As the Ethereum price reaches $2k, data shows that there has been a lot of leverage in the Ethereum futures markets.

Ethereum Open Interest Gains the Most Value in 4 Months

A CryptoQuant analyst points out that leverage in the ETH futures market is on the rise.

The “open interest” is an indicator that measures the total number of Ethereum futures contracts currently open in all derivatives exchanges.

Investors are taking more market positions when the value of the metric increases. As more futures positions mean that the market is leveraging, this can also lead to increased volatility.

However, the indicators’ declining values could indicate that holders have closed their positions. This trend could lead to a lower volatility value for ETH.

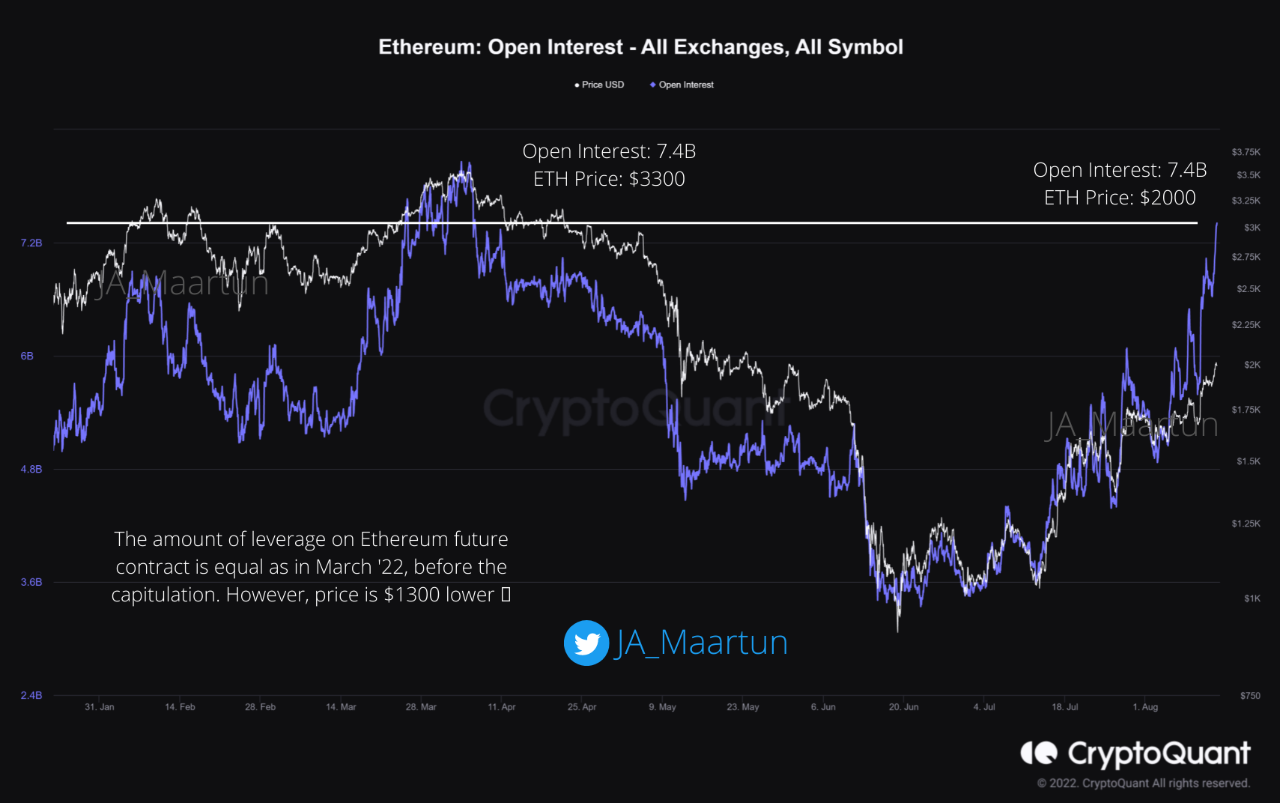

Below is a chart that illustrates the Ethereum open interest trend for the year 2022.

The value of this metric seems to have jumped in recent days. Source: CryptoQuant| Source: CryptoQuant

You can see that Ethereum’s open interest showed a strong uptrend over the last few weeks, as shown in the graph.

It has reached 7.4 billion now, its highest value in the last four month. There is an interesting contrast here.

ETH’s price was $3.3k 4 months ago when these values were first observed. Today, the price of ETH is $2k and around $1.3k lower than back in those days.

The open interest, however, is the same, which means the Ethereum market could be having the same degree leverage as the other markets, even though it is priced lower.

A lot of futures markets have high levels of leverage, which can lead to a sharp price swing that could result in large amounts being liquidated. These liquidations further increase the volatility of futures markets, which can lead to more positions being liquidated.

In this way, liquidations can cascade together, and the event is called a “liquidation squeeze.” This is the reason behind the volatility of an overleveraged market.

If a lengthy squeeze happens, the latest rally in ETH’s value may be able to hit the breaks.

ETH price

At the time of writing, Ethereum’s price floats around $1.9k, up 5% in the past week.

The market value for Ethereum appears to have risen in recent days. Source: ETHUSD at TradingView| Source: ETHUSD on TradingView

Featured Image from Kanchanara, Unsplash.com. Charts by TradingView.com. CryptoQuant.com.