Trade volumes have soared on the 10 largest cryptocurrency exchanges amid market chaos. The trade volumes of the five largest exchanges amounted to more than $60 billion during Tuesday’s 24-hour trading period. The top 10 crypto exchanges in terms of trade volume saw an increase between 126% and 305% over the previous day. Although exchange volumes rose significantly, Kraken and Coinbase both reported connectivity problems on the exchanges.

Tuesday’s Crypto Exchange Volume Jumps 183% Higher Than Last Week, Top 5 Exchanges Record More Than $60 Billion in 24-Hour Trade Volume

During the last few days, the speculation surrounding FTX led to Binance’s CEO Changpeng Zhao (CZ) telling the public his company plans to acquire FTX. More reports followed the acquisition announcement, as one account said FTX was actively “canvassing deep pockets in Silicon Valley and Wall St” on Tuesday morning.

Another report noted that FTX CEO Sam Bankman-Fried reportedly told staff members that withdrawals on the exchange FTX.com were “effectively paused.” All of this led to significant crypto market fluctuations throughout the day on Tuesday, and both Kraken and Coinbase reported connectivity problems and “latency delays” during the day.

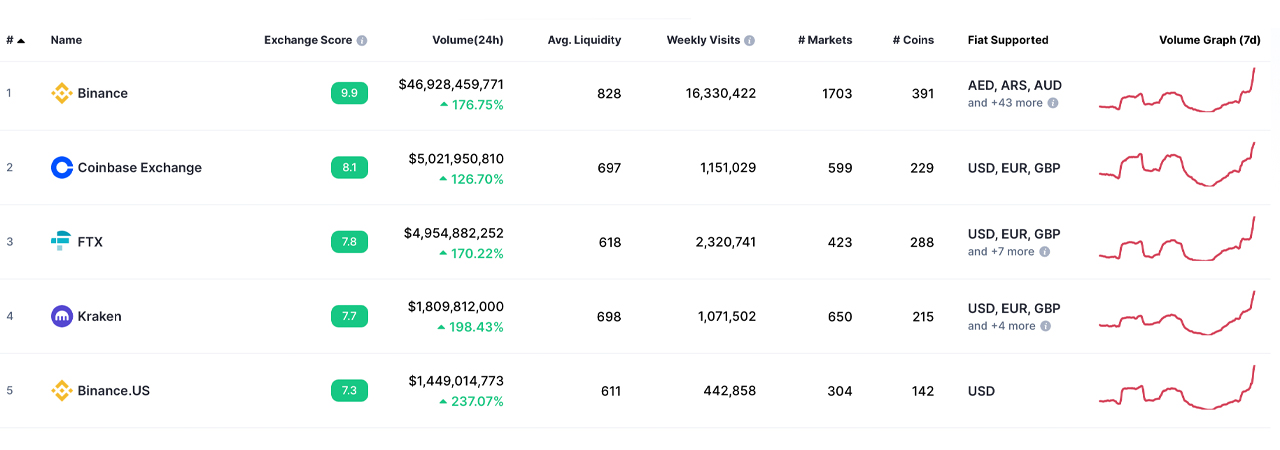

In terms of 24 hour trade volume, all 10 top crypto exchanges experienced significant triple-digit growth. The world’s largest exchange by trade volume, Binance, saw $46.92 billion in global trade volume during the past day. Binance’s exchange volume has jumped 176.75% higher during the last 24 hours. Out of the top ten exchanges, Coinbase’s trade volume saw the lowest rise on Tuesday but it still experienced a 126.70% increase in 24 hours.

Coinbase’s trade volume represented the second largest volume on Tuesday with $5.02 billion, which was followed by FTX’s $4.95 billion. Binance, Coinbase and FTX were closely followed by Kraken ($1.80B), and Binance US ($1.44B).

From the total $201.62 billion global trade volume on all exchanges worldwide, these five largest exchanges had $60.13 trillion in trade volume. Binance US was followed closely by Kucoin Huobi Global Bitfinex Gemini and Bitstamp, respectively in terms 24-hour trade volume.

The global trade volume recorded last Wednesday (Nov. 2, 2022) was $71.22 billion. Global trade volume was $201.62billion, which is 183% greater than the Wednesday before. The Additionally, stablecoin tether (USDT) captured $128.90 billion out of Tuesday’s $201.62 billion in global trade volume.

The volume of trades in the last 24 hours was down by double digits on all 10 largest crypto exchanges. This is rather than triple-digit increases that were seen Nov. 8 and 11. Binance’s exchange volume on Nov. 2, was down 17.10% that day and it saw $14.19 billion, in contrast to the $46.92 billion recorded on Tuesday, Nov. 8.

Let us know your thoughts on the Nov. 8 crypto market collapse and exchange volume. Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or be attributed to the author or the company.