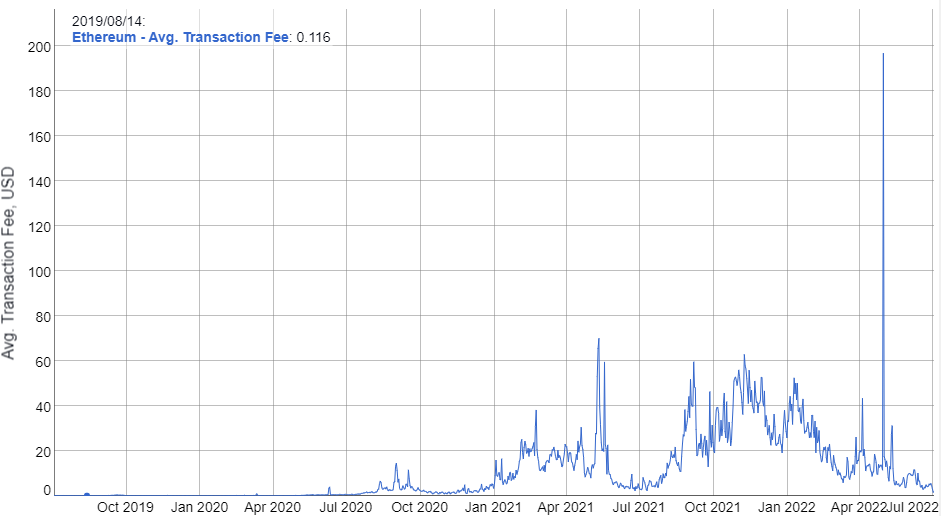

Now, Ethereum’s average gas fee has fallen to $1 after reaching the level it was last seen November 2020.

Ethereum Gas Fees Falls

On Saturday, transaction fees in Ethereum dropped to 69 cents. This was a rare event over the past 19 months. The following day, gas prices reached $1.57 or 0.0015 ETH, which is equivalent to December 2020’s numbers. Today’s transaction costs ranged between 20 cents and merely 20cs with 20cs the most expensive.

From July 2016 through May 2017, gas prices within the Ethereum ecosystem varied from $0.01 up to $0.10. From July 2016 to May 2017, the average transaction fee in Ethereum was $69, which is a significant cost. In May 2022, the highest recorded gas price was $196.683.

The Ethereum blockchain is not widely accepted due to high costs of gas and network fees. This has led to users being frustrated. NFT owners are benefiting as the number of NFT holders shrinks.

Source: Bitinfo charts

DappRadar reported that OpenSea has seen 50,466 traders trade their assets, an increase of 10.14 percent over the day before. At the time of writing, the largest NFT market’s trading volume increased by 34.18 percent to $15.92 million.

According to DappRadar data, all of the top 20 collections (led by Ethereum Name Service and DopeApeClub), God Hates NFTees (God Hates NFTees), Bored Ape Yacht Club, (BAYC) and Mutant Ape Yacht Club, (MAYC) were transacted in Ethereum.

TA: Ethereum Close Below $1K Could Spark Larger Degree Downtrend| TA: Ethereum Close Below $1K Could Spark Larger Degree Downtrend

More Price Stabilization

Analysis of the price for ethereum shows that it is in bearish because of consolidation at $1,050. Also rejection of any further recovery. ETH/USD could fall further, and even surpass the local support of $1,000. The $900 swing low should then be reassessed the next week.

The decline approached the $1040–$1000 area that serves as a close support and was accompanied by a sharp increase in demand pressure. This is a result of sellers trying to breach this barrier with smaller rejection candles.

The renewed optimism could motivate buyers to once again challenge the $1260 overhead barrier, giving ETH holders a chance of a recovery.

The USD/ETH exchange rate consolidates at $1k. Source: TradingView

A significant swing bottom in the price movements of ethereum was created at the beginning the week. The price of Ethereum/USD fell by over 21% to $1,000.

From then, a swift upward reaction continued to the $1,115 level, where Friday’s rejection of further recovery was observed. Sideways consolidation led to lower local highs, and lows.

Since then, the $1,050 level has functioned as the main trading range, with this morning’s denial of further gains. ETH/USD therefore is ready to fall further to try and surpass the 1,000-level.

The next drop in price could be as a result of traders being persuaded to move past the bottom support by sellers.

Ethereum (ETH) Bends Toward $1,000 As Doubt Fills Crypto Markets| Ethereum (ETH) Bends Toward $1,000 As Doubt Fills Crypto Markets

Featured image UnSplash Chart from TradingView.com