Bitcoin’s price remains below $20,000, as Ethereum and the other altcoins dominate the price action and drive the sector higher. Ethereum just deployed the “Bellatrix” upgrade, the final step before “The Merge”, and the price of Ethereum is blazing through local resistance.

Bitcoin’s price is currently at $19,000. There have been slight movements over the last 7 days and 24 hours. The Ethereum price is currently trading at $1,670, with a profit of 7% and 8.8% over the same periods.

Ethereum could break out of this range while the Bitcoin price lags

“The Merge” will migrate the Ethereum network from a Proof-of-Work (PoW) consensus to a Proof-of-Stake (PoS) consensus. The event caused much excitement in the crypto markets as investors believed that Ethereum would see greater improvements and enter an era of increased adoption.

The chart below shows that a fake trader describes the current Ethereum price range as well as its attempts to overcome overhead resistance. If Ethereum validates this bullish move, the cryptocurrency might achieve another milestone and “flip” Bitcoin in terms of market capitalization.

Of course, “The Merge” poses many questions for investors as they wonder if this will operate as a “buy the rumor, sell the news” event. Trader pseudonym said:

ETH trying out to escape a range. The last time it did so it doubled relative to BTC If it doubles again relative to BTC it’ll flip it. Bitcoiners will allow it to happen. Will they continue to pump BTC in an effort to prevent the situation from worsening? Oder will all the BTC be pumped for a reset

Ethereum Can Flip Bitcoin

QCP Capital, a trading desk might be able to provide clues. The firm recently reported that Ethereum’s price is correcting following its oversold status in the wake of liquidations by Three Arrows Capital (3AC).

Therefore, a lot of the move upward might be the price bouncing back as selling pressure faded and less related to “The Merge”. There are two potential bullish factors associated with “The Merge”: the transition will reduce ETH supply issuance while increasing its burning rate.

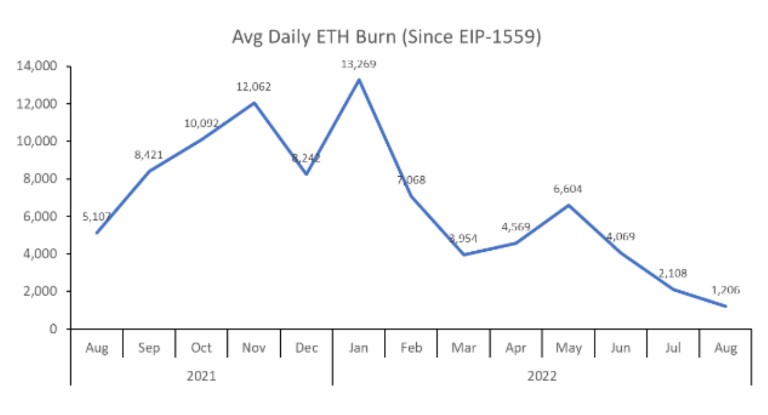

While the former is “looking bullish”, QCP claims, the latter is trending to the downside. In other words, the supply is being burned at a slower rate heading into “The Merge”. QCP Capital has been added

This doesn’t change our view on the long-term viability of ETH, and its consequent bullish impact on price. We consider ETH to be the asset of decade. This does not change the near-to medium-term pricing dynamics or the amount of event that is priced in.

As “The Merge” approaches, the trading firm will look into Ethereum price mimicking the Bitcoin price “halving” effect. This could provide ETH’s price performance with further support to reclaim its previously lost territory and continue to push the sector up with it, including the Bitcoin price.

You can find more market analysis, forecasts and strategies on our YouTube channel.