any protocol that offers high APY. This will help you avoid losing your entire deposit. - Inadequacy of regulatory Mechanisms

For cryptocurrencies, there are currently no regulations. So, while staking Ethereum, if the government decides to freeze your assets or ban cryptocurrencies, there’s nothing you can do. - Secure Ethereum

When you stake ETH, your ETH tokens are locked, and you won’t be able to withdraw or use them until the Ethereum 2.0 (ETH 2.0) Merge is completed. While the Ethereum Foundation has hinted at September 2022 as the date for the Merge, there is no guarantee that it’ll happen on time as it has regularly faced delays due to complex technical issues.

Conclusion

Ethereum pioneered smart contracts and was the driving force behind the global adoption of blockchain. Ethereum 2.0 will be faster, more scalable and longer-lasting thanks to the PoS blockchain. The PoS blockchain will facilitate high transaction throughput with low fees, without compromising security or decentralization.

Get started now to stake Ethereum and be part of the future revolution. You will also earn a steady passive income.

You should remember, however, that cryptocurrencies are volatile. Before investing, you need to do your research. The information in this article should not be considered financial advice. Cryptocurrencies can cause permanent or complete loss, which was evident in the $LUNA crash.

If you’re interested in learning more about DeFi and how to make the most of it, visit our complete guide, “What Is DeFi.” To learn more about keeping track of all your portfolios, check out our guide on “crypto portfolio trackers.”