DAI (Decentralised Autonomous Organisation) is the creator and regulator of DAO, which is a collateralized stablecoin. It was founded by Rune Christiansen who serves as CEO. DAI is a soft-pegged cryptocurrency that is tied to the dollar to reduce volatility.

Are you looking to buy DAI but don’t know where to start? Continue reading to find out everything about DAI and how to buy it in a few easy steps.

Let’s get right to it!

You can also read more articles on crypto wallets and tokens. CoinStats, which includes How to Buy Shiba Inu. IDEX review, and more.

What is DAI?

Dai is the original stable, decentralized and collateral-backed cryptocurrency.

DAI, an ERC-20 token, aims to keep a steady 1:1 value with USD by locking crypto assets into smart contracts. It’s the native token of the Maker Protocol – a decentralized autonomous ecosystem of smart contracts running on the Ethereum blockchain.

MakerDAO’s lending platform is secured by the DAI token. Lenders can use collateralized loans to obtain a loan. They lock away their assets. DAI is generated when a MakerDAO loan is taken. It is used as a stabile Ethereum token to purchase things and can be borrowed by users who then repay it.

What are stablecoins?

Stablecoins, cryptocurrencies tied to the value an underlying asset are called. An underlying asset could be commodities such as gold or fiat currencies. Or the U.S. dollar. DAI is tied to the U.S. dollar’s value, so one unit of DAI equals $1.

Tether (USDT), USD Coin and Wrapped Bitcoin, all Ethereum-hosted stablecoins are very popular.

DAI is a Stablecoin That Has a Twist

DAI, unlike other stablecoins, is not issued by and managed centrally. And, in contrast to other stablecoins, which rely on a customer’s trust in their underlying asset deposits, Maker Protocol uses smart contracts to back the value of DAI with collateralized crypto deposits.

In order to create DAI, the users need to deposit collateral assets in Maker Vaults. Deposited collateral is equal to the amount of DAI that was loaned. The collateral is repaid after the stability fee and principal amounts are repaid. MakerDAO issued the MKR governance token in addition to DAI. MKR holders manage the Maker Protocol via executive voting and governance polling.

DAI: Why buy it?

Before helping you with your DAI purchase, let’s first look into a few factors that make DAI a good investment.

DAI gives stability

The stability of DAI is undoubtedly one of the best reasons to invest in it. DAI can maintain USD value, as it is stablecoin. DAI is used as an asset hedge to protect against changes in price. The crypto market volatility can be reduced by having your DAI repaid.

You can deposit $200 of Ethereum (ETH) to secure a DAI. If the price of Ethereum skyrockets you’ll still receive your entire ETH back, regardless of how much it has appreciated. You can also keep your DAI borrowed and return it to vault only if the price drops.

DAI provides financial stability to residents of highly volatile countries, such as those where their local currency fluctuates.

DAI provides unrestricted access to funds

DAI is an open-source stablecoin which allows for transparent and unrestricted access to funds. DAI transactions are executed automatically thanks to smart contracts. i.e., they don’t warrant permission from any central authority. While governments can limit access to fiat currencies by setting transactional and withdrawal limits, DAI empowers the users to have full control of their assets.

Secure, quick and affordable transfers

Transferring money by traditional methods can be time-consuming, costly, and tedious. DAI transfers are instantaneous, safe, and more efficient.

You can earn income from holdings

DAI permits holders to earn income by investing in smart contracts. A smart contract which self-executes will distribute earned interest to holders according to the Dai Savings Rat (DSR). MKR token holders can determine the DSR through an executive vote. DAI may sometimes differ from USD rates. The value of DAI could also fluctuate by just a few cents depending on which exchanges they trade. DAI holders can take advantage of arbitrage by selling or buying DAI to quickly make a profit.

Do you need DAI?

Our step-by-step guide will show you where to find DAI.

WARNING:It is risky to invest in cryptocurrency. You should not expect to see your token’s price change after you have finished reading this blog post. You should consider all possible risks.

Step 1: Selecting an exchange

An exchange which trades DAI tokens is required in order to buy DAI. There are several cryptocurrency exchanges that accept DAI, including Coinbase, Kraken and Bitfinex.

Not all crypto exchanges will allow fiat currency purchases. Additionally, some exchanges might have regulations or restrictions that are specific to your area. Before you choose an exchange, ensure it fulfills all of your requirements.

Kraken is an example of the buying process.

Step 2: Create an account

After you’ve identified the right exchange, it is time to register with them.

Sign up first by creating a username and valid email address. You should secure your account using a strong password.

The exchange will email you a verification mail once you’ve created an account. After you have confirmed your email address, you are able to use the platform.

Keep in mind that many exchanges require you to complete a KYC verification (Know Your Customer). To start trading, you must provide your address details and an I.D. (identification card) issued by the government. You must submit your address and a Government-issued valid identification card (I.D.) in order to be verified before you can start trading.

Step 3: Funding your Account

The next step is to fund your account.

The exchange will determine which payment method is best to fund your account. Fiat currency can be deposited into your account via credit or debit cards, PayPal, and PayPal. It is also possible to deposit crypto currencies.

Before you proceed, please make sure that you compare the deposit options available and any associated fees.

Step 4: Purchase DAI

You can buy DAI once your account has been successfully funded.

Prior to proceeding, you will need to choose which currency pair (USD/DAI/ETH/DAI), Once you are sure that the amount entered is correct, you can purchase DAI. DAI tokens are available once your transaction has been approved by the exchange.

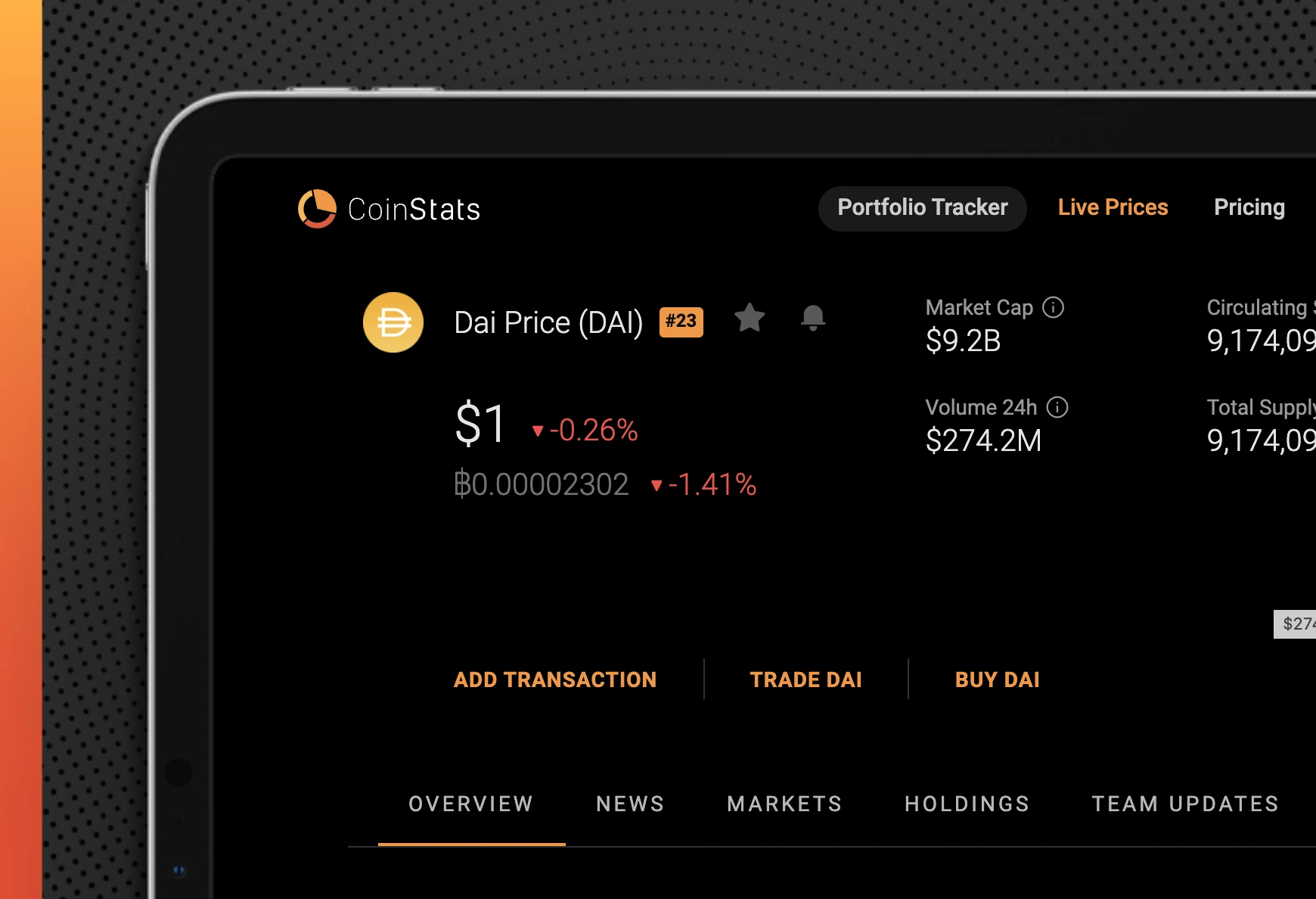

Note: Since DAI is pegged to the USD, it’s best to check the price first to ensure its current price is either $1 or lower. It is best to wait until the value drops before purchasing if the price is more than $1. You can check here the DAI price before you decide to buy.

You Need to Store Your DAI

It is important to keep your cryptocurrency safe when purchasing it. While you can opt to let your DAI remain on the exchange, it’s much safer to transfer your tokens to a decentralized custodial wallet for extra security. Every wallet is unique and comes with its own set of keys. This ensures that you only have full access to your funds.

There are two kinds of decentralized wallets.

Hardware or cold Wallets

Hardware wallets store cryptocurrency offline and are physically attached devices. You must use them as a pendrive to be able to access your cryptocurrency. While cold wallets can be more expensive, they offer greater security. To avoid getting scammed, make sure you research all cold wallets on the market. Also, ensure that you only buy from trusted dealers.

Software, or hot Wallets?

Hot wallets operate online and are digital, unlike cold wallets. Although they’re easier to use, hot wallets are more secure and less susceptible to hackers.

Install soft wallets to your smartphone or computer, then connect them with a cryptocurrency exchange. You will be able to access your funds quickly and easily.

DAI can be stored in Ethereum software wallets such as MetaMaskOr TrustWallet. Or, opt for a hardware wallet like this Trezor Key.

Dai can be used to generate liquidity for DeFi projects. Currently, over 400 DeFi apps integrate Dai.

Dai owners are driven to secure their assets in liquidity pool and then earn trading fees for the creation of a market. There are many services that lend money on DAI deposits.

- Two percent per year can be earned by Coinbase customers who deposit DAI. You can use the Coinbase Card to convert DAI into fiat and then spend it on your Visa Card.

- dPiggy dApp offers users the opportunity to earn interest and get your returns used automatically to buy various crypto assets at month’s end.

- DAI can be generated using Bitcoin.

DAI is fast on the way to being the first mainstream trustless currency. It was the fourth largest stablecoin in terms of capitalization at 5.5 billion Dai as of July 2021.