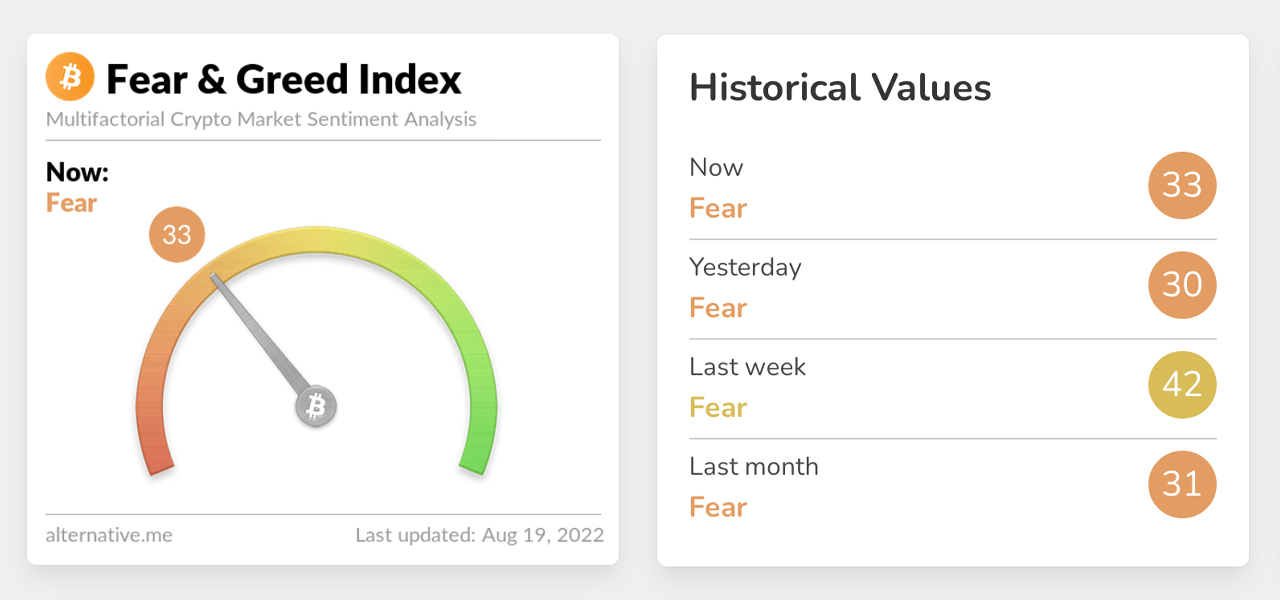

After the Crypto Fear and Greed Index (CFGI) dropped to significant lows and pointed to “extreme fear” in crypto markets at the end of May, and throughout most of June, today the CFGI rating is still in the “fear” zone, but it has seen an improvement. On June 19, the CFGI rating tapped a low score of 6 which means “extreme fear,” and 61 days or two months later, the CFGI rating now shows a score of 33 or “fear.”

CFGI Ranking Score Shows Crypto Winter Continues to Keep Investor Sentiment in the ‘Fear’ Zone

The crypto economy has rebounded above $1 trillion, but prices are starting to plummet again since the last rally. After the Terra blockchain collapse, crypto currency lost substantial value. The community was also shaken by extreme fear that continued into June. The Crypto Fear and Greed Index (CFGI) hosted on alternative.me dropped severely at the time, and on May 31, 2022, Bitcoin.com News reported the CFGI ranking score was 16 out of 100 or “extreme fear.”

Every day the CFGI ranking score analyzes “emotions and sentiments from different sources and crunch them into one simple number.” Alternative.me indicates that the value of 0 means “Extreme Fear” while a value of 100 represents “Extreme Greed.” The website adds:

The cryptocurrency market [behavior]This is very personal. Fear of missing out (FOMO) is a reaction to market volatility. People get greedy and become greedy. In irrational response, many people sell their coins. [to] seeing red numbers — There are two simple assumptions: 1) Extreme fear can be a sign that investors are too worried. This could indicate a potential buying opportunity. 2) If investors are becoming too greedy it is a sign that the market needs a correction.

Mid-June saw the CFGI rank score fall further and fell to a low score (6 out of 100) on June 19, 2022. BTC traded for $20,553 that day. On June 18, BTC touched a low of $17,593 in 2022, according to historical crypto price data. Today, the CFGI ranking score has improved and the sentiment value has moved out of the “extreme fear” position into the “fear” zone with a score of 33 out of 100.

BTC was able to recover some of its losses from the June and May market crashes. On August 14th 2022 the unit price hit $25,212. The CFGI rating score jumped from a 46 to a 47 on the same day. This was a sign that sentiment was changing. However, during the last 48 hours, BTC has dropped significantly in value, sliding from $23,593 per unit to today’s low of $21,268. The CFGI ranking has not been able to rise above the “fear” zone and seems to be heading back to the range of “extreme fear” scores.

How do you feel about the recent CFGI scoring score? And the cryptocurrency economy dipping in USD values again? Comment below and let us know how you feel about the subject.

Images Credits: Shutterstock. Pixabay. Wiki Commons. CFGI via Alternative.me

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of companies, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.