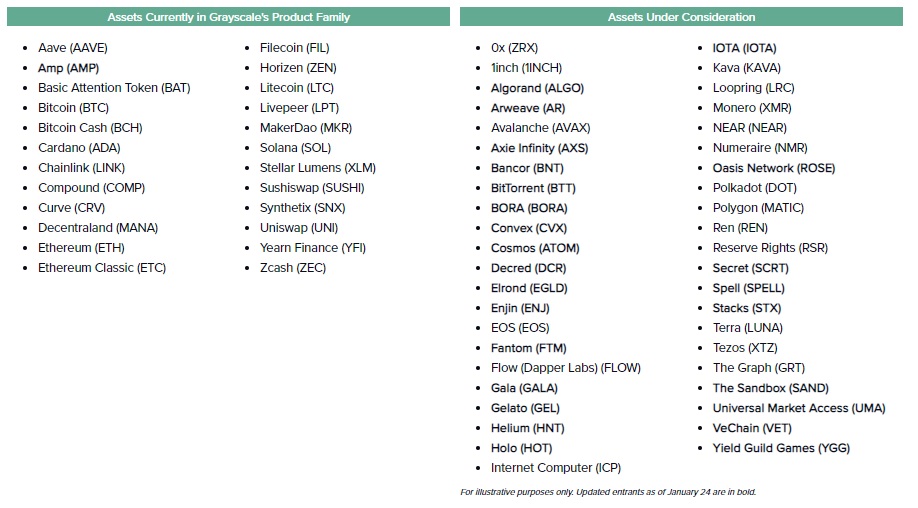

Grayscale, the world’s largest crypto asset manager, is considering 25 more crypto assets for investment products. With the latest additions, the company’s list of coins under consideration has grown to 43. “The process of creating an investment product similar to the ones we already offer is a complex, multifaceted process,” said Grayscale.

25 Crypto Assets Added to List of Coins Under Consideration for Grayscale’s Investment Products

Grayscale Investments has announced that Monday it updated its digital asset list for consideration in 2022. Grayscale manages $30.6 billion of net assets.

The company explained that the “Assets Under Consideration” list comprises “some digital assets that are not currently included in a Grayscale investment product, but that have come to our attention as part of our exploration of this sector, and that our team has identified as possible candidates for inclusion in a future investment product.” Grayscale detailed:

With our most recent update in January 2022, we’ve added one additional asset to our product family column, and 25 assets to our assets under consideration column.

Amp (AMP) is the only digital asset added to Grayscale’s product family.

Algorand is (ALGO), Arweave, (AR), AxieInfinity (AXS), Bancor(BNT), Bittorrent/BTT), Bora/BORA, Convex (CVX), Cosmos/ATOM), Decred/DCR), Elrond/ENJ), Fantom/FTM, Gala (GALA), Gelato/GEL), Helium/HNT), Holo/HOT), Iota/IOTA), Vechain (VET), Vechain (VET), Vechain Games (VET), Vechain (VET) and Yield Guild Games (YGG

Grayscale was added

It is complex and multi-faceted to create an investment product that looks like the one we offer.

“It requires significant review and consideration and is subject to our internal controls, custody arrangements, and regulatory considerations, among other things,” the asset management firm elaborated.

Grayscale’s decision to consider 43 crypto assets as investment options? What is your opinion? Please leave your comments below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.