Since January 2022, the entire crypto economy has shed $1.36 trillion in value, as the market capitalization dropped from $2.34 trillion to today’s $979 billion. While the crypto economy is down in value, trade volumes are lower, and the value locked in decentralized finance (defi) has shed billions, treasuries held by decentralized autonomous organizations (DAOs) have increased by 7.69% in value since January, as roughly $700 million was added to the projects’ caches in eight months.

DAO Treasuries jump 7.6% higher in USD Value; since 2016, the value held by decentralized autonomous organizations grew by 6,025%

For the first time, $10 billion was the maximum amount of money held by DAO treasuries on June 10, 2022. Despite the bearish sentiment and lower crypto prices, DAO treasuries’ value has weathered the storm.

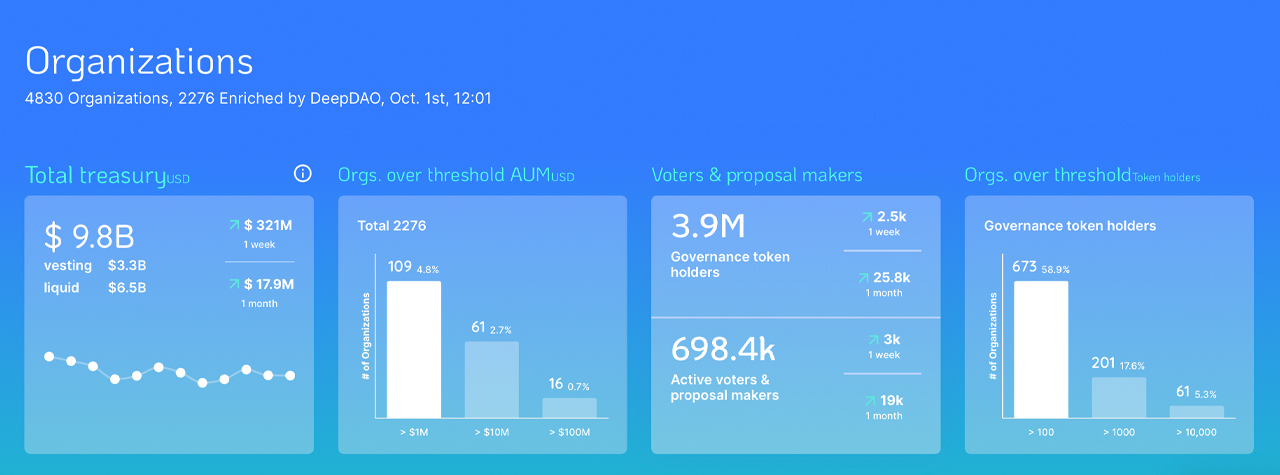

DAOs currently hold $9.8 Billion across 483 organizations. This is just $200 Million less than what DAOs held 112 days ago. According to statistics aggregated by deepdao.io, it’s $200 million lower than three months ago. However, DAO Treasury values have increased $700 million in the past year.

Archive.org recorded deepdao.io metrics on January 22nd. They show there were 42227 organizations then, with $9.1 Billion in DAO Treasuries. With $9.8 billion today, that’s a 7.69% increase in USD value held by DAO treasuries over the last 251 days.

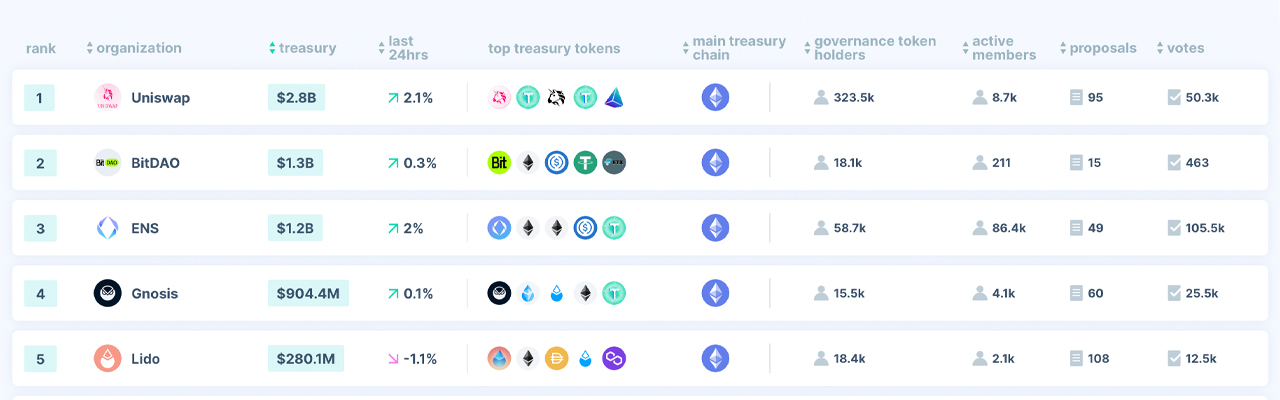

Bitdao had $2.4 billion in its Treasury at the time. It was also the largest DAO Treasury in January. Uniswap, which had $2.1 billion in treasury at that time was second. Bitdao, Uniswap and Uniswap remain the two largest DAOs by treasury sizes. However, Uniswap now holds the lead.

On October 1, Uniswap has $2.8 billion, while Bitdao’s cache has shrunk to $1.3 billion from the $2.4 billion held at the beginning of the year. Bitdao’s $1.3 billion makes it the second largest DAO treasury and it’s followed by ENS which holds roughly $1.2 billion.

251 Days ago, ENS ranked 14th and Lido Finance ranked third. The liquid staking protocol’s DAO is now the fifth largest, with $283 million held in the Lido DAO today. Uniswap and Bitdao have the top ten DAO treasuries. These include ENS, Gnosis (ENS), Gnosis (Lido), Olympus DAO, Mango DAO, Merit Circle, Compound, and Aragon Network.

There are 9 million governance token holders and 698.400 active vote-makers and voters out of $9.8 billion. While 109 DAOs possess $1,000,000 or more, only three DAOs control more than one billion dollars.

While Uniswap has $2.7 billion, 98.7% of the project’s treasury funds are held in uniswap (UNI) tokens, and Bitdao has a treasury comprised of a bunch of different crypto assets which include tokens like BIT, ETH, USDC, and USDT.

While the cryptocurrency economy faces many challenges, the decentralized autonomous organization (DAO) treasuries continue to grow steadily since their inception. DAO treasuries’ USD value has increased by 6,025% since the creation of the DAO in 2016.

Do you have any thoughts about the millions of DAOs and the $9.8 trillion in DAO treasuries today? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or allegedly cause any kind of damage.