Decentralized finance (DeFi), one of the most prominent trends in blockchain technology, has the potential for overtaking the existing financial system in an decentralized and permissive way using distributed ledger technology and DApps that are built on blockchain. DeFi seeks to provide everyone with transparent and secure financial services that are efficient and transparent.

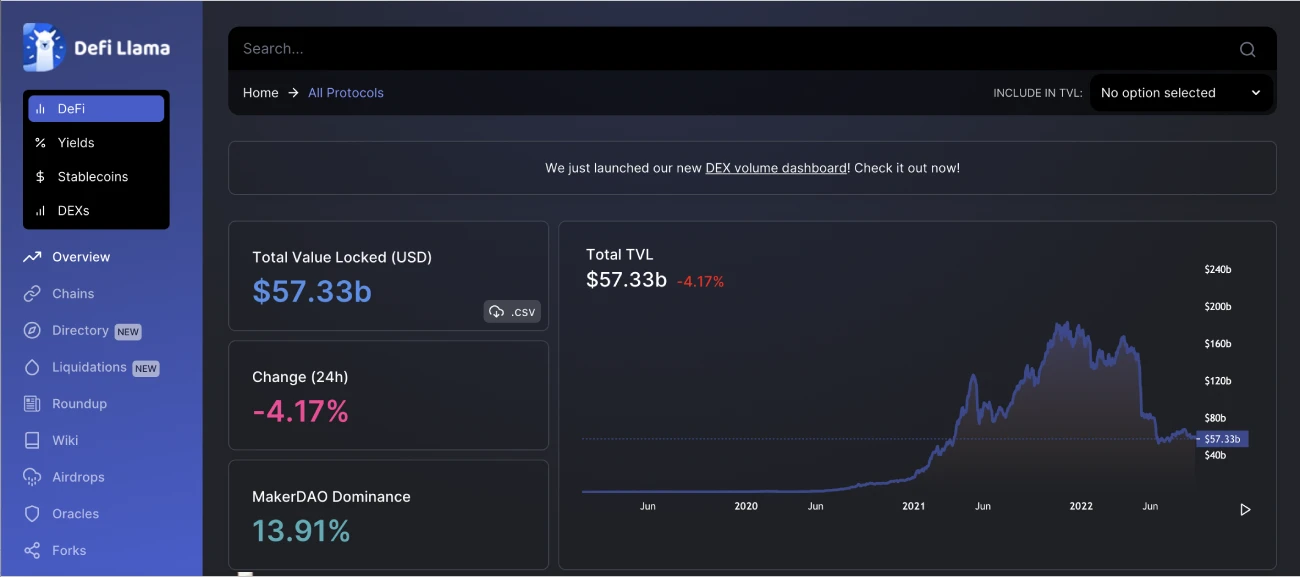

The DeFi market has experienced exponential growth since the summer of 2020, referred to as “the DeFi summer,” when the number of DeFi projects reached 235, and the TVL, total value of crypto-assets locked in DeFi applications, exceeded USD 200 bn in 2021.

It is difficult for crypto investors, due to the decentralized nature of DeFi projects’ growth, to monitor each one individually and keep track with multi-chain developments. DefiLlama is a cross-chain database that provides data about the current state of Decentralized Finance as well as the popularity and liquidity for each protocol.

DefiLlama, one of the biggest TVL aggregators, tracks the DeFi TVL, which is the total value of cryptocurrencies that have been deposited into a liquidity pool or lending pool.

Continue reading to find out everything about DefiLlama and its competitors. Also, how you can make the most of it.

We mentioned DeFi earlier. Are you interested in learning more? You’re welcome to check the CoinStats guides “What exactly is deFi?,” and “DeFi Solutions” to explore the concept further. DeFi has potential. However, it still needs to prove itself, just as Sam Bankman Fried once said.

Let’s get right to it!

What is DefiLlama?

Decentralized analytics dashboard DefiLlama tracks DeFi platforms, their Dapps, and uses TVL for showing which DeFi protocol is the most popular and how they have developed over time. This platform aggregates cross-chain data about the state of Decentralized Finance and provides it free to DeFi users.

DefiLlama states that it has no ads and is not sponsored by any content. DeFiLlama provides a list of DeFi projects across all blockchains and sources reliable information from open DeFi protocols. This includes over 130 Layer 1 Blockchains, 1750 DApps etc. This data is maintained by a team from their respective communities and coordinated through the DefiLlama/DefiLlama-Adapters Github repository.

DefiLlama gathers information about a protocol through calling endpoints and making blockchain calls. The SDK supports only EVM chain. Therefore, if your projects are in one of these chains, an SDK-based adapter should be developed. For other chains, a fetch adaptation will be required. The adapter is a function that returns the balances of tokens in your protocol’s smart contract at that time and takes a timestamp (on Ethereum).

It acts as a single-stop platform where users can track all popular blockchains, DeFi protocol, DApps, and other associated information. DeFiLlama has over 175 DeFi protocols, and more than 130 distinct blockchains at the time this article was written.

DeFiLlama not only keeps accurate TVL data, but also tracks DeFi analytics such as the following:

- DeFi Applications

- DeFi Chains

- DeFi Oracles

- DeFi Forks

- DeFi Airdrops

- NFTs.

How much is Total Value Locked?

DeFiLlama’s most vital data, the total value locked, is available only to registered users. The total value locked (TVL) is the amount of crypto assets/tokens which have been transferred into DeFi protocol. TVL growth in a DeFi protocol is a strong indicator of user confidence and increased activity. TVL can be calculated using the USD-denominated values of tokens that are locked into smart contracts, such as:

- Take-Away Pools All assets are held across multiple Proof-of-Stake staking pool networks. In proportion to how much staking assets are held, the interest of stakers is equal.

- Lending: The DeFi protocol acts as a loan platform. Smart contracts are used to process loans. TVL calculation includes tokens that are locked on different lending platforms. Interest is earned by DeFi token holders who lend them.

- Liquidity: Liquidity in the DeFi projects is one of the major indicators of people’s trust and support of those projects. Liquidity mining incentives are offered to users who lock their tokens into a project.

Remember that TVL is not a metric to measure how much one can earn on their deposits; it’s simply the total value of tokens locked within the ecosystem. TVLs for particular DeFi protocols can fluctuate depending on when they are updated.

- Crypto assets can be withdrawn or deposited into DeFi projects by users.

- The prices of tokens that DeFi supports, as well as native tokens are subject to change.

Notice: Crypto prices can fluctuate greatly, so the TVL is subject to constant change. However, if the prices are down, it doesn’t necessarily imply an outward capital flow from the project.

A DeFi protocol built on several chains will have a different TVL. Because most DeFi projects use Ethereum for their software, Ethereum is the largest network by TVL.

Tip: The market cap of a DeFi protocol shows active and passive investors’ support for a protocol. However, the total value of protocol assets locked can be a good indicator of its performance in the DeFi ecosystem.

How Does DefiLlama Work

When visiting the DeFiLlama site, you’ll go straight to its dashboard, displaying a chart of TVL across different DeFi activities. You can find the TVL ranking for DApps on the home page. It includes TVL ratings based upon USD. Profit generation, insurance protocols and profit generation are all included. Also, you will see the percentage change in one, seven, or a month.

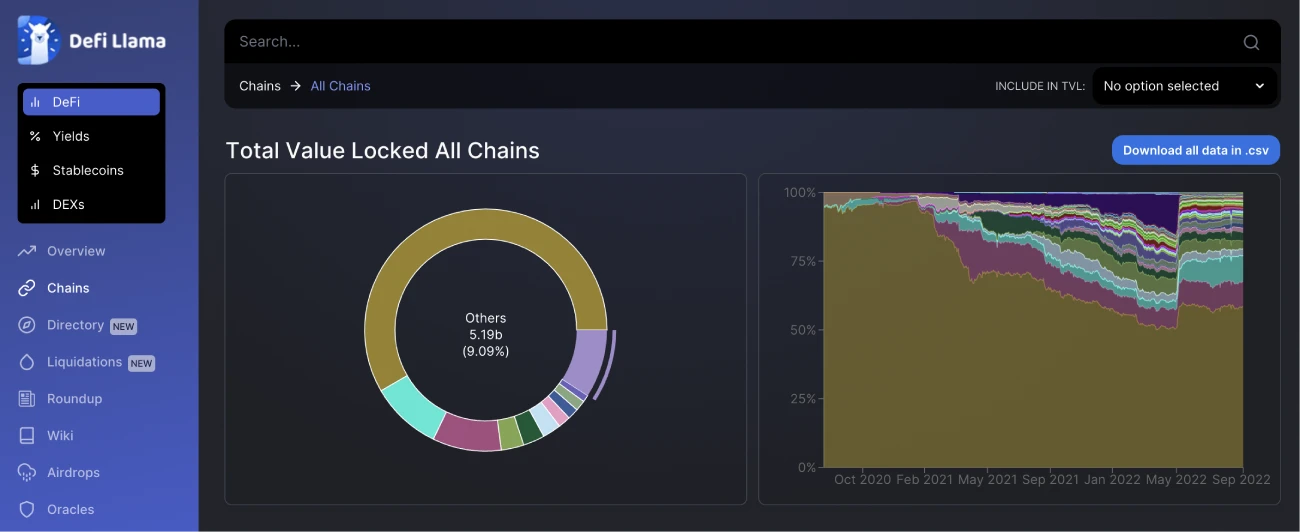

The TVL ranking can be viewed based on different chains like Terra, Fantom or Binance Smart Chain. Or you may choose to look at a broad overview. You can view the applications that were built on the chosen chain’s TVL, and then select the largest DeFi apps. You can also check if the application is compatible with other chains under the “Chains” tab.

This will allow you to locate the top DeFi exchanges in the largest chains and save time by not having to research each one individually.

You can find sections on the left side of your dashboard.

- Chains

- DeFi Forks

- You can drop off your items by airdrops

- Oracles

- Stablecoins.

How do DeFiLlama sections work?

DefiLlama, a multi-chain TVL dashboard shows statistics of DeFi activities in relation to these:

DeFi Chains

On the DeFiLlama dashboard, click “Chains” to view a list of Layer 1 chains and check the TVL of the largest blockchains. DeFiLlama does not list Layer 1 Blockchains that support smart contracts or can be used for development. Bitcoin cannot be listed.

At the time of writing, the Ethereum blockchain was the most popular DeFi chain with a market share at 57.88% and a TVL value of USD 35.56 trillion. Ethereum supports EVM chain and allows developers to create ERC-20 tokens or DApps. DeFi began with Ethereum. With it, developers could create applications such as UniSwap or OpenSea and lay the foundation for decentralized trading. The dominance of Ethereum has dropped dramatically from almost 95-97% in the early 2021 to a mere 3% today. The major factor behind this decline was the significant rise in gas costs, prompting users to migrate to rival chains Terra, BSC, or Avalanche.

DeFi Oracles

The Oracles tab shows the most popular oracle service providers in the market. They help to verify data and improve security. They transmit data such as weather and payment service data.

DeFi Forks

A fork is a copy of original software that’s been slightly altered to make improvements. DeFi apps are generally open-source. The code can then be used for other purposes and is freely available. Sometimes, forks may have more TVL combined than the original application.

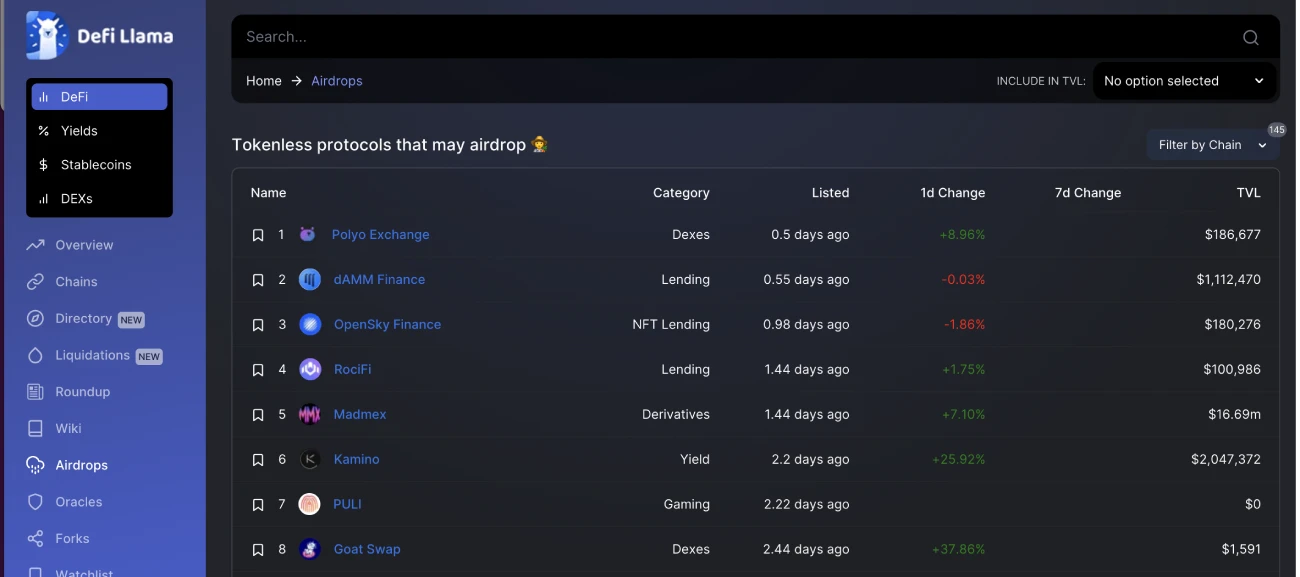

DeFi Airdrops

The DefiLlama Tab – Find protocols which may be airdropping soon. Get in on the early bird to increase your chances of winning.

DeFi Stablecoins

You can use the Stablecoins tab to view the market’s most popular stablecoins, ranked by market caps.

DefiLlama Features

DeFiLlama added these features to its TVL aggregator:

Broken Chain

DeFiLlama allows anyone to access TVL data across multiple protocols. This provides information on the chain in which the protocol is located and its TVL fragmentation across different chains.

Market Cap Data

Along with TVL data, DeFiLlama provides a protocol’s market cap data to allow users to evaluate a protocol (Mcap/TVL).

Charts

DeFiLlama charts help users understand and track the protocol’s total inflows and outflows, thereby providing insight into the future prospects of a DeFi project.

Chain TVL

DeFiLlama keeps track of over 130 different blockchains and offers data on each TVL. Click on any chain to see a DeFi listing of all projects that are operating on it.

Stablecoin Market Cap

The Stablecoin Market Cap Chart is another underutilized DeFiLama product. The chart gives a breakdown of total stablecoin market caps by asset or chain. The information includes the MCap, information about the chains, the stablecoin’s price, etc.

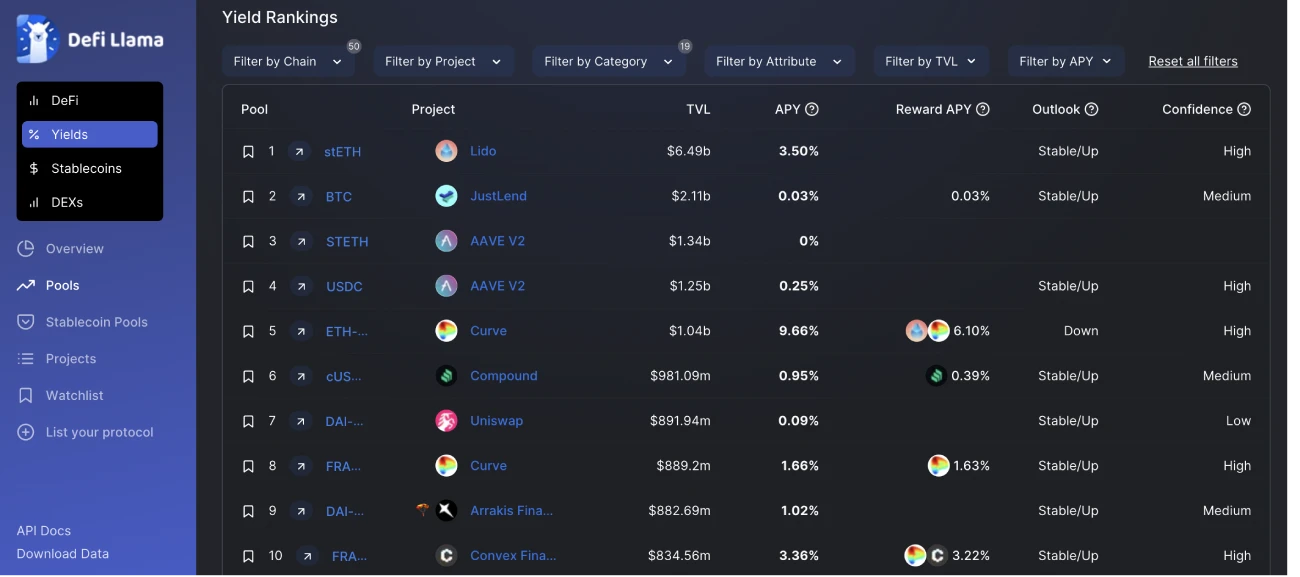

Yield Rankings

DeFiLlama products are divided into the following categories:

- Pools: Information about the pool is broken down into Projects, Chains, TVL, TVL Change, and APY Predicted Outlook.

- Overview: Heatmaps of APY for different protocols, and charts showing APY average vs. market volatility.

- Projects: Information on a protocol’s number of pools, combined TVL, audits, and median APY.

Conclusion

DeFiLlama, one of the best and most trusted web tools, allows you to find out about DeFi protocol and blockchains and their growth and liquidity, so that you can make informed investment decisions. DeFiLlama combines all data to create new tools that help you track them in real-time.

Although cryptocurrency prices on decentralized or centralized exchanges may look good, it’s hard to make an informed investment decision without all the data, such as price deviations.

You’re welcome to apply DeFiLlama tools to look up the popular chains and try out the DeFi applications built on them.

FAQ

Do You Know of Any Other DefiLlama Options?

DeFiLlama is not the only one with many competition, like CoinMarketCap and CoinGecko or DappRader. To get the most accurate data, we’d advise using a combination of data sources from DeFiLlama and its competitors.

You can also use software such as DeBank -DeBank’s mission is to create a bridge between users, DeFi tech, and financial services; Ape Board – they support Ethereum, Binance Smart Chain, Terra, Solana, Binance Exchange, and Polygon; DeFi Pulse, etc., to check out the DeFi list which includes the best resources in DeFi and track and display all your DeFi activities across multiple chains.

What are the other services or applications that DefiLlama can be integrated with

DefiLlama can be integrated with Aave and Arbitrum, Avalanche. Celo, CoinGecko. Ethereum. Fantom. Fuse. Harmony. Instadapp. Polygon (Matic). Solana. Terra.

Do DefiLlama have Integrations API?

Yes, DefiLlama offers API access. You can integrate the DeFi Landscape’s key stats on your website using their API.

To learn about wallets and exchanges, visit our “Wallet and Exchange Reviews. To discover how to keep track of all your DeFi activities across multiple chains for all your DeFi activities check out our “Crypto Portfolio Trackers.”